Difference between revisions of "Online Reverse Procurement Marketplaces and Auctions"

| Line 101: | Line 101: | ||

** Drugs, drug proprietaries and druggists' sundries | ** Drugs, drug proprietaries and druggists' sundries | ||

[[File:Ecommerce Market.png|thumb]] | [[File:Ecommerce Market.png|thumb]] | ||

** Apparel, piece goods, and notions | ** Apparel, piece goods, and notions | ||

** Groceries and related products | ** Groceries and related products | ||

Revision as of 09:06, 5 November 2019

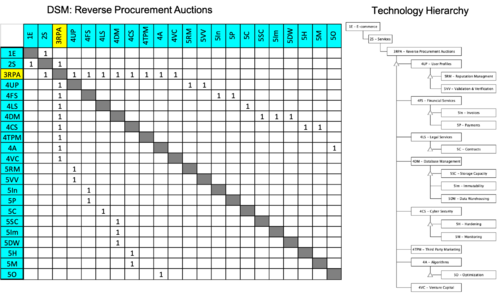

Technology Roadmap Sections and Deliverables

Roadmap Overview

Clear and unique identifier:

3RPM - Reverse Procurment Markets

This Roadmap focuses on online reverse procurement marketplaces and auctions, which are online marketplaces and auctions where service providers bid on different service requests from people and companies in need of contract work. Examples include Upwork, Mechanical Turk, and other industry specific markets and auctions.

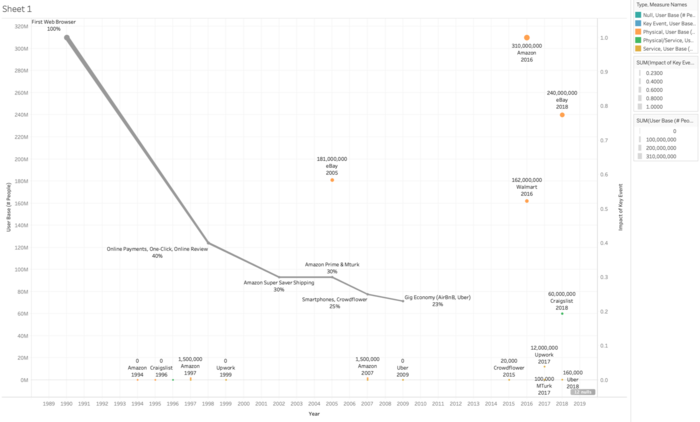

The chosen figure of merit is user base, measured as either active buyers (of products) or service providers (for services). We have chosen to segment by several major e-commerce platforms of both services and products, which generally show the relative scope and growth of each sector. Figure of Merit: User Base [# buyers of products, providers of services] Theoretical Limit: World Population (all transactions for goods/services are online)

The technology that we will consider through a technology roadmap is online reverse procurement marketplaces and auctions, which are online marketplaces and auctions where service providers bid on different service requests from people and companies in need of contract work. Examples include Upwork, Mechanical Turk, and other industry specific markets and auctions.

Design Structure Matrix (DSM) Allocation

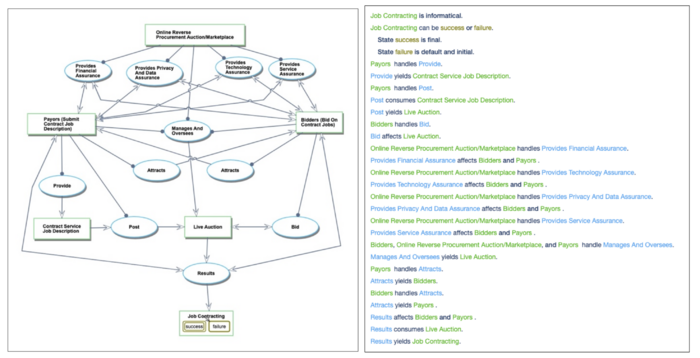

Roadmap Model using OPM

Figures of Merit

Scale [%] [$ of services transacted online/$ of total services transacted online & offline]

User Base [# Total Active Users] (can subdivide to separate sides of market: buyers and service providers)

Average Margin [%] [average of market fee / total transaction value] (declining margin shows broad acceptance and use along with industry maturity)

Transaction Speed [Seconds]

[measured from payor’s initial interest in seeking contract work to contracting, and does not include fulfillment time (which may or may not be shortened)]

In considering the figure of merit of speed, we looked at the transaction speed to conduct trade between New York and California between 1825 and the present. We considered two components to the conduct of trade, the time to connect with the opposite party (either in person or through another communication method) and the time to consummate payment. We considered the fastest forms of communication and payment. For example, we skipped payment by check, as in person currency transactions and remote Western Union payments eclipsed the speed of checks at early dates.

