¶ Roadmap Overview

Communication satellites play a critical role in enabling global telecommunications. These artificial satellites ensure connectivity even in the world's most remote regions. There are various uses for satellite communications technology, including TV broadcasting, telephone services, internet access, navigation, military tactical communications, and others. Recently, with 3GPP release 17 and the standardization of non-terrestrial 5G networks (5G NTN), a new frontier for satellite communications has been defined -- direct-to-device communications [2]. This advancement has resulted in significant interest and investment from both new and established market players, all competing for the largest market share. Additionally, mobile device manufacturers are now developing compatible user equipment, creating a dynamic, double-sided market that is about to experience a significant expansion.

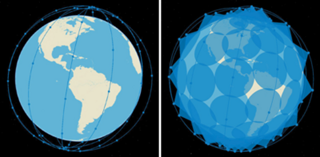

This roadmap focuses on Low Earth Orbit (LEO) communication satellites used in 5G Non-Terrestrial Networks (NTN) for direct-to-device communications. LEO satellites, operating at altitudes ranging from 180 to 2,000 kilometers, constitute the primary choice for non-terrestrial 5G applications. These satellites have attracted considerable attention because of their advantages, including lower latency and increased communication speeds, which are beneficial for real-time applications such as high-speed internet. By being in an LEO orbit, the coverage of a single satellite is reduced; however, deploying a satellite constellation working in tandem can enhance throughput and coverage. LEO satellites are also cheaper to build, and due to their size, they can often be sent to space as a secondary payload. This reduced cost and direct-to-device potential have led to new entrants to the satellite communications market, such as Lynk Global, AST SpaceMobile, and Amazon Kuiper, with the big existing player Starlink.

Starlink Satellite Rendering

LEO Satellite Constellation Coverage

¶ DSM Allocation

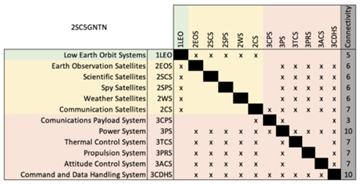

Connectivity DSM

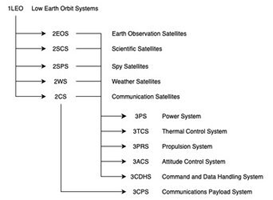

For the DSM allocation, the Level 1 roadmap was chosen as Low Earth Orbit Systems; this was a strategic choice to focus on technologies being developed with this particular orbital region in mind. However, it is understood that there will be links to roadmaps for systems in MEO and GEO. Working down the decomposition, the Level 2 roadmaps would align with the application-specific satellites. Finally, the Level 3 roadmap focuses on the individual subsystems. What can be appreciated from this connectivity is that 3PS, 3TCS, 3PRS, 3ACS, and 3CDHS are all common subsystems across all satellite classes. This indicates that the underlying technologies for these subsystems can come from different application domains, and improvement in any of these subsystems via one domain will improve the technology for all domains.

The 3CPS subsystem only applies to 2CS; this implies that improvements in this subsystem will only come from development from the Communication Satellites domain. As this roadmap looks at direct-to-device communications, improvements along the technology performance S-Curve will only come from dedicated development of the 3CPS subsystem.

¶ Roadmap Model Using OPM

The diagram below shows the Roadmap OPM for SC5GNTND2D; it captures the main object (LEO Communications Satellite) FOMs (Cost of Transmission, Capacity Factor ...), major functions (receiving, transmitting, processing), subsystems (Communications payload system, power system, ...), and competitors (Lynk, Starlink, SpaceMobile...). For completeness, the OPL description of the roadmap is included below; it describes the same content as the OPM in a formal language.

Error creating thumbnail: File missing when checked in Oct 2025

Roadmap OPM

¶ FOMS

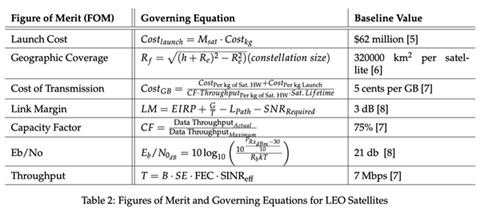

The figure below shows the FOMs by which Satellite Communications 5G NTN D2D systems can be assessed. The primary figures of merit of Launch Cost, Geographic Coverage and Cost of Transmission are bolded. The rationale for this selection came from looking at it from the perspective of the user; the two key characteristics of a useable technology would be 1) Geographic Coverage and 2) Cost of Transmission (which drives the price to the users). Furthermore, current operational costs are heavily weighted by the Launch Cost. Hence, our top three selections.

