Difference between revisions of "Lab Grown Meat"

| Line 135: | Line 135: | ||

The projected revenue in the plateau period can be calculated with the planned capacity and unit price of the product. UPSIDE Foods plans to scale up to a total capacity of 400,000 lbs [2]. The unit price of lab-grown meat should be comparable to the traditional meat products in the plateau period, which means we can assume it to be the highest price in the current meat market, $12/lb [3]. This leads to an annual revenue of $4.8M [4] during the plateau period. | The projected revenue in the plateau period can be calculated with the planned capacity and unit price of the product. UPSIDE Foods plans to scale up to a total capacity of 400,000 lbs [2]. The unit price of lab-grown meat should be comparable to the traditional meat products in the plateau period, which means we can assume it to be the highest price in the current meat market, $12/lb [3]. This leads to an annual revenue of $4.8M [4] during the plateau period. | ||

We assume a Logistic Growth Model for the revenues in the ramp-up period. The | We assume a Logistic Growth Model for the revenues in the ramp-up period. The expression of such a model is: | ||

[[File:LGM_equation1.jpg|120px]] | [[File:LGM_equation1.jpg|120px]] | ||

Revision as of 02:56, 21 November 2023

Roadmap Overview

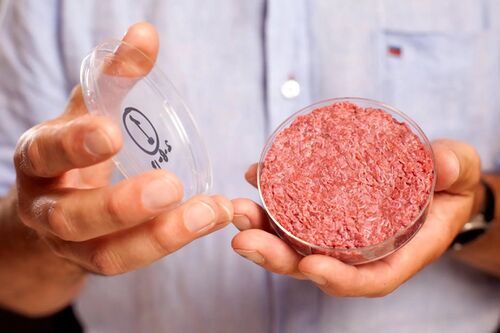

This roadmap focuses on cellular agriculture for meat production, which is also commonly referred to as cultured meat or lab-grown meat. This technology permits one to generate edible meat products without rearing and slaughtering livestock. Instead, operators can obtain targeted tissue and cell samples from the desired organism and then culture them in a bioreactor to fabricate meat products that are biologically identical and structurally similar to their conventional counterparts. Anticipated benefits of this technology are increased water efficiency, reduced feed requirements, and lower risks of zoonotic disease transfer.

Taxonomically, cellular agriculture can be categorized as a transform process that applies to organisms, corresponding to (L,1) in the five-by-five Expanded Technology Matrix. This technology takes tissues and cells that ordinarily develop in vivo and provides circumstances that allow them to develop in vitro.

- Tissue Engineering Applications (1TEA)

- 2ORG: Organ Regeneration

- 2VOF: In Vitro Organ Fabrication

- 2IVM: In Vitro Model

- 2OOC: Organ-on-a-Chip

- 2ARW: Artificial Womb

- 2LGM: Lab-Grown Meat

- Lab-Grown Meat (2LGM)

- 3CTC: Cell/Tissue Culturing

- 3CEL: Cell Line Development

- 3SCA: Socio-Cultural Acceptance

- Cell/Tissue Culturing (3CTC)

- 4BIR: Bioreactor

- 4MED: Culture Medium

- 4ECM: Extracellular Matrix (Scaffold)

- Cell Line Development (3CEL)

- 4SOR: Source Organism

- 4CPD: Cell Proliferation and Differentiation

- Socio-Cultural Acceptance (3SCA)

