Difference between revisions of "1TIRE Tires"

Igoryachev (talk | contribs) |

|||

| (48 intermediate revisions by 3 users not shown) | |||

| Line 7: | Line 7: | ||

Although tires may seem like a simple form of technology, they are complex engineered products primarily composed of rubber (both natural and synthetic), carbon black, steel wire, fabric cord, and various chemical additives. The manufacturing process involves mixing these raw materials, extruding and calendaring the rubber compounds, building the tire structure layer by layer (including the inner liner, body plies, belt package, and tread), and finally curing the assembled tire in a mold under heat and pressure to vulcanize the rubber and create the final shape and tread pattern. This process results in a product that serves multiple crucial functions: providing traction for acceleration and braking, supporting the vehicle's weight, absorbing road shocks for improved comfort, and offering low rolling resistance for better fuel efficiency while ensuring durability and safety across various operating conditions. | |||

The evolution of tire technology has progressed from solid rubber tires of the early 19th century to today's sophisticated pneumatic designs. Early automobiles used basic rubber tires, but the introduction of synthetic rubbers, radial construction (which replaced bias-ply designs), and advanced tread patterns has dramatically improved performance, longevity, and safety. Modern innovations focus on reducing rolling resistance for better fuel economy, developing run-flat capabilities for safety, and using sustainable materials to decrease environmental impact. Beyond automotive applications, tire technology impacts numerous markets, including aviation (where specialized tires must withstand extreme temperatures and pressures), agriculture (where tires must provide traction while minimizing soil compaction), construction equipment, bicycles, and even space exploration, with each application requiring unique design considerations and specialized materials. | |||

<br clear=all> | <br clear=all> | ||

| Line 14: | Line 16: | ||

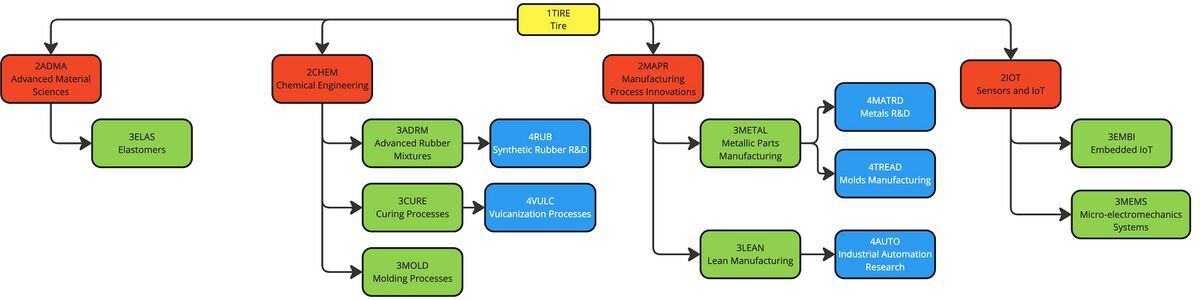

Our DSM Allocation for tires is based on a modern tire, with the different levels of technologies highlighted in different colors. | Our DSM Allocation for tires is based on a modern tire, with the different levels of technologies highlighted in different colors. | ||