Error creating thumbnail: File missing when checked in Oct 2025

FOM with Trends

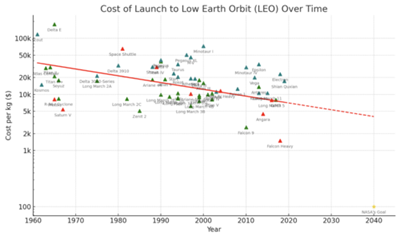

As the direct-to-device communications industry is nascent and many companies do not disclose many of the specifications of their constellations, it is challenging to come up with quantitative measures of the trends. One big exception is Launch Cost, as this data is public, trends over the last 60 years are shown in the diagram below (the graph is plotted on a logarithmic scale). As of 2024, the best-reported launch cost is from Falcon Heavy at $1500/kg. This is a significant reduction from the early days, but it is still 15x higher than the 2040 NASA target of $100/kg. The caveat with this goal is that the time value of money is not clear. It is not explicitly stated whether NASA accounted for a launch cost of $100 at the time of setting their goal or if this cost is assessed in terms of its adjusted value to 2040 dollars.

¶ Alignment with Company Strategic Drivers

The Satellite Communications and Space sector overall are experiencing a new resurgence in excitement, innovation, and investment. The entire ecosystem around space is growing at a rapid pace, not only domestically in the US but globally. With the continued innovation in this sector, LEO-based D2D 5G NTN is starting to gain traction as it has the potential to provide internet connectivity to existing terrestrial devices over the 5G standard. The topology and expanse of Earth make it infeasible and astronomically costly to provide mobile internet connectivity everywhere around the world. This is where we see the potential for LEO-based D2D 5G NTN. The world’s population is increasingly becoming more digital, and we are deploying swaths of IoT sensors to measure everything from air pollutants to crop yields, water temperature, and much more. These devices will need a cost-effective way to operate anywhere in the world. This is a nascent technology and an emerging market, meaning there is potential for new entrants to disrupt existing Satellite Communications solutions. Listed below are the strategic drivers for the company, and the alignment targets of our roadmap to these drivers:

| Number | Strategic Drivers | Alignment targets |

|---|---|---|

| 1 | To develop a LEO satellite constellation that can provide connectivity globally direct-to-device over 5G. | The 2SC5GNTN roadmap is aligned to this strategic driver. The Technology Roadmap will target a satellite constellation size that can have full global coverage. |

| 2 | To develop a Communications Payload System that can provide a high enough QoS for most current use cases of Audio/Data communications from devices and Data Telemetry from IoT. | The 2SC5GNTN roadmap is aligned to this strategic driver. The 2SC5GNTN Technology Roadmap will help develop a system that can enable high enough throughput and Eb/No to maintain high QoS. Our current target for throughput is 20 Mbps with a minimum EbNo of 30 dB. |

| 3 | To develop a business model that provides 5G NTN service at comparable costs to existing terrestrial networks. | The 2SC5GNTN roadmap is not aligned to this strategic driver. The cost of transmission, which influences the service cost, is dominated by the CapEx cost to launch satellites into space. The current monthly service cost target is $75/month, this is a price that needs to come down to build a globally accessible service. |

¶ Positioning of Company vs. Competition

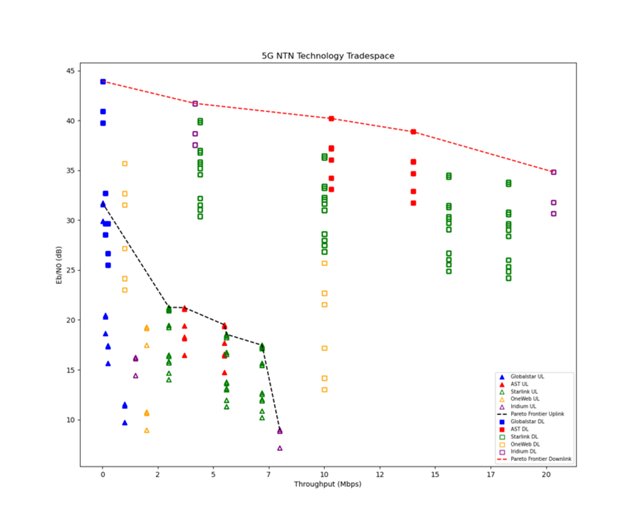

As this is a rapidly evolving field, future endeavors in this technology will need to position itself as an Attacker and pioneer. The image and table below show some of the major competitors in the LEO Satellite Communications market with their known technical characteristics. The data to compile the information below was sourced from [6-25].

| Company | Constellation Size | D2D Capability Tested | D2D Constellation Size | Tested D2D Downlink Speed | Antenna Size [m^2] | Weight [kg] | Orbital Altitude [km] | Sat Antenna Gain [dBi] | Sat Transmit Power [dBm] | Frequency Bands |

|---|---|---|---|---|---|---|---|---|---|---|

| Starlink | 6111 | Yes | 13 | 15.6~17.2 Mbps | 25 | 970 | 323~614 | 38 | 50 | Ku, Ka, E |

| Eutelsat OneWeb | 600 | Unknown | - | - | - | 150 | 1200 | 37 | 43 | Ku |

| Globalstar | 48 | Yes | 17 (By 2025) | 10 kbps | - | 715 | 1414 | 36.2 | 41.8 | S, L |

| Iridium | 66 | No | 0 | - | - | 680 | 781 | 37.5 | 59.5 | K, Ka |

| AST SpaceMobile | 6 | Yes | 6 | 14 Mbps [120 Mbps claimed for future] | 642 | 1500 | 752~740 | 43 | 53 | UHF, V, F |

These competitors fall under the following categories:

- Deployed: Globalstar with their SOS capability on the iPhone

- Tested & Proven: AST SpaceMobile & Starlink. AST SpaceMobile has also received FCC approval.