- 4TPL: Transparent Labeling

- 4RDC: Religious Diet Certification

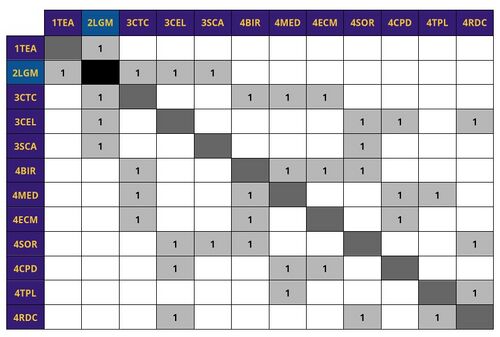

Design Structure Matrix (DSM) Allocation

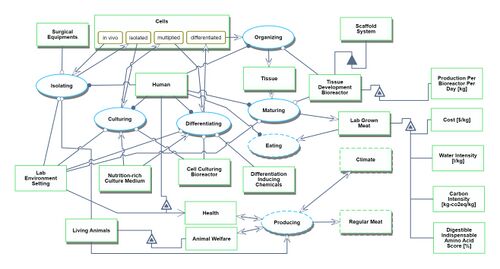

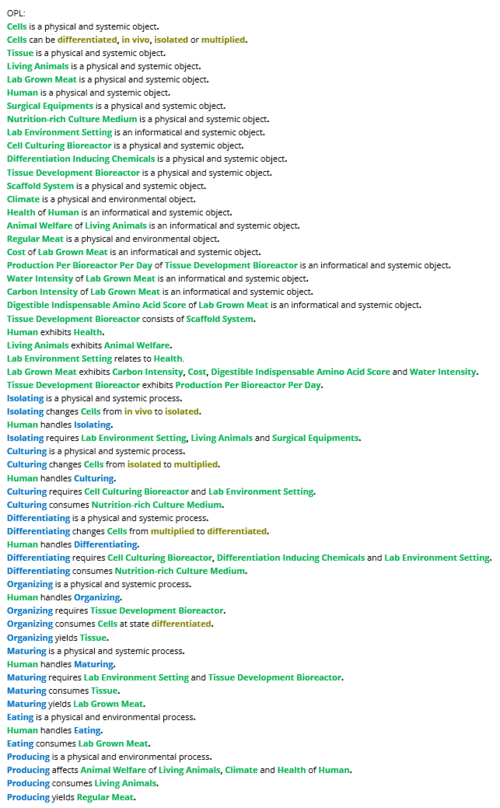

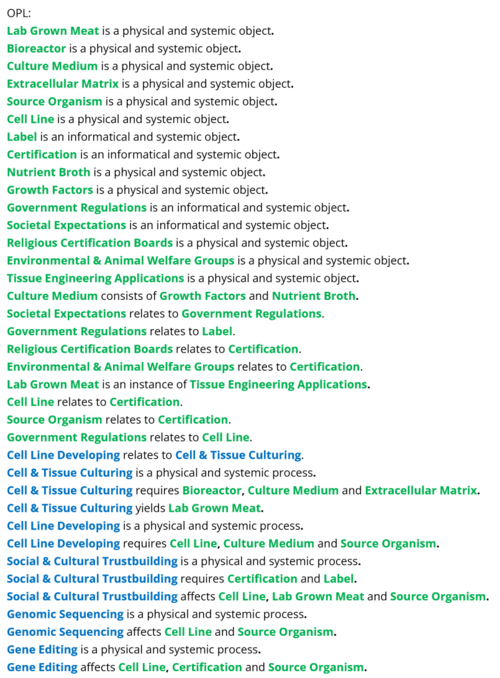

Roadmap Model using OPM

Techno-System OPD for Lab Grown Meat

Roadmapping OPD for Lab Grown Meat

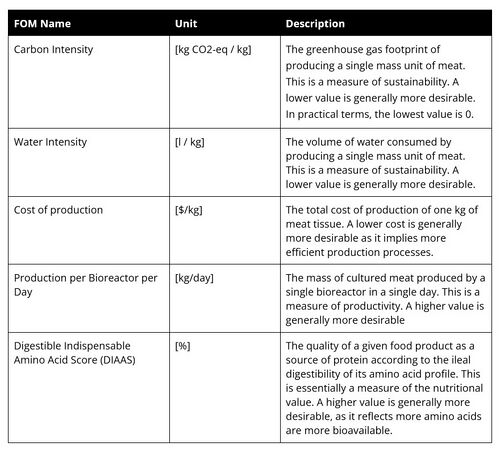

Figures of Merit

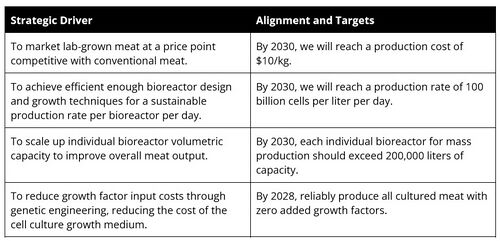

Alignment with Strategic Drivers

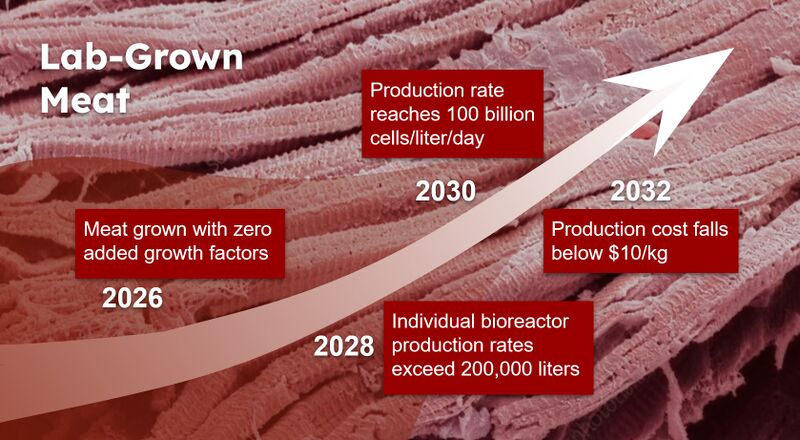

Current companies producing lab grown meat are Upside (formerly known as Memphis Meats), Believer Meats, and GOOD Meat. GOOD Meat has the single largest bioreactor for cultivated meat at 6000 L in size. After comparing and contrasting the strategic drivers of these other companies, we can create our own:

For reference, the strategic drivers of GOOD Meat include driving “their serum-free media cost further down from the current $1 per liter to ‘tens of cents,’ according to Tetrick, allowing the company to produce “hundreds of thousands of pounds” of cultivated meat.” GOOD Meat’s “next phase is to install vessels north of 100,000 liter each, which will enable tens of millions of pounds.” GOOD Meat is also the first company to start selling chicken nuggets and chicken breasts through restaurants and food vendors in Singapore, and dishes cost about $18.5 singaporean dollars (or $14 USD). [1]

Believer Meats, another startup from Israel, “recently claimed to have achieved a production density of 100 billion cells per liter,” in addition to using a “medium that costs less than $5 per liter.” [1]

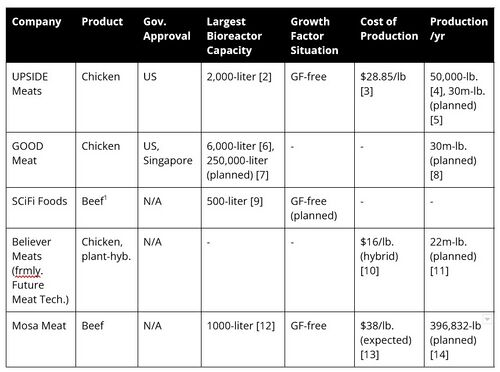

Position of Competition

NOTE: As this is an emerging market, details concerning company metrics and plans are sparse and fairly vague.

