Difference between revisions of "Radio Frequency Counter UAS System"

| Line 126: | Line 126: | ||

==Financial Model== | ==Financial Model== | ||

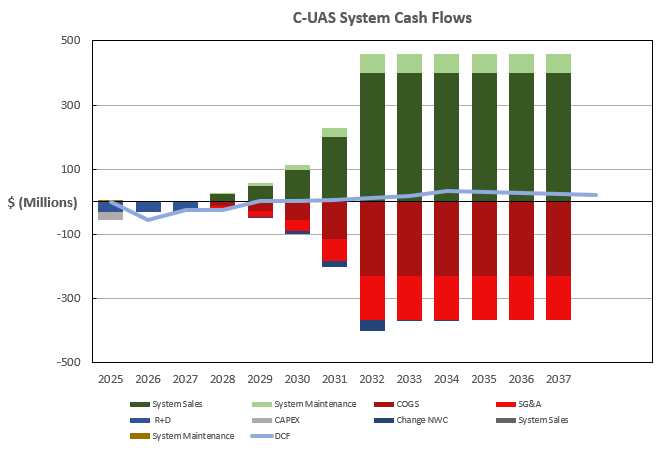

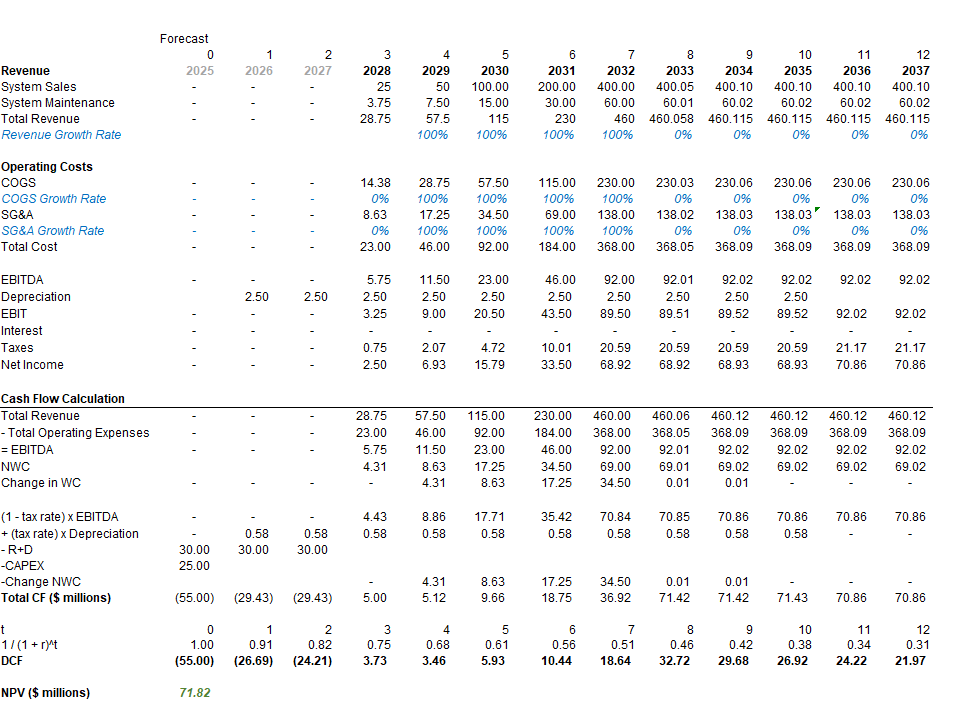

Our analysis is prepared from the perspective of an early-stage startup targeting fixed counter-UAS systems. We assess the total addressable product market is currently $1.2B, growing at a 24.7% CAGR, and forecast our future sales to be 6% of the market. Our discounted cash flows | Our analysis is prepared from the perspective of an early-stage startup targeting fixed counter-UAS systems. We assess the total addressable product market is currently $1.2B, growing at a 24.7% CAGR, and forecast our future sales to be 6% of the market. Our discounted cash flows account for revenues from sales of C-UAS systems and recurring system maintenance, as well as research and development (R&D) costs, CAPEX required to build a sufficient manufacturing footprint, and operating expenses (COGS, SG&A, Working Capital) necessary to produce and sell our systems. Ultimately, this model projects a positive Net Present Value of $71.82M and our summary of cash flows and key assumptions are depicted below. | ||