- Announced D2D desire: Iridium

- Potential for D2D: Eutelsat OneWeb already has the capability to operate directly with the 5G protocol.

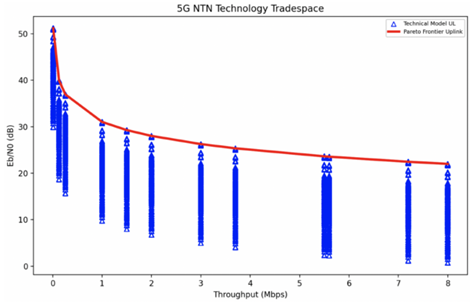

One of the challenges with performing a competitive comparison directly on the FOMs is that many of the technical specifications are not disclosed as these are private companies. To make a realistic comparison, we took our Technical Model with the available publicly available information and created a tradespace for Eb/N0 and Throughput. In the plot below, we show two Pareto fronts, one each for the downlink (square symbols) and uplink (triangle symbols). Any point that is filled in indicates a system that is approved for D2D 5G communications.

What is appreciable from the graph is that the uplink is significantly more limited than the downlink, so any future system will really need to focus on improving the uplink throughput FOM in order to have a good QoS (Quality of Service). Furthermore, it is clear that there are a number of concepts that live on the Pareto front, with AST performing well on a balance of Eb/N0 to Throughput for both uplink and downlink. As this is a nascent technology, we expect these Pareto front curves to shift toward the top right. Due to the lack of available information, one of the major limitations of this tradespace comparison is that it assumes the same modulation schemes for all of the satellites.

¶ Technical Model

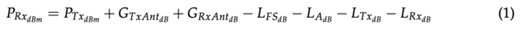

The technical technology model is built around two primary figures of merit, Eb/No and throughput. The Eb/No figure of merit defines the energy per bit to noise power ratio at the communications receiver. A high-throughput system will require a high modulation depth, and without sufficient Eb/No values, errors will be introduced in the received data. The throughput figure of merit defines the maximum number of bits in the uplink and downlink that the system can transmit or receive. To construct the technical model of the communications link, one first needs to compute the received communication signal power. This can be done using (1) below.

Where PRxdB is the received power, PTxdB is the transmitted power, GTxAntdB is the transmitting antenna gain, GRxAntdB is the receiving antenna gain, LAdB is the atmospheric loss, LTxdB and LRxdB are the transmitter and receiver dissipative losses respectively, and LFSdB , is the free-space path loss, defined in (2) as

where d is distance to the satellite, f is the carrier frequency and c is the speed of light. All variables in (1) are in units of dB or dBm (highlighted in the subscripts). Once the received power is known, Eb/No can be computed as

Where Rb is the bitrate (throughput) in bits/s, PRxdBm is the received power in dBm, k is the Boltzmann constant, T is the temperature in Kelvin (290 ◦K), and Eb/N0dB is the energy per bit to noise ratio expressed in decibels.

In this model Eb/N0dB and throughput are very closely related, and the throughput FOM is embedded in Eb/N0dB calculation. This is because Eb/N0dB drives the bit rate depending on the modulation scheme (BPSK, QPSK, 16-QAM etc) used to encode the information. High modulation depth requires a very high Eb/N0dB , but the throughput can be increased. In this model, the modulation efficiency is assumed to be 1 (bit/s)/Hz. Therefore, a 1:1 mapping of the signal bandwidth and throughput is assumed.

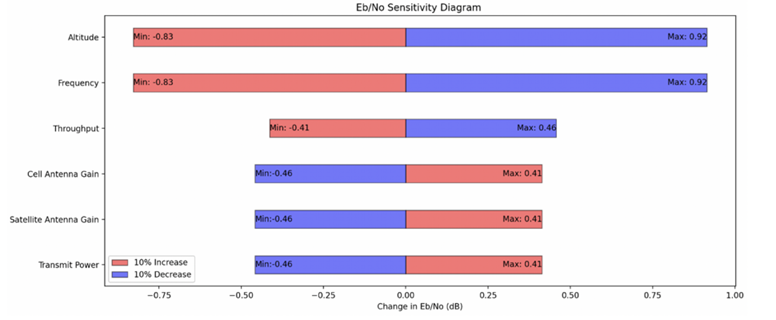

To assess the sensitivity of Eb/N0dB to all the model variables, the nominal Eb/N0dB value was first computed based on the nominal data. That became the reference value for the sensitivity analysis. Then each model variable was perturbed by 10% from the nominal to construct the tornado diagram shown below. The throughput FOM is used as one of the variables as it is used to compute the Eb/N0dB value. As can be seen in the figure, a 10% increase in the altitude (in LEO orbit) or frequency will result in approximately 1 dB of drop in Eb/N0dB. By contrast, increasing the antenna gain for either the satellite or the cell will improve the Eb/N0dB by almost 0.5 dB.