[[File:DSMoverview.jpg| | [[File:DSMoverview.jpg|1200px]] | ||

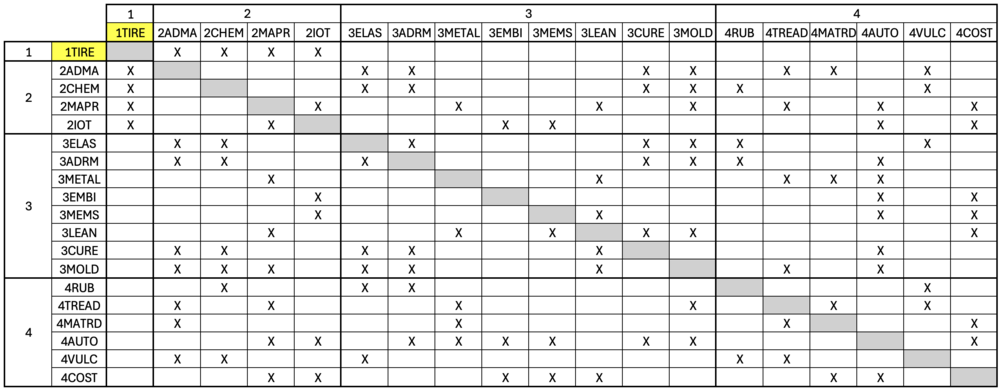

The following DSM shows the interdependencies between the different technologies that intervene in 1TIRE. | The following DSM shows the interdependencies between the different technologies that intervene in 1TIRE. | ||

<br clear=all> | |||

[[File:DSM Excel.png|1000px]] | [[File:DSM Excel.png|1000px]] | ||

| Line 23: | Line 27: | ||

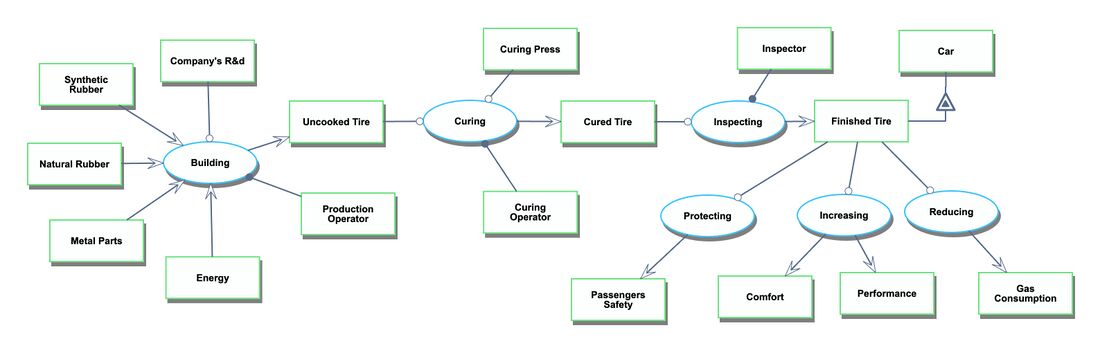

==Roadmap Model using OPM== | ==Roadmap Model using OPM== | ||

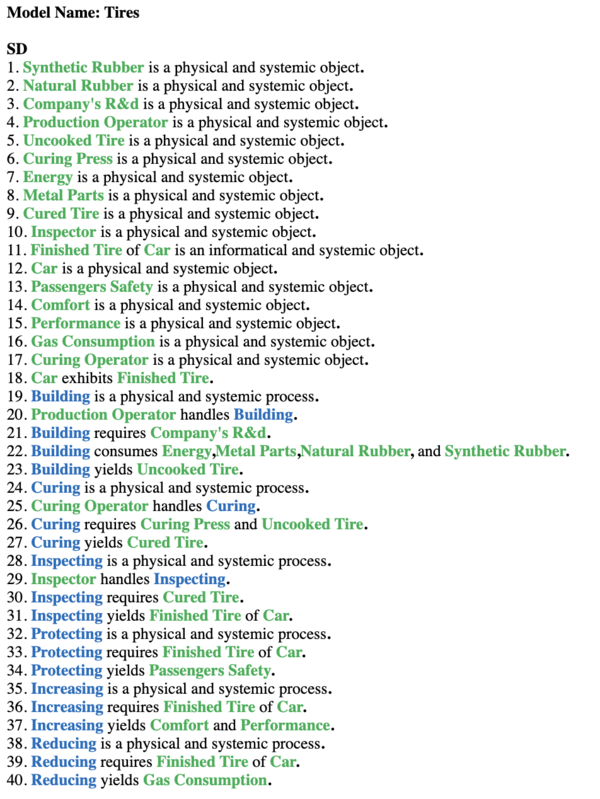

We have our Object Process Diagram (OPD) for the 1TIRE roadmap below. This strives to capture the various components of tires, and how they relate to relevant Figures of Merit (FOMs). | We have our Object Process Diagram (OPD) for the 1TIRE roadmap below. This strives to capture the various components of tires, and how they relate to relevant Figures of Merit (FOMs). | ||

