Difference between revisions of "Energy Storage via Battery"

(financial model) |

|||

| Line 108: | Line 108: | ||

==Financial Model== | ==Financial Model== | ||

[[File:Battery value chain.png | [[File:Battery value chain.png|value-chain|700px]] | ||

''Figure: Battery value chain. We assume we are a supplier of battery packs for Electric Vehicles. Image from [1]: Schmuch, R., Wagner, R., Hörpel, G., Placke, T. & Winter, M. Performance and cost of materials for lithium-based rechargeable automotive batteries. Nat. Energy 3, 267–278 (2018).'' | ''Figure: Battery value chain. We assume we are a supplier of battery packs for Electric Vehicles. Image from [1]: Schmuch, R., Wagner, R., Hörpel, G., Placke, T. & Winter, M. Performance and cost of materials for lithium-based rechargeable automotive batteries. Nat. Energy 3, 267–278 (2018).'' | ||

| Line 117: | Line 118: | ||

Under this set of assumptions, our project is estimated to have a net present value (NPV) of $3.25Million. | Under this set of assumptions, our project is estimated to have a net present value (NPV) of $3.25Million. | ||

[[File:NPV-baseline.png | [[File:NPV-baseline.png|NPV baseline|500px]] | ||

''Graph: NPV analysis, base-line scenario'' | |||

Specific references for our financial analysis: | |||

:1. Schmuch, R., Wagner, R., Hörpel, G., Placke, T. & Winter, M. Performance and cost of materials for lithium-based rechargeable automotive batteries. Nat. Energy 3, 267–278 (2018). | |||

:2. Insideevs.com. Sales of all electric vehicles in the world by model. (2019). | |||

:3. Scotiabank. Numbers of cars sold worldwide from 1990 to 2019. (2019). Available at: https://www.statista.com/statistics/200002/international-car-sales-since-1990/Statista. (Accessed: 15th November 2019) | |||

:4. International Energy Agency. Global EV Outlook 2016, Beyond one million electric cars. (2016). | |||

:5. Safari, M. Battery electric vehicles: Looking behind to move forward. Energy Policy 115, 54–65 (2018). | |||

:6. Nykvist, B. & Nilsson, M. Rapidly falling costs of battery packs for electric vehicles. Nat. Clim. Chang. 5, 329–332 (2015). | |||

==R&D Portfolio== | |||

Revision as of 19:20, 18 November 2019

Technology Roadmap Sections and Deliverables

Our chosen Technology is that of electricity storage via battery for the purpose of vehicle mobility. We will refer to it within our descriptions as "battery" This is a level 3 technology. It serves the major subsystems found in electric vehicles