Sensitivity Analysis for relevant parameters of D2D 5G NTN

The table below shows the morphological matrix of the system parameters, data sourced from [8-12, 17, 27-35]. All of the values are taken from publicly available documents on the real state-of-the-art LEO satellites used for direct-to-device communications. For the uplink and downlink frequencies, the 3 bands were selected: n253, n254, and n255, as defined per 3GPP. The standard defines n254 as 1610 MHz to 1626.5 MHz (uplink) and 2483.5 MHz - 2500 MHz (downlink), n255 as 1626.5 MHz to 1660.5 MHz (uplink) and 1525 MHz to 1559 MHz (downlink), n256 as 1980 MHz to 2010 MHz (uplink) and 2170 MHz to 2200 MHz (downlink). In the model, the center frequencies were used in each of the bands. The model also assumes 30 dBm transmit power from a typical cellphone and a 0 dBi Tx/Rx antenna, which implies isotropic radiation.

Error creating thumbnail: File missing when checked in Oct 2025

Morphological Matrix for D2D 5G NTN

From this table we can construct the downlink and uplink tradespaces. Given the fixed values of throughput, the performance of the model is constrained on the horizontal axis and can only increase or decrease on the vertical axis with the change of parameters in equation (3).

Error creating thumbnail: File missing when checked in Oct 2025

Eb/N0 vs. Throughput Tradespace for downlink communications

¶ Financial Model

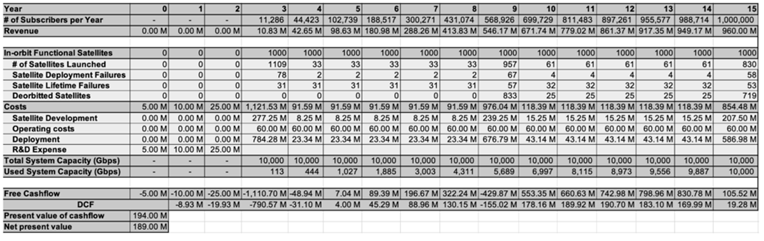

The financial model of the system is shown below.

Financial Model over 15 years

The model has a number of parameters as shown in the figure below.

Error creating thumbnail: File missing when checked in Oct 2025

Financial Model Parameters

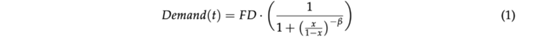

The data throughput demand per customer is assumed to be 10 Mbps. The customer growth is modeled as an S-curve (shown below) and using equation (1) starting from year 3, where the first 3 years are allocated for R&D development,

Error creating thumbnail: File missing when checked in Oct 2025

Demand S-Curve

where FD is the final demand at tmax (year 15 in our model) and x is the normalized time base (current year/tmax. The price per 1 Mbps of throughput per month is set to $8, which is less than the competition but still provides healthy project margins). Since direct-to-device communications do not require ground stations and their management, the operating costs are minimal and estimated to be $0.5 per Mbps. The cost per satellite (bill of materials, labor, and testing) are estimated to be $250,000, in line with current StarLink satellites [3]. The remaining parameters are also estimated based on the current technology pricing. The discount rate is assumed to be 12%.

The customer growth and project finances are modeled around 1 million maximum subscribers for easy scaling. This, however, is not representative of the total 5G-NTN direct-to device subscriber market, which, according to Statista, will reach 390 million subscribers globally by 2030 [4].

The cash flow of the project is shown in below. As can be seen from the graph, the initial R&D investment is a small fraction of the project costs. This is because the modeled system is comprised of a large number of relatively small LEO satellites. The development of a single LEO communications satellite is estimated to cost $40 million over the first 3 years of the project, after which the system can be scaled up and the constellation can be deployed. In our model, T = 0 is considered for the year 2025.

¶ List of R&D Projects and Prototypes

The primary differentiator of 5G NTN-based satellite communications technology is the antenna array and receiver technology. The beam-steerable phased-antenna array allows spatial multiplexing to improve the number of geographical cells that can be served by a single satellite. The receiver technology, on the other hand, is primarily concerned with the reception of very low amplitude signals emitted by smartphone devices. The transmitted power is usually around 30 dBm (1 W), and with a free space path loss of around 160 dB, the received signal is very close to the receiver noise floor. By improving the receiver technology, one would be able to improve the signal-to-noise ratio of the received signal in the uplink and thus improve the maximum possible data throughput by allowing a broader bandwidth of signals to be transmitted and received.