Assumptions: | Assumptions: | ||

Revision as of 04:00, 26 November 2024

Roadmap Creators:

Time Stamp: 5 November 2024

Radio Frequency Counter UAS System

Roadmap Overview

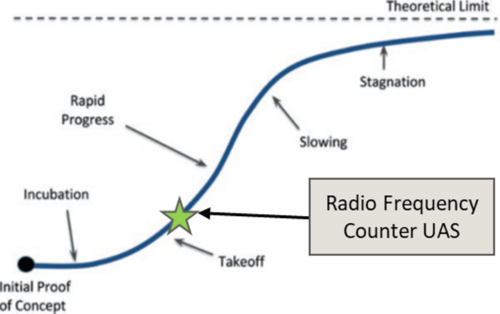

Counter-Unmanned Aircraft Systems (C-UAS) are technologies developed to detect, track, and neutralize unmanned aerial vehicles (UAVs) in situations where they pose security threats. With the proliferation of drones around the world, C-UAS is essential to the future airspace security landscape. C-UAS are modular and interoperable with numerous platforms. Demonstrated technologies include radar, electro-optical/infrared, acoustic, and radio frequency sensors for drone detection, as well as communication signals jamming, cyber takeover, and directed energy applications (laser and electromagnetic) for drone mitigation. Due to the variety of C-UAS configurations, our roadmap focuses on radar detection and radio frequency (RF) jamming.

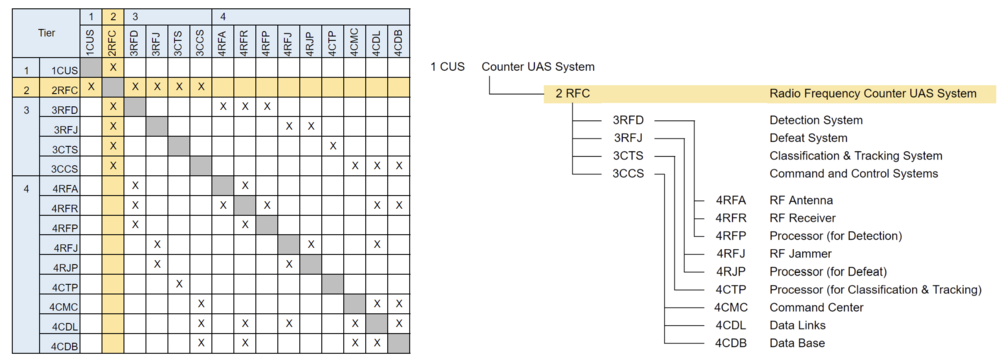

DSM Allocation

The above 2RFC tree shows the relationship between some systems related to the Counter UAS system that uses radio frequency as for detection and defeat. This tree says that the Counter UAS system consists of the detection system (3RFD), defeat system (3RFJ), classification & tracking system (3CTS), and command and control system (3CCS). In addition, these subsystems require several components such as an RF antenna (4RFA), RF jammer (4RFJ), a processor for classification and tracking (4CTP), command center (4CMC), and so on. As this DSM shows, The DSM indicates that each component is coupled to function as an RF counter UAS system.