Roadmap Overview

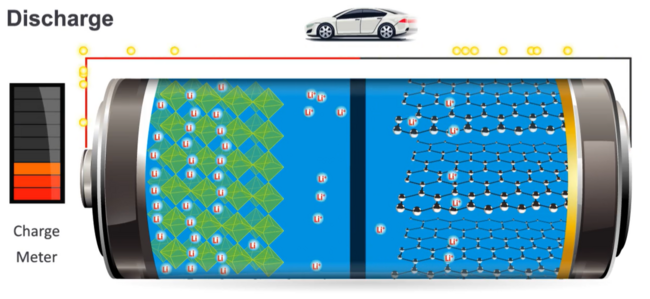

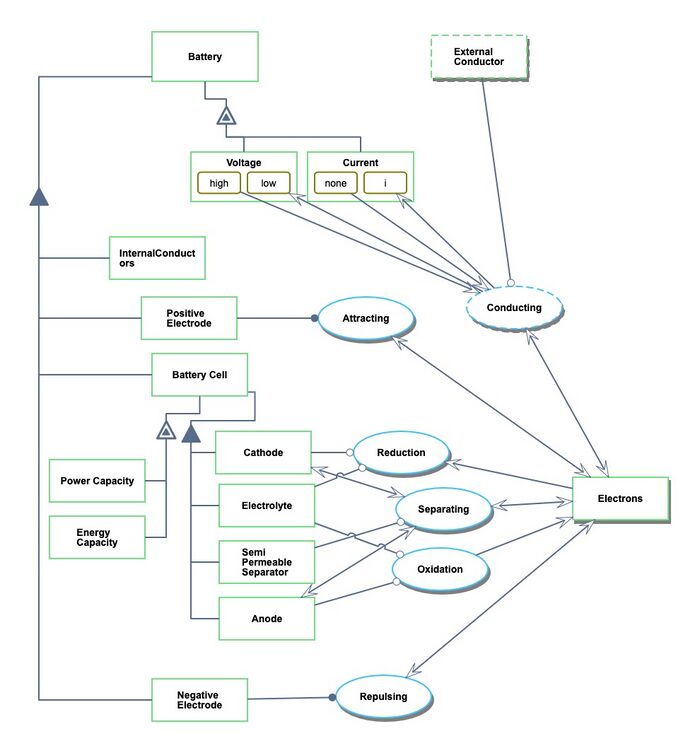

The working principle and architecture of an electrical battery are depicted in the below.

An electrical battery can store and use energy by chemical reaction. It is composed of an anode (-), a cathode (+), the electrolyte, and separator. The chemical reaction is a redox reaction caused by an electrical difference between the anode and the cathode. That is, electrons are expelled from the anode to the cathode via an external circuit and metal ion in the electrolyte receives the electrons on the cathode. This redox reaction lasts until electrical equilibrium. Although the primary battery is designed to be used once and discarded, the secondary battery can be recharged with electricity and reused. First secondary batteries based on Ni/Cd and Pd-acid were produced around 1900. After that, Ni/Zn battery which showed higher specific density appeared in the 1950s. In 1990, Lithium-ion battery (LIB) which is a major rechargeable battery today was released. The capabilities of LIB such as specific density, volumetric density, and cycle durability have improved more and more by developing new materials and the energy price is going down. These trends contribute to the growing availability of Electric vehicles.

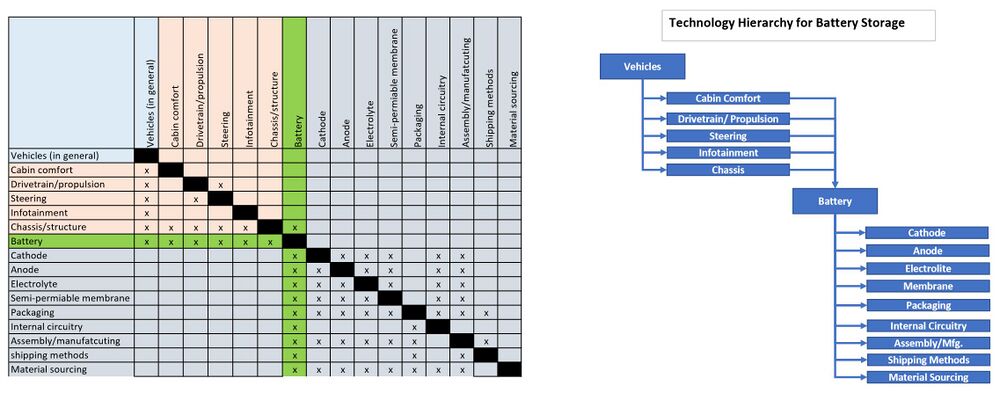

Design Structure Matrix (DSM) Allocation

Our technology of interest is identified in the DSM above with green highlighting. it is portrayed in the context of the consuming technology of interest, electric vehicles, where we identified the typical consuming technology systems for reference. The diagram on the right is a dependency tree that has been extracted from the DSM. The battery storage technology consumes technology related to battery chemistry, including cathode, anode, catalyst, and semi-permeable membrane technologies. Battery technology also consumes technology related to the design of the shipping, manufacturing, material supply chain, and internal circuitry technologies

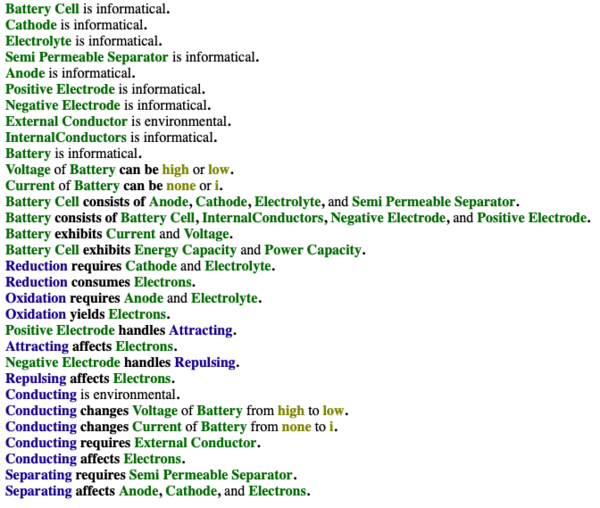

Roadmap Model using OPM

We provide an Object-Process-Diagram (OPD) of the Battery technology in the figure below. This diagrams captures the main object of the technology (Battery), the value-generating processes and different instruments associated with their characterization by Figures of Merit (FoM).