[[File:Tiresmodel.jpeg|1100px]] | |||

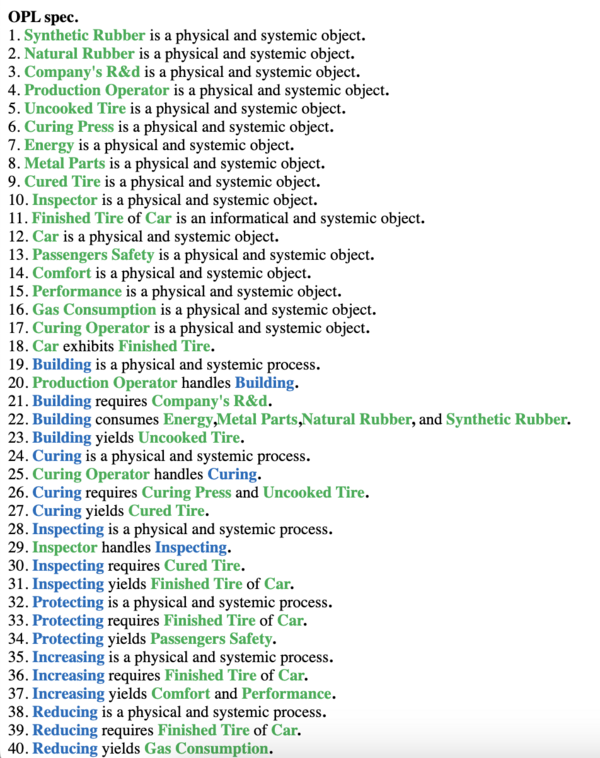

An Object Process Language (OPL) description for 1TIRE can be found below. This translates the OPD into a natural language. | |||

<br clear=all> | |||

[[File:OPL1.png|600px]] | |||

<br clear=all> | |||

[[File:OPL2.png|600px]] | |||

<br clear=all> | <br clear=all> | ||

==Figures of Merit== | ==Figures of Merit== | ||

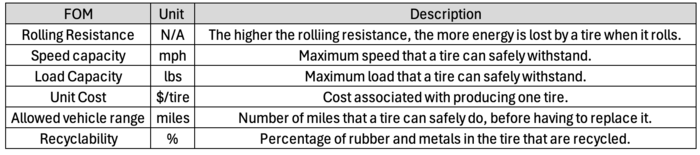

Relevant figures of merit can be seen in the table below. | Relevant figures of merit can be seen in the table below. | ||