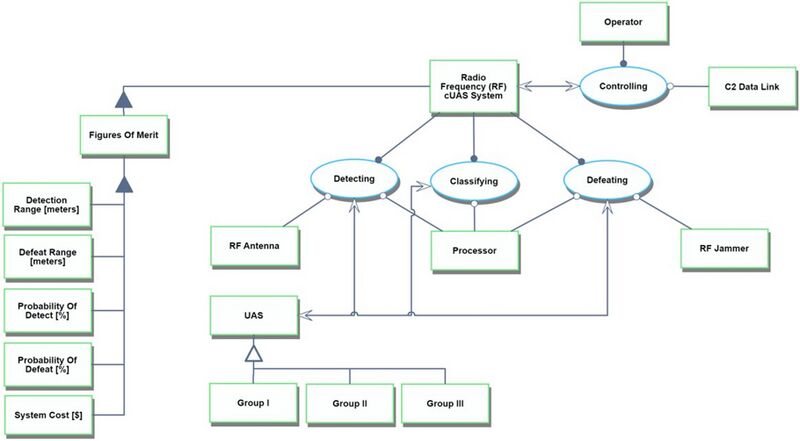

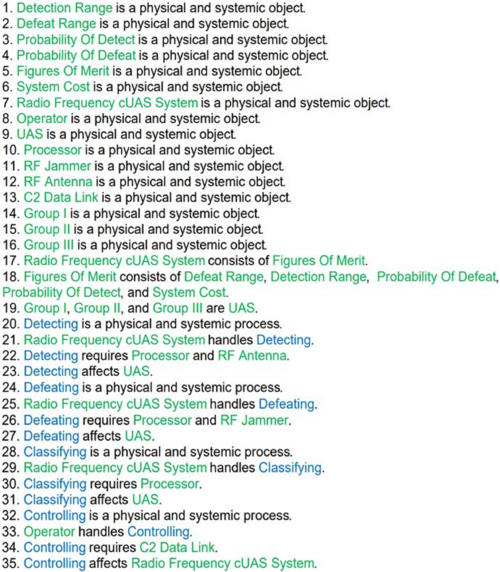

Roadmap Model using OPM

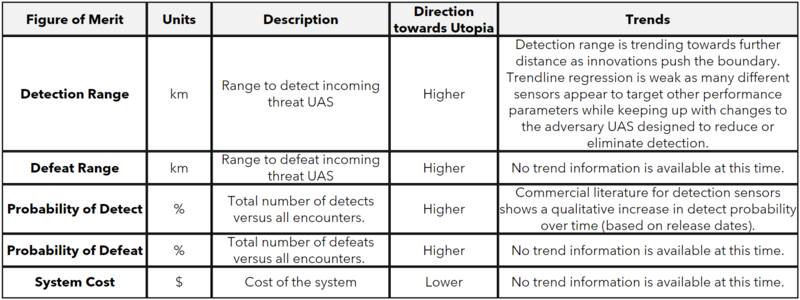

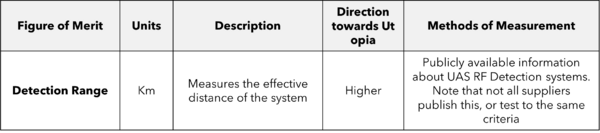

Figures of Merit (FOM)

The table above summarizes a number of different Figures of Merit (FOM) for the C-UAS System. The complete system that detects and defeats will have similar FOMs on either side of the chain, and we've selected to focus on Detect as the key FOM. Detect ranges are one of the more widely publicly available data metrics for such systems. However, each entity may not utilize the same metrics for comparison. This study makes the assumption that detection range metrics from different suppliers are one-to-one.

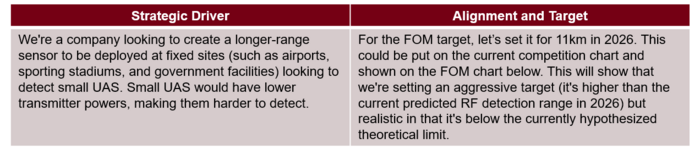

Alignment with “Company” Strategic Drivers

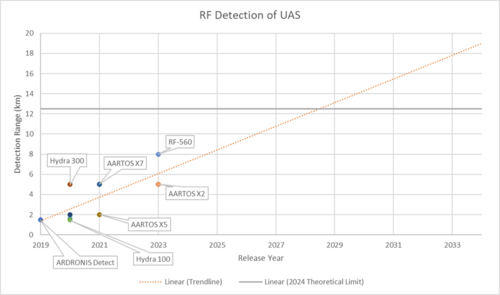

FOM Targets

Based on the recent proliferation of UAS, there should be a need to address the case of UAS misuse. The company's strategic drivers and FOM targets based on this need are considered to be as follows.