An Object-Process-Language (OPL) description of the roadmap scope is auto-generated and given below. It reflects the same content as the previous figure, but in a formal natural language.

Figures of Merit

We identify several Figures of Merit (FOMs) for the energy storage via battery technology:

- Energy density: Wh/kg - Power Capacity cost ($/W) - Energy Capacity cost ($/Wh)

Additional figures of merit for rechargeable battery are typically:

- Energy efficiency rate (%), energy stored / energy used to charge - Power efficiency rate (%), power delivered / power used to charge - Cycle life (cycles) - Max depth discharge (%) - quantity or rare materials needed (kg), as a potential constraint for scalability

Note: basic reminders (as we rediscovered them) about the units and relationships:

- we used traditional units of power and energy for electricity, yet in order to compare across different energy storage technologies, a reminder that Wh and J are two units measuring energy. - Electric power: P = V * I where V is the electric potential (volts, V) and I the current (Ampere, Amp). Battery’s capacity is the amount of current that can be delivered in one hour (in Amp*h). The energy capacity is then the battery’s voltage multiplied by its current capacity.

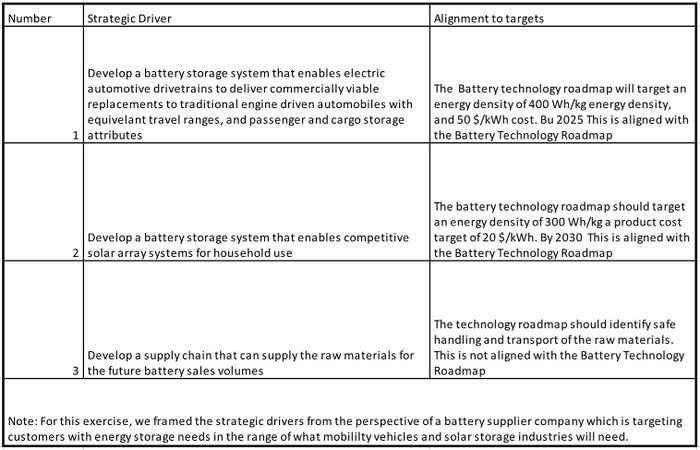

Alignment to Strategic Drivers

Positioning of Company vs. Competition

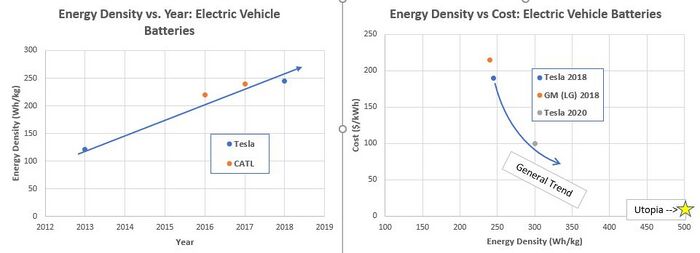

The Chart on the left shows energy density of several electric vehicle batteries from several manufacturers over time. The chart on the right compares the energy density to cost for three examples that we were able to acquire data for. In general, Lithium Ion technologies seem to be improving energy density at a rate of about 5% per year and improving in cost at a rate of about 20% per year. CATL, another leading battery manufacturer for electric vehicles, has roadmap diagrams citing energy densities at 400 Wh/kg at around 2020. A posting discussing a "Dry Battery Electrode" technology which was purchased by Tesla speaks of allowing the current 300 Wh/kg batteries and improving them to about 500 Wh/kg. Pricing data and were not available with this article, but the author was speculating at a timeframe for deployment of about 2021.

Technical Model

As a technical model, let us do sensitivity analysis as the first step.