Antenna Array

The primary R&D technology focus for 5G NTN satellite communications system is the phased-array antenna, which consists of an array of individual radiating elements, each capable of generating a unique communications signal. By precisely controlling the phase and amplitude of the signal radiated by each element, the antenna can form highly directive beams that can be steered electronically. In addition to beam steering, phased arrays should adopt spatial multiplexing, which is a key technique for improving data throughput, the key figure of merit for our technology. This is achieved by exploiting the spatial dimension of the wireless channel, where each data stream is sent through a different spatial path over the same frequency band. The phased-array antenna creates multiple narrow beams that cover smaller geographic areas, effectively increasing the number of cells within a given region. This allows more users to be served simultaneously, enhancing the overall capacity of the network. The prototyping of such an antenna array is estimated to take 12-18 months.

Receiver Technology

The key challenge in the development of a very low-noise receiver is minimizing its noise figure, which directly impacts the received signal-to-noise ratio (SNR) and, consequently, the data throughput. This involves using high-performance low-noise amplifiers (LNAs) that operate at cryogenic temperatures to reduce thermal noise. The development of this technology will immediately impact the G/T figure of merit of 5G NTN satellite communications technology. The use of high-quality, low-loss materials in the construction of the receiver’s components, such as superconducting materials for the LNAs and high-Q resonators for filters, is crucial to minimize the receiver noise. Furthermore, state-of-the-art digital signal processing (DSP) algorithms can be utilized to enhance signal detection and correction. The prototyping of the receiver technology can run concurrently with the phases-array antenna design with spatial multiplexing and must be completed in the first 3 years of the technology development.

| Number | R&D Projects and Demonstrators | Description |

|---|---|---|

| 1 | Phased-Array Antenna Prototype | Needed for beamforming and spatial multiplexing capabilities, ensuring efficient signal targeting and high data throughput. The multiple demonstrators designed over the first 2 years of system development with the prototype launched in year 3. |

| 2 | Low-Noise Receiver Prototype | Embedded in the satellite for SNR improvement in uplink communications. Required for the uplink throughput improvement. The design should run concurrently with the phased array with the final prototype deployed in year 3 of the project. |

| 3 | Over-the-Air (OTA) Demonstrator | Real-world testing of the system’s performance, including handling Doppler shifts and latency. This should be done early in the project with the help of a broad-band satellite link emulator that emulates the satellite communications link effects in real-time. |

| 4 | Software-Defined Radio (SDR) Receiver Reconfiguration Demonstrator | For a satellite communications payload capable of operating across multiple frequency bands and protocols. Multiple demonstrators should be ready after year 1 with a prototype launched in year 3. The SDR demonstrator testing could be done at the same time as OTA demonstrator testing. |

| 5 | Prototype Algorithms for Beamforming and Signal Processing | Prototypes to optimize the DSP required for efficient communication. Must be ready by the end of year 2 and fully deployed in the prototype by year 3. |

| 6 | Satellite Bus | Used to integrate all the sub-systems together. Multiple demonstrators throughout the first 3 years of the R&D process with the final prototype ready by year 3. |

¶ Key Publications & Patents

The key papers and patents for direct-to-device satellite communications technology are listed below. This is a very active area of research, and the list below is by no means exhaustive.

Publications

- Maral G., and De Ridder J. J., ”Low Earth Orbit Satellite Systems for Communications”, Int. J. Sat. Comm., Jul. 1991

- This paper discusses the emergence of low earth orbit (LEO) satellite systems for communication, marking a shift from geostationary satellite systems and covers system design, orbital configurations, network topologies, multiple access schemes, and service applications for LEO constellation systems. The paper also explores real-time and delayed communication systems and presents examples of single- and multibeam coverage satcom link designs.

- A. Guidotti et al., ”Architectures and Key Technical Challenges for 5G Systems Incorporating Satellites,” in IEEE Trans. Veh. Techn., vol. 68, no. 3, pp. 2624-2639, Mar. 2019.

- The paper discusses the integration of satellites in 5G non-terrestrial network (NTN) systems, focusing on key technical challenges and contention resolution procedures. It also addresses the need for enhancements in current wireless communication technologies to meet the growing demand for broadband, high-speed, low-latency, high-reliability services.

- G. Giambene, S. Kota and P. Pillai, ”Satellite-5G Integration: A Network Perspective,” in IEEE Network, vol. 32, no. 5, pp. 25-31, Sep./Oct. 2018.

- The paper discusses the integration of satellite and 5G communication systems. It highlights the need for high bandwidth, low latency, and increased coverage in rural areas, air, and seas. The architecture of 5G NTN networks described in the paper includes the use of software-defined networking (SDN) and network functions virtualization (NFV) approaches for integration with the terrestrial system. In addition, a novel technique based on network coding is analyzed to joint-exploit multiple paths in the integrated system. The document mentions the importance of network slicing for differentiating data traffic.