[[File: | |||

[[File:FOM_v2.png|700px]] | |||

==Strategic Drivers== | ==Strategic Drivers== | ||

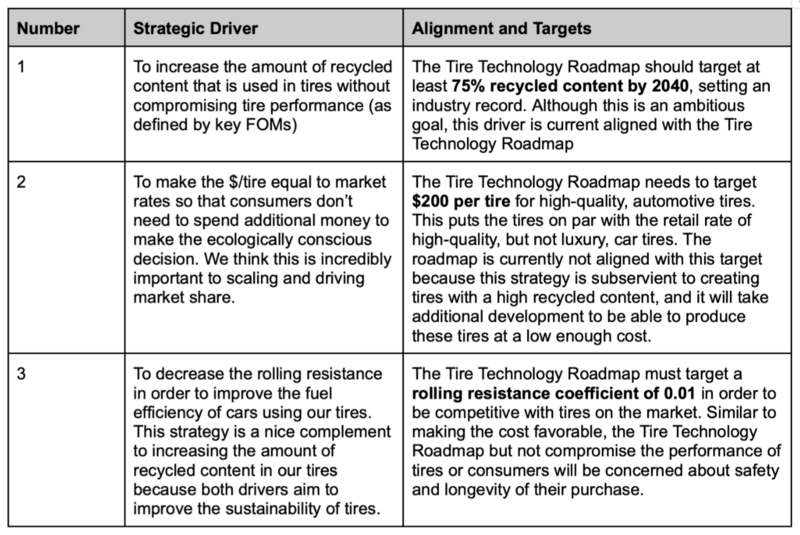

The drivers below capture the most critical strategic elements that the company must pursue in order to innovate in the tire industry. At a high level, the push towards more sustainable practices is what differentiates the company from others on the market. In order to stay competitive, the company must retain competitive pricing -- this will be quite challenging -- as well as a low rolling resistance coefficient and other key FOMs (speed capacity, load capacity, and allowed vehicle range. | |||

[[File:Table13.png|800px]] | |||

==Comparison with Competitors and FOMs== | ==Comparison with Competitors and FOMs== | ||

[[File:ComparisonTires.png|700px]] | |||

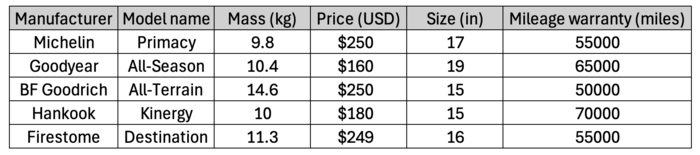

The table above shows the values of different FOMs, for different companies and products. Data about rolling resistance was not easily accessible, as it is often kept a secret by companies, so we used as a proxy the mileage warranty. This parameter seems not to be strongly correlated with price (which was our initial assumption), but it might be due to marketing reasons. | |||

However, this provides useful insights for our company trying to enter the car tire market. A few takeaways that we can gather from this are that we should target a maximum price of $250, as we cannot afford to be more premium than the most premium brands in the market. But it shows that the market might benefit from a player with an even higher mileage warranty: this could be our niche. | |||

[[File:Scatter Plot.png|900px]] | |||

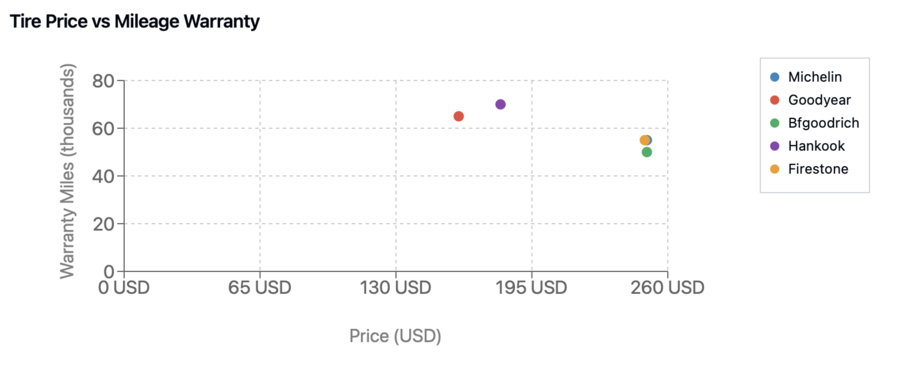

Looking at the scatter plot of tire prices versus warranty miles, there's a price range from $160 to $250 USD, with several tires clustered around the $250 mark (Michelin, BF Goodrich, and Firestone). The mileage warranty ranges from 50,000 to 70,000 miles, with no clear positive correlation between price and warranty length - in fact, the most expensive tires don't offer the highest warranties. There appears to be two main clusters: a high-price cluster around $250 with varying warranties (50,000-55,000 miles), and a lower-price cluster between $160-$180 (Goodyear and Hankook) that actually offers higher warranties (65,000-70,000 miles). This suggests that higher prices might be driven by factors other than warranty length, such as brand reputation or tire performance characteristics. | |||