[2] https://cen.acs.org/food/Inside-effort-cut-cost-cultivated/101/i33 [3] https://www.trouw.nl/groen/van-het-lab-naar-een-bord-is-een-lange-weg-voor-kweekvlees~ae6d9867/ [4] https://www.fooddive.com/news/upside-foods-cultivated-cell-based-meat-plant-epic/609182/ [5] https://www.illinois.gov/news/press-release.27020.html [6] https://techcrunch.com/2023/01/18/good-meat-regulatory-approval/ [7] https://agfundernews.com/good-meat-gets-green-light-from-fda-for-cultivated-meat [8] https://www.foodnavigator-usa.com/Article/2022/05/25/GOOD-Meat-plans-US-cultivated-meat-facility-with-capacity-to-produce-up-to-30m-lbs-of-meat# [9] https://www.fastcompany.com/90831145/the-first-crispr-gene-edited-meat-is-coming-and-this-is-the-ceo-making-sci-fi-reality [10] https://www.mckinsey.com/industries/agriculture/our-insights/cultivated-meat-out-of-the-lab-into-the-frying-pan [11] https://www.prnewswire.com/news-releases/believer-meats-breaks-ground-on-largest-cultivated-meat-production-facility-in-the-world-301697617.html [12] https://agfundernews.com/mosa-meat-opens-facility-sees-a-clear-path-towards-price-parity [13] https://cleantechnica.com/2019/09/12/mosa-meat-from-e250000-to-e9-burger-patties/ [14] https://www.dutchnews.nl/2020/10/food-for-thought-cultured-meat-maker-brings-in-55m-in-funding/

Technical Model

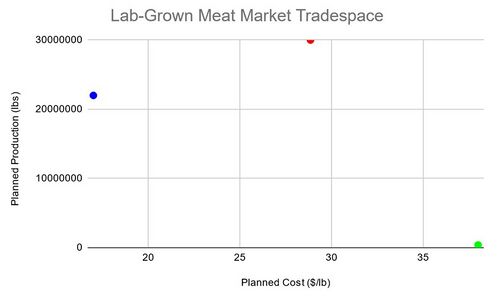

Tradespace

Figure 1. The market tradespace for current lab-grown meat companies. The blue datapoint is Believer Meats, the red datapoint is Upside Meats, and the green datapoint is Mosa Meats. Note that the two axes, the planned cost, and planned production, are taken from news releases from all three startups. The further left a data point is, the lower the planned cost, and the more desirable the technology. Similarly, the further up a data point is, the higher the planned production, and the more desirable the technology.