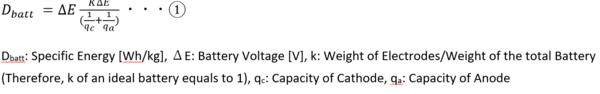

<Sensitivity analysis> One of our important FOMs is a specific density [Wh/kg]. This FOM can be calculated with an equation as below:

The results of the sensitivity analysis are shown in the figure below:

As the graph above shows that ΔE and k are the highest sensitivity in these four parameters. However, higher ΔE (about 5V) leads to the degradation of the electrolyte. Furthermore, the k-value depends on the battery packaging, which strongly related to safety regulations. Therefore, we analyze the sensitivity of qc (capacity of cathode) furthermore. We use LiCoO2 as a base cathode material.

qc can be described as below:

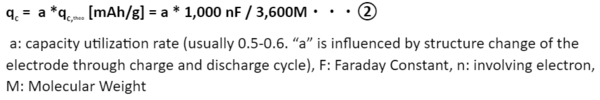

The result is shown in the figure below:

As the graph above, we find each parameter has the same sensitivity and all of them relate to cathode material. From this figure and equations, the ideal cathode material is something involving many electrons (that is the amount of lithium contained in electrode), being small molecule weight, and having a resident structure to charge and discharge cycle.

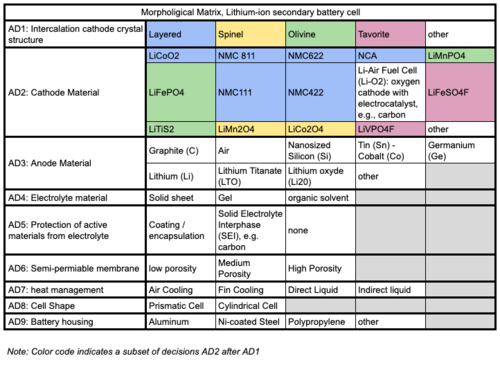

Figure: Morphological matrix, Lithium-ion secondary battery cell

The morphological matrix for the battery technology is provided above illustrating the current known materials and methods for several of the key design decisions. The projects stemming from this roadmap could include these options or could identify additional options for exploration.

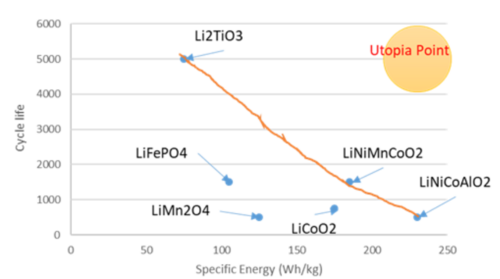

From sensitivity analysis, cathode performance is important for battery specific density. Especially, we focus on the number of lifecycles, which relate to "a" in the qc equation. Therefore, we made a tradespace graph of cathode materials for specific energy and lifecycles.

Figure: Tradespace clustered by architectural decision about the cathode, Lithium-ion secondary battery cell

Interestingly, the lower cathode material shows high cycle life. Therefore, we can choose the material based on the priority of longer battery life or higher specific energy.

Keys Publications and Patents

Since the Nobel Prize in Chemistry 2019 was awarded jointly to John B. Goodenough, M. Stanley Whittingham and Akira Yoshino “for the development of lithium-ion batteries”, we select some of their publications. The three articles we chose give a general overview of the electrochemical batteries history and future challenges (Whittingham 2012), a more specific vision of the Lithium-ion battery by its inventor (Yoshino 2012), and eventually one of the current area of innovation with all-solid state battery system (Braga et al. 2017). For the patents, we recommend two direct applications in the vehicle industry with two patents assigned to Toyota (Abe et al. 2017) and to Ford Global Technology (Vann Decker et al. 2014), and an “accompanying” type of patent related to battery housing, jointly assigned to Bosh and Samsung (Woehrle and Leuthner 2017).

- Braga, M. H., N. S. Grundish, A. J. Murchison, and J. B. Goodenough. 2017. “Alternative Strategy for a Safe Rechargeable Battery.” Energy and Environmental Science 10 (1): 331–36.

- Whittingham, M. Stanley. 2012. “History, Evolution, and Future Status of Energy Storage.” Proceedings of the IEEE 100

- Yoshino, Akira. 2012. “The Birth of the Lithium-Ion Battery.” Angewandte Chemie - International Edition 51

- Abe, Takeshi, Akira Tsujiko, Tomitaro Hara, Keiko Wasada, and Sachie Yuasa. 2017. Method of charging and maintaining Lithium-ion secondary battery, battery system, vehicle and battery-mounted device. US 9,812,741 B2, issued 2017.