==Technical Model and Morphological Tradespace== | ==Technical Model and Morphological Tradespace== | ||

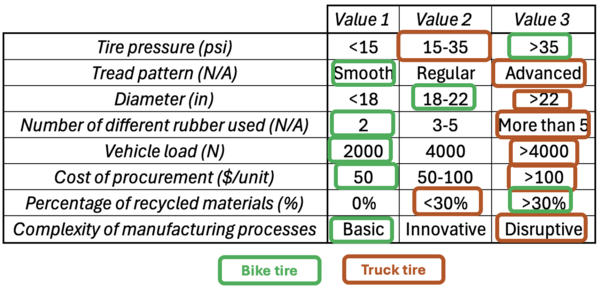

In order to assess the feasibility of technical (and financial) targets at the level of the 1TIRE roadmap it is necessary to develop a technical model. The purpose of such a model is to explore the design tradespace and establish what are the active constraints in the system. The first step can be to establish a morphological matrix that shows the main technology selection alternatives that exist at the first level of decomposition, see the figure below. | |||

[[File:TechModel_v2.png|600px]] | |||

It is interesting to note that the architecture and technology selections for a bike tire or a truck tire are quite different. Truck tires use more advanced materials and processes, in order to reduce the rolling resistance of the tires. This comes at the expense of the price. Bike tires however focuses on simpler products to be able to reach a lower price. Having fewer materials involved also allows for a higher use of recycled materials. The rolling resistance is less important for a bike tire, as a rider very rarely rides their bike for more than a few miles. | |||

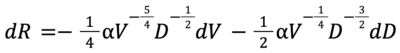

The technical model centers on how the rolling resistance is impacted by the velocity of the vehicle, and the size of the wheel. | |||

[[File:Equation.png|400px]] | |||

The following tornado chart has been established and shows the sensitivity of the rolling resistance with the velocity and the size of the wheel. This shows that the wheel diameter has a greater influence on the rolling resistance, than the vehicle load. | |||

[[File:TornadoChart.png|600px]] | |||

<br clear=all> | <br clear=all> | ||

| Line 45: | Line 81: | ||

'''Foundational Patents''' | |||

1. Charles Goodyear's Vulcanization Patent (1844): U.S. Patent No. 3633, "Improvement in India-Rubber Fabrics" | |||

Description: Goodyear's discovery of vulcanization transformed natural rubber into a durable material resistant to temperature extremes. | |||

Relevance: This process made rubber viable for a multitude of applications, including tires, by enhancing its elasticity, strength, and resilience. | |||

2. Robert William Thomson's Pneumatic Tire Patent (1845): British Patent No. 10990, "Aerial Wheels" | |||

Description: Thomson patented the first pneumatic (air-filled) tire, which provided a cushioned ride by using air pressure. | |||

Relevance: Although ahead of its time and not commercially successful then, it laid the groundwork for future pneumatic tire developments. | |||

3. John Boyd Dunlop's Pneumatic Tire Patent (1888): Patent: British Patent No. 10607 | |||

Description: Dunlop reinvented the pneumatic tire to improve the comfort of bicycle rides. | |||

Relevance: His design was practical and commercially successful, leading to widespread adoption in bicycles and eventually in automobiles. | |||

4. Michelin Brothers' Removable Pneumatic Tire Patent (1891): French Patent No. 211,582 | |||

Description: The Michelin brothers introduced the first removable pneumatic tire, simplifying tire repair and replacement. | |||

Relevance: This innovation was crucial for the practical use of pneumatic tires in motor vehicles. | |||

'''Key Technological Advancements''' | |||

5. Harvey Firestone's Non-Skid Tread Design Patent (1909): U.S. Patent No. 914,024 | |||

Description: Firestone's patent introduced a tire tread pattern designed to prevent skidding. | |||

Relevance: This non-skid tread improved vehicle safety by enhancing traction, especially on slippery surfaces. | |||