Alignment with Company Strategic Drivers

This section is written from the perspective of Etsy. Etsy is an online retailer that focuses on the direct sale of specialized products to customers. Common things you might find on Etsy for sale or things like custom furniture, artistic pieces, and specialized leather goods. The marketplace generally focuses on creating artistic and unique pieces for small customer bases, but has an extremely devout group of users and is very much a niche product to market that people come to for a specific reason.

| Number | Strategic Drivers | Alignment And Targets |

|---|---|---|

| 1 | To increase the amount of active yearly sellers uniformly across the available categories | Etsy will aim to increase the percentage of active yearly sellers by 5% year over year, and focus on attaining sellers of products in under-represented categories |

| 2 | To increase the amount of yearly active buyers on the platform | For every 1% gain in sellers we will aim to increase the number of active buyers on the platform by 3%. The demand for products should encourage more sellers to come to the platform |

| 3 | To maintain a consistent year over year growth in revenue | Revenue is not as much of a primary driver as gaining scale is but is key to gaining future investment and increasing internal development efforts on new initiatives |

Positioning of Company vs. Competition

The above Pie Chart captures the fact that Amazon dominates the online e-commerce market. 56% of all e-commerce interactions, as reported by similar web, were via Amazon.com. Amazon is a dominant entity in the space because it has achieved a massive scale, an extremely high user base, and high customer satisfaction and "stickiness." Stickiness is a common phrase used to describe the number of things that bring a user back to a certain online marketplace. In the case of Amazon, these are things like prime shipping, Amazon video, Amazon music, and discounts at related stores like whole foods. All of these factors combined to make Amazon an extremely dominant force in e-commerce that is unlikely to waiver over the coming years.

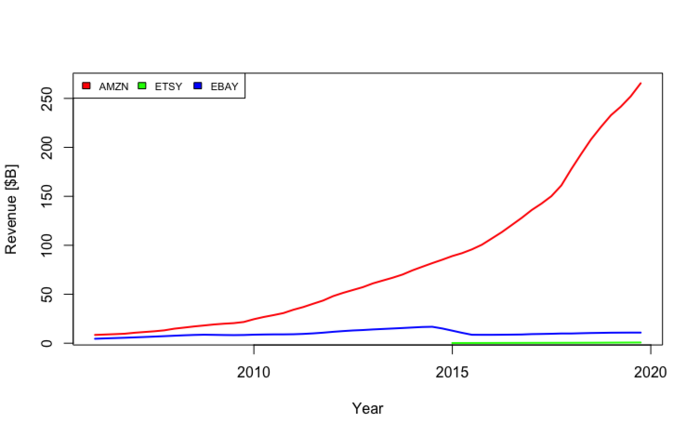

From the perspective of a company like Etsy, which only captures about 3% of the total e-commerce market, there are two views and perspectives to take. Either you take the view that there is very large upside potential still left in the e-commerce space, or that you have missed the opportunity for mass adoption and growth of your e-commerce platform is low so you should, therefore, lean into your niche marketplace. Without an abundance of data it's hard to see with the right approach it, what we can do is illustrate the fluctuating revenues that the smaller market places are seen when compared to that of their large scale competitors. The figure below highlights Etsy, eBay, and Amazon revenue from their inception.

What is clear from this graph is that Etsy was in no way a disruptor to the dominance of Amazon in the e-commerce marketplace. But this is expected. Etsy did not enter this marketplace with the intent of being the source for everything you would ever need (like Amazon wants to be). Etsy entered into this sector to fill a niche desire that was under-addressed by the larger players in the space.

Technical Model & Financial Model

Challenge: Because the system at the root of this wiki page is non-physical writing a technical model has been challenging. They are not underlying physic equations that govern how these complex e-commerce markets work. The approach we have taken to capture and build a model for how the system performs is a couple of different data science methodologies, both regression and classification-based, that leverage large amounts of data on the key companies and the environment in which the companies are operating.

To this end, the major sources of data we were able to collect and use for these underlying models are: 1) Financial Data (From Company Inception)

- Revenue

- Profit

- Margin

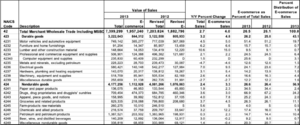

2) Ecommerce vs Conventional Commerce Data (22 different economic Sectors, 2009 - 2017)

- Total Merchant Wholesale Trade Including MSBOs2

- Durable goods

- Motor vehicles and automotive equipment

- Furniture and home furnishings

- Lumber and other construction material

- Professional and commercial equipment and supplies

- Computer equipment and supplies

- Metals and minerals, excluding petroleum

- Electrical goods

- Hardware, plumbing and heating equipment

- Machinery, equipment and supplies

- Miscellaneous durable goods

- Nondurable goods

- Paper and paper products

- Drugs, drug proprietaries and druggists' sundries

- Apparel, piece goods, and notions

- Groceries and related products

- Farm-products raw materials

- Chemicals and allied products

- Petroleum and petroleum products

- Beer, wine, and distilled beverages

- Miscellaneous nondurable goods

Initial approaches to leverage all the above data in a regression model proved impossible, due to all the coupling. Attempts at a CART model also shown little insight into the underlying mechanics of how these complex marketplaces perform.