Position of Company vs. Competition

FOM charts

While the FOMs listed above are important indicators for measuring system performance, not all data for products currently on the market are publicly available. This section presents charts only for detection ranges for which data is publicly available, and comparisons can be made between products.

Technical Model

Morphological Matrix and Tradespace

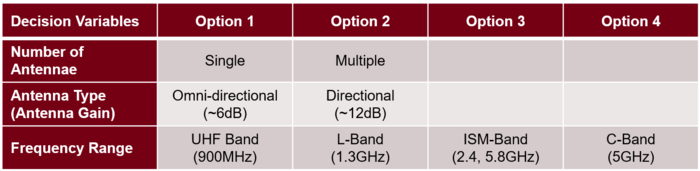

Numerous design vectors determine the system, and it is impossible to list them all. Therefore, three representative decision variables are presented here.

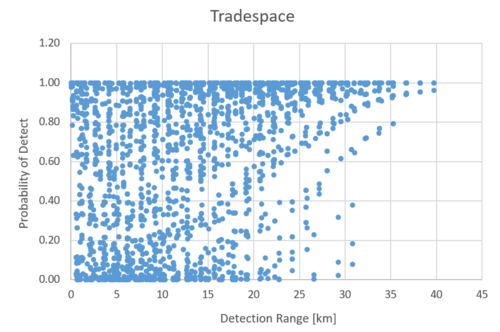

The Tradescope based on the combination of these decision variables is as follows. Typically, a performance versus cost comparison is typical, but considering that cost estimation is currently difficult, a Tradescope was created for the two indicators that will undergo sensitivity analysis later. As explained in the section on sensitivity analysis, the parameters of the UAS being detected are also taken into consideration here.

Many results show detection probabilities close to 1, and most of these are combinations with high antenna gain. However, it should be noted that high-gain antennas have high directivity, which narrows the detection range compared to omnidirectional antennas. Therefore, compensation, such as appropriately integrating multiple antennas to cover the same area, is necessary.

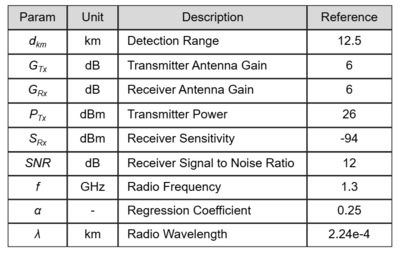

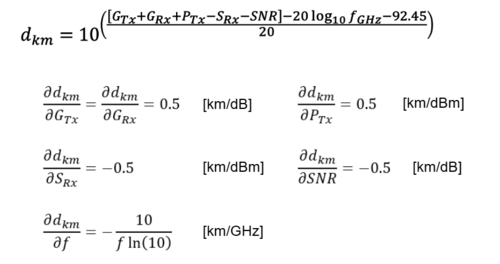

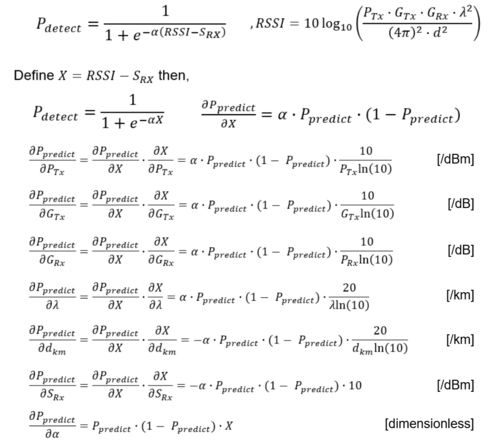

FOM Sensitivity

The FOM of the counter UAS system is shown above. Among them, we formulate the detection range and probability of detect and evaluate their sensitivity. The variables used in the formula and their reference values are listed below.