- J. Liu, Y. Shi, Z. M. Fadlullah and N. Kato, ”Space-Air-Ground Integrated Network: A Survey,” in IEEE Comm. Surveys & Tutorials, vol. 20, no. 4, pp. 2714-2741, Q4, 2018.

- The paper discusses the emerging architecture of a Space-Air-Ground Integrated Network (SAGIN) that integrates satellite systems, aerial networks, and terrestrial communications, and provides a comprehensive review of recent research, covering network design, resource allocation, performance analysis, and optimization. Challenges like heterogeneity, limited network resources, system integration, protocol optimization, and resource management are discussed. Future directions and technology challenges are presented.

- Y. Su, Y. Liu, Y. Zhou, J. Yuan, H. Cao and J. Shi, ”Broadband LEO Satellite Communications: Architectures and Key Technologies,” in IEEE Wireless Comm., vol. 26, no. 2, pp. 55-61, Apr 2019.

- The paper provides an overview of broadband LEO satellite communication systems that aim to provide seamless worldwide mobile communications coverage using proper beam formation and distribution schemes. The described systems consist of a space segment, a ground segment, and a user segment. The benefits and drawbacks of the Walker Delta and Star LEO satellite constellations are also presented

Patents

- AST & Science, LLC, ”Satcom GSM solution directly communicate with GSM phones”, US Patent US 2024/0031013 A1, Oct. 3, 2023

- The independent claim of this patent is the multi-cell global-system-for-mobiles (GSM) satellite communication system that is used to communicate with various user equipment (UE) systems. The key patented elements of the satellite communications system are the tracking antenna which is configured to communicate with many active UEs in a multibeam (spatial multiplexing) configuration and the processing device coupled to the tracking antenna to compensate for the communications delay, Doppler shifts, provide beam-steering capability to the tracking antenna, and frequency compensation.

- Eutelsat, ”Methods for the Transmission of Data Between a Resource Constrained Device and a Non-Geostationary Satellite and Associated System”, US Patent 2023/0275651 A1, Jul. 2, 2020.

- The patent discusses methods for data transmission between a resource-constrained device and a non-geostationary satellite, emphasizing on low earth orbit satellites and leveraging beacon signals for communication. The key aspect of the invention is the elimination of the need for GPS in ground-based objects for the collection and transmission of position data, reducing cost and energy consumption.

- Apple Inc., “Communication Terminal,” U.S. Patent 11,528,076 B1, Sep. 19 , 2019.

- This patent has 3 independent claims related to multiple antenna arrays arranged in a particular configuration (rectangular or circular) and a lens covering the antenna arrays to condense the radiation beams and improve the reception quality when talking to a satellite. This technology directly improves the link budget of the satcom link.

- AST & Science, LLC, S. “System and Method for High Throughput Fractionated Satellites (HTFS) for Direct Connectivity to and from End User Devices and Terminals Using Flight Formations of Small or Very Small Satellites,” US Patent 9,973,266 B1, May 15, 2018

- This patent claims the invention of a high-throughput fractionated satellite system that employs multiple, structurally disconnected satellites that are deployed in orbit to from a large, volumetric phased array with beam-steering capabilities to provide high data throughput to multiple communication cells on earth. The benefit of this invention is the reduction of the cost of system launch and the significantly improved spectral reuse efficiency.

¶ Technology Strategy Statement

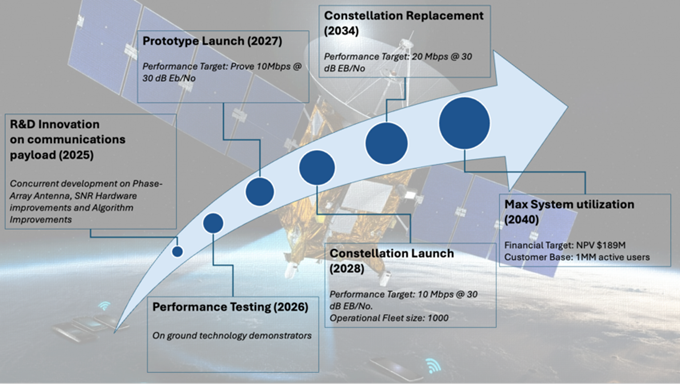

We aim to develop a new LEO Communications Satellite Constellation that uses the 5G NTN standard to achieve direct-to-device communication with unmodified cellular devices with a 10 Mbps data rate by 2028 and 20 Mbps by 2034. We will invest in three major R&D projects to achieve this data rate. The first is to develop a phased-array antenna that can beamform and perform spatial multiplexing; the second is to develop an improved Low-Noise Receiver; and the third is an algorithmic endeavor to optimize the software DSP techniques. Alongside the R&D initiatives, there will be three demonstrator projects: an OTA demonstrator, a Software-Defined Radio Receiver Demonstrator, and a final Satellite Bus integration demonstrator. These projects and demonstrators will be critical to achieving our Eb/N0 target of 30 dB and eventual data rate of 20Mbps.