- Vann Decker, Edward, Chi Paik, Dawn Bernardi, and William Moore. 2014. Method For Revitalizing And Increasing Lithium Ion Battery Capacity. US 9,358,899 B2, issued 2014.

- Woehrle, Thomas, and Stephan Leuthner. 2017. Battery Housing For Lithium-ion Cells. US 9,806,325 B2, issued 2017.

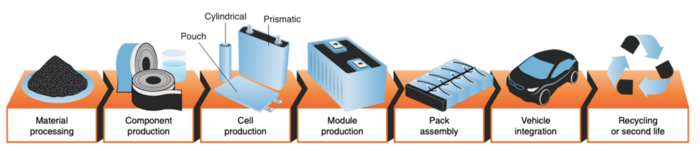

Financial Model

Figure: Battery value chain. We assume we are a supplier of battery packs for Electric Vehicles. Image from [1]: Schmuch, R., Wagner, R., Hörpel, G., Placke, T. & Winter, M. Performance and cost of materials for lithium-based rechargeable automotive batteries. Nat. Energy 3, 267–278 (2018).

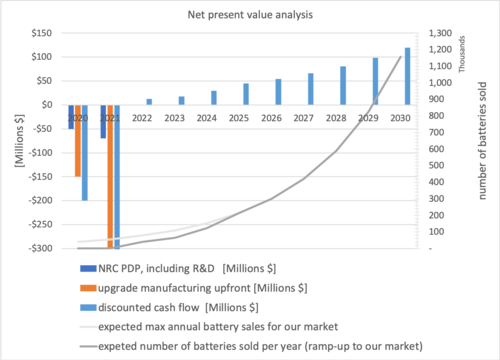

We are an existing battery supplier targeting electric vehicle market, with a product equivalent today (2020) with the performance of the “Renault Zoe” battery, i.e. we are not market leader, we have today a 5% market share on the global electric vehicles market [2] with a market strategy targeting increasing our market share to 10% of the electric vehicles market worldwide, equivalent of today’s Nissan Leaf. As a reference, Tesla Model 3 captures the biggest market share with 19% of electric vehicles sales worldwide [2]. As a general context, we evaluate that the sales of electric vehicles, which today represent less than 1% of the number of cars sold worldwide [3], will exponentially increase in the next decade, from 0.8 million today up to 25 millions or more of EV vehicles sold in 2030 [4]. We conservatively assume that the number of electric vehicles sold per year will be annually multiplied by 1.4, reaching 23 million in 2030. In this context, we carry on a baseline NPV analysis with a 10-year period of observation. We assume that our product is reaching and maintaining a share of 5% of the EV Market based (“free-riding” on the R&D, no additional investment) with a battery pack cost of 160$/kWh [5, 6], and an energy capacity per battery of 55 kWh (with a density of 130 Wh/kg). We use a discount rate of 15%. We include upfront expanses to upgrade manufacturing facilities, and non-recurring cost of the product development which include R&D expenditures. We allow 2 years of project development and start the sales in 2023 with a ramp-up to our full estimated market share from 2023 to 2025. An illustration of the discounted cash-flow over the period of observation is provided below, as well as the detailed table. Under this set of assumptions, our project is estimated to have a net present value (NPV) of $3.25Million.

Graph: NPV analysis, base-line scenario

Specific references for our financial analysis:

- 1. Schmuch, R., Wagner, R., Hörpel, G., Placke, T. & Winter, M. Performance and cost of materials for lithium-based rechargeable automotive batteries. Nat. Energy 3, 267–278 (2018).

- 2. Insideevs.com. Sales of all electric vehicles in the world by model. (2019).

- 3. Scotiabank. Numbers of cars sold worldwide from 1990 to 2019. (2019). Available at: https://www.statista.com/statistics/200002/international-car-sales-since-1990/Statista. (Accessed: 15th November 2019)

- 4. International Energy Agency. Global EV Outlook 2016, Beyond one million electric cars. (2016).

- 5. Safari, M. Battery electric vehicles: Looking behind to move forward. Energy Policy 115, 54–65 (2018).

- 6. Nykvist, B. & Nilsson, M. Rapidly falling costs of battery packs for electric vehicles. Nat. Clim. Chang. 5, 329–332 (2015).