To optimize the technology of lab-grown meat, we seek technologies towards the top left of this tradespace.

Unfortunately, there is a lack of data due to the nature of the industry as one of developing technologies which have not begun to release data and for which production methods are like trade secrets. Since we have so few data points, it is also difficult to assess the pareto frontier of what is achievable in production and cost.

One potential reason that Believer Meats (formerly known as Future Meat) has such a high production and low cost per pound is because of their business model, where they mix lab grown meat with plant-based proteins, which are a lot cheaper to produce.

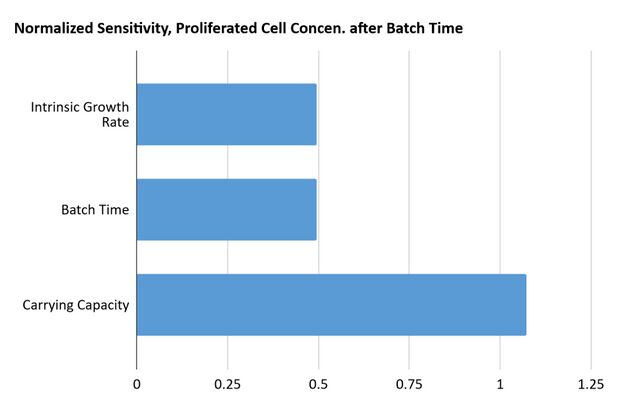

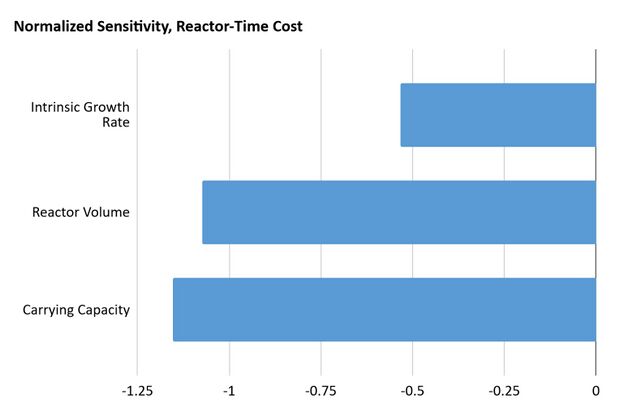

Tornado Charts for Sensitivity Analysis of Selected FOMs

Key Publications and Patents

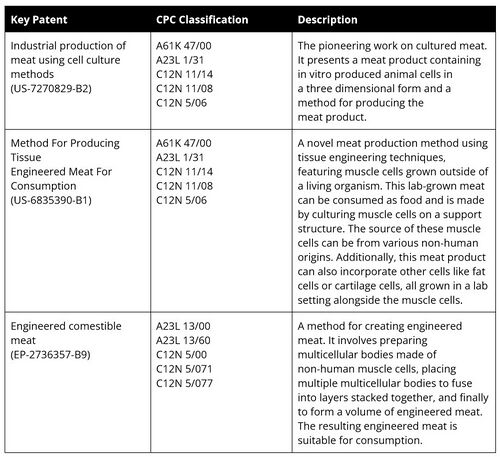

Key Patents

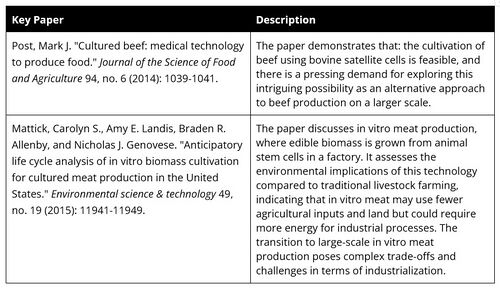

Key Papers

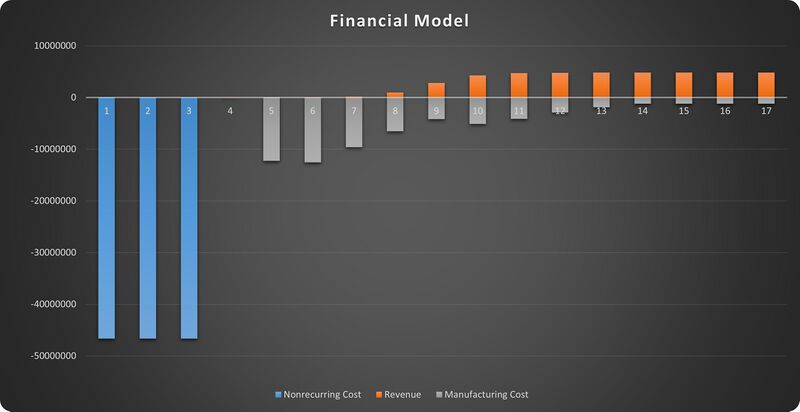

Financial Model

The financial model is based on NPV analysis of nonrecurring cost, revenues and manufacturing recurring cost. And we select UPSIDE Foods (formerly known as Memphis Meats) for case study here. UPSIDE Foods is the first (and one of the only two for now) startup company dedicated to lab-grown meat production that has got approval from FDA. As it is a startup that pioneers the innovation of a new technology, the impacts relative to a baseline business plan can be quantified with the absolute values of costs and revenues.

In accordance with the example provided in Chapter 8 of the textbook, the impacts can be broken down into an initial period (with no scaled production), a ramp-up period and a plateau period after reaching market equilibrium.

For the intuitiveness of analysis, we hypothetically assume that we are currently in the year before UPSIDE Foods was set up.

The components of such a financial model are:

1. Initial period: nonrecurring cost 2. Ramp-up period: manufacturing cost and revenue, variable 3. Plateau period: manufacturing recurring cost and revenue, constant

According to news report, the initial cost for R&D and infrastructure of scaled up production was about $140M for UPSIDE Foods [1], and the company was established in 2014 while started making revenues from production in 2017. So we scaled the initial cost to a 3-year initial period and got the nonrecurring cost value of $47M every year.