¶ References

[1] O. L. De Weck, Technology Roadmapping and Development: A Quantitative Approach to the Management of Technology. Springer, 2022.

[2] 3GPP, “Release 17 description; summary of rel-17 work items,” 3rd Generation Partnership Project (3GPP), Tech. Rep. TR21.917, 2024, version 17.0.0. [Online]. Available: https://www.3gpp.org/specifications-technologies/releases/release-17

[3] B. Wang, “Spacex starlink satellites cost well below $500,000 each and falcon 9 launches less than $30 million,” Accessed: November 23, 2024. [Online]. Available: https://www.nextbigfuture.com/2019/12/spacex-starlink-satellites-cost-well-below-500000-each-and-falcon-9-launches-less-than-30-million.html

[4] Statista, “Direct satellite-to-device market subscribers worldwide,” 2024, Accessed: November 23, 2024. [Online]. Available: https://www-statista-com.libproxy.mit.edu/statistics/1362432/direct-satellite-to-device-market-subscribers-worldwide/

[5] NASA, “The recent large reduction in space cost,” 2020, accessed: 2024-10-06. [Online]. Available: https://ntrs.nasa.gov/citations/20200001093

[6] S. P. Sergei Pekhterev, “The bandwidth of the starlink constellation...and the assessment of its potential subscriber base in the usa.” 2021, accessed: 2024-10-06. [Online]. Available: http://www.satmagazine.com/story.php?number=1026762698

[7] Robotbeat,“StarlinkfundamentalcostperGBequation(andcomparisontocompetition),” 2020, accessed: 2024-10-06. [Online]. Available: https://forum.nasaspaceflight.com/index.php?topic=52254.0

[8] S. Liu, Z. Gao, Y. Wu, D. W. Kwan Ng, X. Gao, K.-K. Wong, S. Chatzinotas, and B. Ot- tersten, “Leo satellite constellations for 5g and beyond: How will they reshape vertical domains?” IEEE Communications Magazine, vol. 59, no. 7, pp. 30–36, 2021.

[9] Iridium, “Iridium next generation statement,” FCC, Tech. Rep., 2013. [Online]. Available: https://fcc.report/IBFS/SAT-MOD-20131227-00148/1031348.pdf

[10] eoPortal, “Oneweb minisatellite constellation,” 2019, accessed: 2024-10-28. [Online]. Available: https://www.eoportal.org/satellite-missions/oneweb#eop-quick-facts-section

[11] FCC, “Oneweb non-geostationary satellite system (leo),” -, accessed: 2024-10-28. [Online]. Available: https://fcc.report/IBFS/SAT-MPL-20200526-00062/2379706.pdf

[12] ASTS, “Ast spacemobile achieves space-based 5g cellular broadband connectivity from everyday smartphones, another historic world first,” 2023, accessed: 2024-10-28. [Online]. Available: https://ast-science.com/2023/09/19/ast-spacemobile-achieves-space-based-5g-cellular-broadband-connectivity-from-everyday-smartphones-another-historic-world-first/

[13] “Bluebird 1-5,” 2024, accessed: 2024-11-04. [Online]. Available: https://ast-science.com/spacemobile-network/bluebird-1-5/

[14] “Ast spacemobile announces successful orbital launch of its first five commercial satellites,” 2024, accessed: 2024-11-04. [Online]. Available: https://about.att.com/story/2024/ast-spacemobile-launches-first-five-commercial-satellites.html

[15] “Fcc approves ast spacemobile’s 1st commercial satellite launch,” 2024, accessed: 2024-11-04. [Online]. Available: https://news.satnews.com/2024/08/06/fcc-approves-ast-spacemobiles-1st-commercial-satellite-launch/#:∼:text=With%20this%20initial%20license%2C%20AST,first%20five%20commercial%20BlueBird%20satellites

[16] “Spacex’s cellular starlink hits 17mbps download speed to android phone,” 2024, accessed: 2024-11-04. [Online]. Available: https://www.pcmag.com/news/spacexs-cellular-starlink-hits-17mbps-download-speed-to-android-phone

[17] FCC, “Spacex antenna gain application approval,” 2023, accessed: 2024-10-28. [Online]. Available: https://licensing.fcc.gov/cgi-bin/ws.exe/prod/ib/forms/reports/swr031b.hts?q_set=V_SITE_ANTENNA_FREQ.file_numberC/File+Number/%3D/SATMOD2023020700021&prepare=&column=V_SITE_ANTENNA_FREQ.file_numberC/File+Number

[18] “Cellular starlink service reaches new milestone with 100+ satellites in orbit,” 2024, accessed: 2024-11-04. [Online]. Available: https://www.pcmag.com/news/cellular-starlink-service-reaches-new-milestone-with-100-plus-satellites#:∼:text=The%20ambitious%20launch%20schedule%20is,users%20with%20robust%20enough%20coverage