Scale of E-Commerce Market:

Key Publications, Presentations and Patents

A. Patents

Information about patents is set forth below. Unlike in the section concerning literature review, in an abundance of caution, we stayed close to the abstract definitions in describing these technologies. We also felt that these abstracts provided the best explanation of the patented technology. As shown below, eBay was a forerunner in developing technology and processes that undergird e-commerce today.

Name: Information presentation and management in an online trading environment

Patent #: 6058417

Inventors: Hess; Martin L. (Aptos, CA), Wilson; Michael K. (Los Gatos, CA)

Assignee: eBay Inc. (San Jose, CA)

Date: May 2, 2000

Abstract: A method and apparatus for information presentation and management in an online trading environment are provided. According to one aspect of the present invention, person-to-person commerce over the Internet is facilitated by providing prospective buyers the ability to quickly preview items for sale. Images are harvested from a plurality of sites based upon user-supplied information. The user-supplied information includes descriptions of items for sale and locations from which images that are to be associated with the items can be retrieved. Thumbnail images are created corresponding to the harvested images and are aggregated onto a web page for presentation at a remote site. According to another aspect of the present invention, a user may submit a query to preview items for sale. After receiving the query, thumbnail images corresponding to items that satisfy the user query are displayed, each of the thumbnail images previously having been created based upon a user-specified image.

Name: Method and apparatus for verifying the identity of a participant within an online auction environment

Patent #: 6466917

Inventors: Goyal; Anoop (East Palo Alto, CA), Poon; Alex D. (Los Altos Hills, CA), Wen; Wen (Cupertino, CA)

Assignee: eBay Inc. (San Jose, CA)

Date: October 15, 2002

Abstract: A method and apparatus for verifying identity of a participant in a network-based transaction facility are described. According to one embodiment, user interface information is provided to the participant via a communications network. The user interface information specifies an identity verification interface for obtaining personal information of the participant. The personal information of the participant is passed to a third party for verification via the communications network. Subsequently, a verification result is received from the third party via the communications network. The verification result is then communicated to the participant via the communications network.

Name: Generic attribute database system for storing items of different categories having shared attributes

Patent #: 6604107

Inventors: Wang; Hsiaozhang Bill (San Jose, CA)

Assignee: eBay Inc. (San Jose, CA)

Date: August 5, 2003

Abstract: Embodiments of the invention provide a method and apparatus for storing multiple items across different categories in a database. One embodiment of the present invention provides a database that includes an attribute value table that has item entries for items of different categories. Each item entry has attribute values for attributes of the items. The database also includes an attribute map table that has attribute map entries. The attribute map entries have attribute map values. Additionally, an attribute value is associated with an attribute map entry, such that the attribute values are translated based on the attribute map values of the associated attribute map entry. In one embodiment, the translating of an attribute value includes determining an attribute type associated with the attribute value.

Name: Method and system for supplying automatic status updates using electronic mail

Patent #: 7139726

Inventors: Fisher; Alan S. (Fremont, CA), Kaplan; Samuel Jerrold (Hillsborough, CA)

Assignee: eBay Inc. (San Jose, CA)

Date: November 21, 2006

Abstract: A system is disclosed for automatically updating the status of customers’ orders and shipments via electronic mail without using a human attendant to create and send the electronic mail messages. Preferably implemented in software, the updating system allows a large set of customers to be periodically updated over a computer or communications network via electronic mail. The system includes a database for maintaining order and shipping status and other relevant information.

Name: Generic attribute database system

Patent #: 6778993

Inventors: Wang; Hsiaozhang Bill (San Jose, CA)

Assignee: eBay Inc. (San Jose, CA)

Date: August 17, 2004

Abstract: Embodiments of the invention provide a method and apparatus for storing multiple items across different categories in a database. One embodiment of the present invention provides a database that includes an attribute value table that has item entries for items of different categories. Each item entry has attribute values for attributes of the items. The database also includes an attribute map table that has attribute map entries. The attribute map entries have attribute map values. Additionally, an attribute value is associated with an attribute map entry, such that the attribute values are translated based on the attribute map values of the associated attribute map entry. In one embodiment, the translating of an attribute value includes determining an attribute type associated with the attribute value.