The projected revenue in the plateau period can be calculated with the planned capacity and unit price of the product. UPSIDE Foods plans to scale up to a total capacity of 400,000 lbs [2]. The unit price of lab-grown meat should be comparable to the traditional meat products in the plateau period, which means we can assume it to be the highest price in the current meat market, $12/lb [3]. This leads to an annual revenue of $4.8M [4] during the plateau period.

We assume a Logistic Growth Model for the revenues in the ramp-up period. The expression of such a model is:

where c is the maximum revenue ($4.8M). The other parameters a and b can be derived by looking at two reference values, $0.001M for 2017 and $2.8M for 2022 [4]. This gives us a=4799 and b=1.7627. By setting f(t) =$4.8M-$0.0001M, we can solve for the length of ramp-up period t=10, meaning the model enters the plateau period in 2027.

Sources:

[1] https://agfundernews.com/upside-foods-to-pump-140m-into-commercial-scale-cultivated-meat-plant-near-chicago [2] https://upsidefoods.com/innovation [3] https://www.ers.usda.gov/data-products/meat-price-spreads/ [4] https://www.zippia.com/memphis-meats-careers-1392392/revenue/

R&D Projects

1. Scaling up operations for mass market (TRL6) - Over 100 start-ups are currently working to mass produce and commercialize affordable lab-grown meat products, which currently exist only as a small-scale and high-cost products available in limited retail contexts.

2. Growth factor-free cell lines (TRL4) - Many companies seek to genetically engineer cell lines to produce their own growth factors, eliminating the need for expensive, additive growth factors.

3. Added scaffold-free cell lines (TRL2) - Similar to growth factors, several companies are beginning to work on genetically engineer cell lines to produce their own scaffold, which reduces the need for added, external scaffolds.

Demonstrator Projects:

1. University of Maastricht burger (2013):

Source: https://www.nytimes.com/2013/08/06/science/a-lab-grown-burger-gets-a-taste-test.html

2. Vow’s mammoth meatball (2023):

Source: https://www.theguardian.com/environment/2023/mar/28/meatball-mammoth-created-cultivated-meat-firm

Technology Statement and Swoosh Chart

Since lab-grown meat is a new industry with a low TRL of around 4-6, our technology strategy in the near-term future focuses on improving the technology for the production of lab grown meat and scaling it to a level where production can become profitable, and startups can begin selling their products.

Our main strategic drivers are to (1) reduce growth factor costs and the amount of growth medium needed, (2) scale up individual bioreactor capacity to improve output, (3) achieve efficient bioreactor design and techniques for a sustainable production rate. (4) market lab-grown meat at a price competitive with conventional meat.