[19] “Constellation connects to 5g, paving the way for high-speed internet access to remote mobile phone users,” 2023, accessed: 2024-11-04. [Online]. Available: https://oneweb.net/resources/constellation-connects-5g-paving-way-high-speed-internet-access-remote-mobile-phone-users

[20] “Iridium unveils project stardust; developing the only truly global, standards-based iot and direct-to-device service,” 2024, accessed: 2024-11-04. [Online]. Available: https://investor.iridium.com/2024-01-10-Iridium-Unveils-Project-Stardust-Developing-the-Only-Truly-Global,-Standards-Based-IoT-and-Direct-to-Device-Service

[21] R. A. K. W. David Jarvis, Duncan Stewart, “Signals from space: Direct-to-device satellite phone connectivity boosts coverage,” 2023, accessed: 2024-11-04. [Online]. Available: https://www2.deloitte.com/us/en/insights/industry/technology/technology-media-and-telecom-predictions/2024/future-of-global-satellite-direct-to-device-communications.html

[22] “Apple picks globalstar for emergency satellite service on iphone 14,” 2022, accessed: 2024-11-04. [Online]. Available: https://www.reuters.com/technology/apple-picks-globalstar-satellite-service-iphone-14-series-2022-09-07/

[23] “Apple to invest up to $1.5 bln in globalstar for satellite coverage expansion,” 2024, accessed: 2024-11-04. [Online]. Available: https://www.reuters.com/technology/apple-invest-up-15-bln-globalstar-satellite-coverage-expansion-2024-11-01/

[24] “Starlink prices,” 2024, accessed: 2024-11-04. [Online]. Available: https://www.starlink.com/us/roam

[25] “Iridium price,” 2024, accessed: 2024-11-04. [Online]. Available: https://www.roadpost.com/iridium-go-monthly-airtime-plans.html?srsltid=AfmBOoqcdqnbD-zHCNkXxErSlLIWuITU81_dl4PD3NtzACvVvGlWaR2K

[26] “Globalstar price,” 2024, accessed: 2024-11-04. [Online]. Available: https://www.globalstar.com/en-us/service-plans

[27] J. Sedin, L. Feltrin, and X. Lin, “Throughput and capacity evaluation of 5g new radio non-terrestrial networks with LEO satellites,” CoRR, vol. abs/2012.02136, 2020. [Online]. Available: https://arxiv.org/abs/2012.02136

[28] FCC, “Bluewalker 3 non-geostationary satellite updated technical annex,” 2021, accessed: 2024-10-28. [Online]. Available: https://apps.fcc.gov/els/GetAtt.html?id=281537&x=

[29] W. Monte, Louie, “Mobile telephony through leo satellites: To obp or not,” Conference, 1991.

[30] Jackson, “‘life-saving technology’: Ast spacemobile ceo outlines capabilities of direct- to-smartphone leo satellite service,” 2021, accessed: 2024-10-28. [Online]. Available: https://urgentcomm.com/2021/04/09/life-saving-technology-ast-spacemobile-ceo-outlines-capabilities-of-direct-to-smartphone-leo-satellite-service/

[31] G. Americas, “Update on 5g non-terrestrial networks,” 2023, accessed: 2024-10-28. [Online]. Available: https://www.5gamericas.org/wp-content/uploads/2023/07/Update-on-5G-Non-terrestrial-Networks-Id.pdf

[32] FCC, “Spacex uplink and downlink application approval,” 2023, accessed: 2024-10-28. [Online]. Available: https://licensing.fcc.gov/cgi-bin/ws.exe/prod/ib/forms/reports/swr031b.hts?q_set=V_SITE_ANTENNA_FREQ.file_numberC/File+Number/%3D/SATMOD2023020700021&prepare=&column=V_SITE_ANTENNA_FREQ.file_numberC/File+Number

[33] H. K. L. M. N. S. S. T. X. Euler, Fu, “Using 3gpp technology for satellite communication,” -, accessed: 2024-10-28. [Online]. Available: https://www.ericsson.com/en/reports-and-papers/ericsson-technology-review/articles/3gpp-satellite-communication

[34] Kan, “Spacex’s cellular starlink hits 17mbps download speed to android phone,” 2024, accessed: 2024-10-28. [Online]. Available: https://www.pcmag.com/news/spacexs-cellular-starlink-hits-17mbps-download-speed-to-android-phone

[35] Nikolaenko, “Oneweb’s satellite constellation achieves connection to terrestrial 5g,” 2023, accessed: 2024-10-28. [Online]. Available: https://www.bcsatellite.net/blog/oneweb-testing-5g-backhaul-via-satellite/#:∼:text=OneWeb’s%20LEO%20fleet%20can%20extend%205G%20access,performance%20for%20remote%20users%2C%20unlocking%20bandwidth%2Dheavy%20apps.