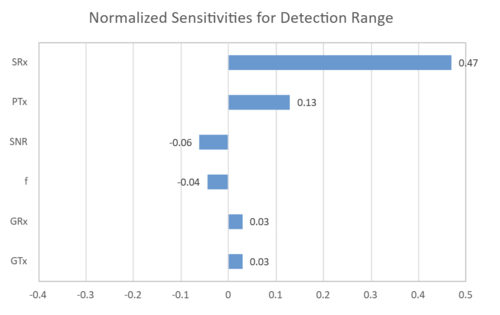

Detection Range

Here, GTx, PTx, and f are values determined by the UAS to be detected, but considering that the system's performance varies depending on the detection target, we will check the impact of these values.

When the partial derivatives of each variable are calculated, the partial derivatives for all variables except f are low values. Therefore, the influence of these variables on the detection distance, which is an important index in evaluating the performance of the system, is easy to interpret.

Next, we evaluate the sensitivity of the detection distance d to each variable. Here, the rate of change in the detection distance is shown for a 1% increase in each variable from the reference value.

The results show that improving the receiver's receiver sensitivity is strongly influenced by improving the detection distance. It is necessary to construct a system that can detect UAS even when the reception level is low.

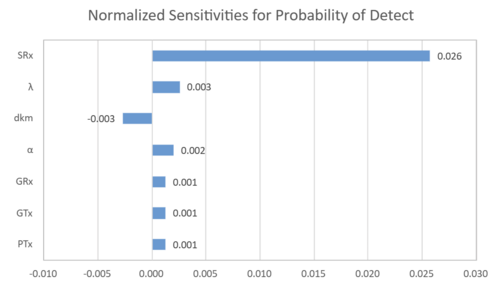

Probability of Detect

Here, since the detection probability follows a logistics function, the result of the partial differentiation of each variable shows a sigmoidal slope. Thus, a positively large value of the partial derivative implies a higher probability of detection. Next, we evaluate the sensitivity of the probability of detection to each variable. Here, the rate of change in the detection distance is shown for a 1% increase in each variable from the reference value.

The results show that improving the receiver's receiver sensitivity is strongly influenced by improving the probability of detection. Despite the different indicators and different derivation assumptions in the equations, the most contributing variables are consistent with the results for detection distance, and the results for each are considered plausible.