B. Literature Review

We considered a variety of articles, beyond those listed below, and focused our discussion on five important articles, which include early analysis of e-commerce and online auctions and more recent consideration of online procurement marketplaces.

In considering the evolution of e-commerce, we started with MIT graduate David Lucking-Reiley’s early work on electronic auctions and e-commerce in general, reviewing three articles (David Lucking-Reiley, 2000; David Lucking-Reiley & Daniel F. Spulber, 2001; Lucking-Reiley, 2000).

David Lucking-Reiley considered internet auctions in “Auctions on the Internet: What’s Being Auctioned, and How?” (Lucking-Reiley, 2000). Lucking-Reiley canvassed the history of internet auctions dating back to the mid-1990’s, which were often completed with meager technological support (Lucking-Reiley, 2000). The paper went on to describe the composition of popular internet auctions in terms of volume, velocity, products, business models, and auction formats (Lucking-Reiley, 2000).

Also in 2000, Lucking-Reiley provided more detail on auction theory as applied to e-commerce (David Lucking-Reiley, 2000). Vickrey auctions, achieving true value bids through second price auctions, and their precursors were explained in detail (David Lucking-Reiley, 2000). This paper provided an in depth historical treatment of commerce in general, from the lens of auction development over time (David Lucking-Reiley, 2000).

In “Business-to-Business Electronic Commerce,” Lucking-Reiley and Daniel F. Spulber provide an early analysis of the potential of e-commerce (David Lucking-Reiley & Daniel F. Spulber, 2001). They promote the vast potential, now realized, of electronic transactions, and detail the cost efficiencies from automated transactions, the benefits of market making including reduced search costs and other marketplace advantages, expected consolidation of marketplace due to returns to scale, and organizational design impacts (David Lucking-Reiley & Daniel F. Spulber, 2001).

Next, we reviewed more recent articles concerning the gig economy and the presence of procurement marketplaces on the internet (Ljungh, 2019; Mortleman, 2018; Popiel, 2017).

In “Are the Workers in the On-Demand Economy Employees, Independent Contractors, or a Hybrid Category?”, Doina Ljungholm tackles a critical question and potential limitation in the growth of online procurement auctions and marketplaces, namely, the legal reality of online workers (Ljungh, 2019). Ljungholm details primary considerations and concerns of the on-demand workers that fuel portions of the e-commerce world (Ljungh, 2019). Notably, many of the considerations, both from the business and worker perspectives gather around variability and flexibility, for both sides (Ljungh, 2019).

In “Gig for Victory,” Jim Mortleman describes the increasing need for on-demand “gig” workers and the reality that higher order jobs are now being worked by ad hoc contractors (Mortleman, 2018). One outstanding question, whether highly variable service quality is an initial learning curve or a permanent state of a distributed marketplace, is considered in some detail (Mortleman, 2018). Mortleman makes several interesting points concerning frustrations with the corporate world and new offerings such as “teams-as-a-service (TaaS)” to conclude the piece (Mortleman, 2018).

Finally, we identified one article reviewing whether the platform economy is sustainable (Culkin, 2019).

Culkin, B. (2019). Is Platform Capitalism Sustainable? Digital Business Models, On-Demand Labor, and Economic Growth. Journal of Self-Governance & Management Economics, 7(1), 31–36. https://doi.org/10.22381/JSME7120195

David Lucking-Reiley. (2000). Vickrey Auctions in Practice: From Nineteenth-Century Philately to Twenty-First-Century E-Commerce. The Journal of Economic Perspectives, (3), 183.

David Lucking-Reiley, & Daniel F. Spulber. (2001). Business-to-Business Electronic Commerce. The Journal of Economic Perspectives, (1), 55.

Ljungh, D. P. (2019). Are the Workers in the on-Demand Economy Employees, Independent Contractors, or a Hybrid Category? Linguistic & Philosophical Investigations, 18, 119–125. https://doi.org/10.22381/LPI1820197

Lucking-Reiley, D. (2000). Auctions on the Internet: What’s Being Auctioned, and How? Journal of Industrial Economics, 48(3), 227.

Mortleman, J. (2018). Gig for Victory. Computer Weekly, 28–31.

Popiel, P. (2017). “Boundaryless” in the creative economy: Assessing freelancing on Upwork. Critical Studies in Media Communication, 34(3), 220–233. https://doi.org/10.1080/15295036.2017.1282618

![Source: SimilarWeb]](/images/thumb/d/d2/CompetitionMarketShare.png/700px-CompetitionMarketShare.png)