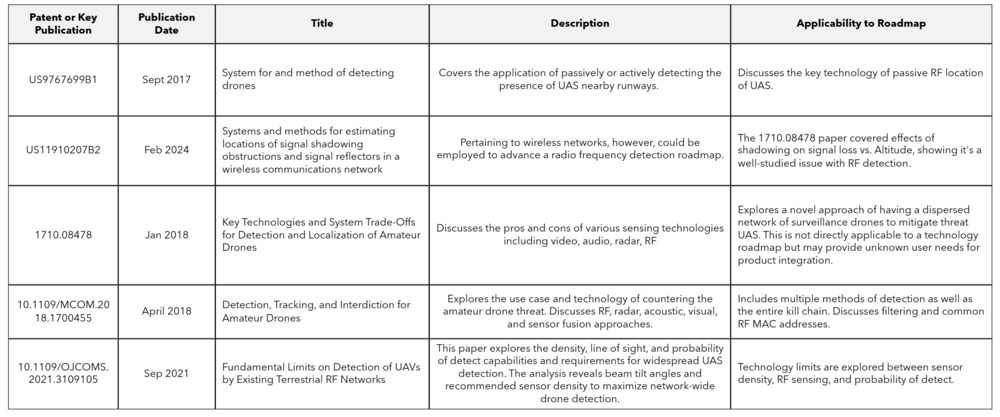

Key Publications and Patents

Financial Model

Our analysis is prepared from the perspective of an early-stage startup targeting fixed counter-UAS systems. We assess the total addressable product market is currently $1.2B, growing at a 24.7% CAGR, and forecast our future sales to be 6% of the market. Our discounted cash flows account for revenues from sales of C-UAS systems and recurring system maintenance, as well as research and development (R&D) costs, CAPEX required to build a sufficient manufacturing footprint, and operating expenses (COGS, SG&A, Working Capital) necessary to produce and sell our systems. Ultimately, this model projects a positive Net Present Value of $71.82M and our summary of cash flows and key assumptions are depicted below.

Assumptions:

- C-UAS System requires $90M R+D expenditure, evenly distributed over 3 years.

- Manufacturing Facility is a one-time $25M CAPEX in year 1, depreciated straightline over 10 years.

- Project timeline is 13 years (3 years of R+D plus a 10-year useful product life before C-UAS system is obsolete)

- Sales grow from $25M to $400M over 4-years and then stabilize at a 5% growth rate.

- Cost of goods sold (COGS) are 50% of Sales in hardware industries.

- SG&A Expenses are 30% of Sales in hardware industries

- Project is all-equity financed (no interest expense)

- 10.25% Discount Rate

- 23% Corporate Tax Rate

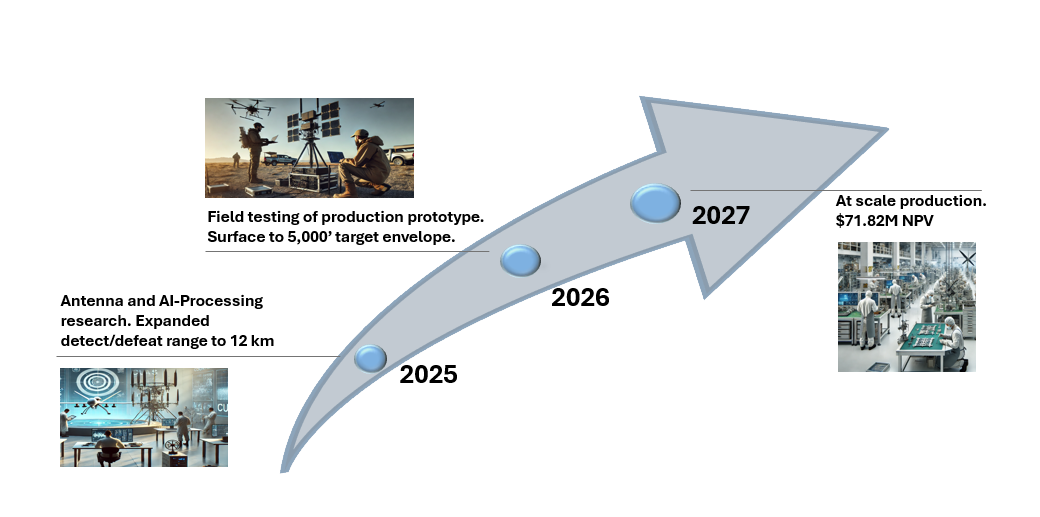

Technology Strategy Statement

The technology strategy for our new Counter-UAS system focuses on leveraging advanced RF detection and defeat capabilities to effectively neutralize Group 1 drones in complex operational environments. By integrating cutting-edge signal processing algorithms with adaptive RF transmission techniques, the system will provide real-time identification, tracking, and disruption of drone threats omnidirectionally at ranges up to 12km and altitudes from surface to 5,000ft AGL. To launch this product in 2028, our company plans to invest Research and Development into high-gain, multi-band, and beamforming antennas as well as AI-powered signal processing. This will progress to a field prototype testing campaign in 2026 and will culminate with at-scale production of our commercial system in 2028.