6. Philip Strauss's Combination Tire and Inner Tube Patent (1911)t: U.S. Patent No. 1,047,710 | |||

Description: Strauss patented a tire system combining an inner tube with an outer tire, which became the standard for pneumatic tires. | |||

Relevance: This design improved reliability and ease of maintenance. | |||

7. B.F. Goodrich's Silvertown Cord Tire (1916): Related patents on cord fabric construction | |||

Description: The introduction of cord fabric in tire construction enhanced tire strength and durability. | |||

Relevance: The "Silvertown Cord" tire reduced blowouts and became a significant safety advancement. | |||

8. Synthetic Rubber Production Patents (1930s-1940s) | |||

Patents: Various, including developments in Buna-S synthetic rubber | |||

Inventors: Multiple chemists and engineers worldwide | |||

Significance: With natural rubber supplies threatened during World War II, synthetic rubber became essential. Patents in synthetic rubber production allowed tire manufacturers to continue operations and spurred innovation in tire materials. | |||

9. Michelin's Radial Tire Patent (1946): French Patent No. 1,056,236 | |||

Description: The radial tire featured cords arranged perpendicular to the direction of travel and steel belts under the tread. | |||

Relevance: This design provided better handling, increased mileage, and improved fuel efficiency, revolutionizing tire performance. | |||

10. Goodyear's Polyester Cord Belted Bias Tire Patent (1967): U.S. Patent No. 3,322,186 | |||

Description: Goodyear introduced a tire combining bias-ply construction with belt layers. | |||

Relevance: This improves tread stability and tire life while maintaining ride comfort. | |||

'''Latest Innovations''' | |||

Run-Flat Tire Patents (1980s onwards) | |||

Patents: Various, including U.S. Patent No. 4,111,249 | |||

Inventors: Multiple, including major tire manufacturers like Bridgestone and Michelin | |||

Description: reinforced sidewalls can bear the automobile’s weight and allow the tire to continue functioning for a limited distance. | |||

Relevance: This technology enhances safety by reducing the risk associated with sudden tire deflation. | |||

12. Goodyear's Aquatred Tire Patent (1992): U.S. Patent No. 5,196,000 | |||

Description: The Aquatred tire featured a deep, wide groove in the center, improving traction on wet roads. | |||

Relevance: This innovation addressed hydroplaning risks and enhanced driving safety in wet conditions. | |||

13. Tire Pressure Monitoring Systems (TPMS) Patents (1990s-2000s) | |||

Patents: Various, including U.S. Patent No. 6,292,102 | |||

Inventors: Multiple, including Beru AG and Schrader Electronics | |||

Description: TPMS technology monitors tire air pressure and alerts drivers to under-inflation. | |||

Relevance: Mandated in new vehicles in many countries, TPMS improves safety, fuel efficiency, and tire longevity. | |||

14. Self-Sealing Tire Patents | |||

Patents: Various, including U.S. Patent No. 2,232,768 | |||

Inventors: Multiple | |||

Description: Self-sealing tires incorporate a sealing layer inside the tire that automatically seals punctures from objects like nails | |||

Relevance: this technology helps to prevent air loss and maintains tire pressure. | |||

15. Airless (Non-Pneumatic) Tire Patents | |||

Patents: Various, including Michelin's Tweel technology (U.S. Patent No. 7,201,194) | |||

Inventors: Michelin and other manufacturers | |||

Description: Airless tires eliminate the need for air pressure, using a flexible spoke system to support the load. | |||

Relevance: These tires resist flats and blowouts, offering potential for reduced maintenance and increased safety. | |||

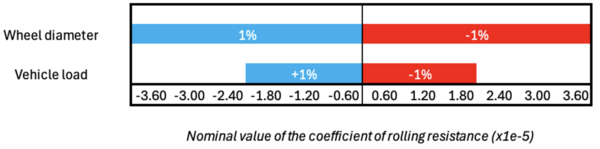

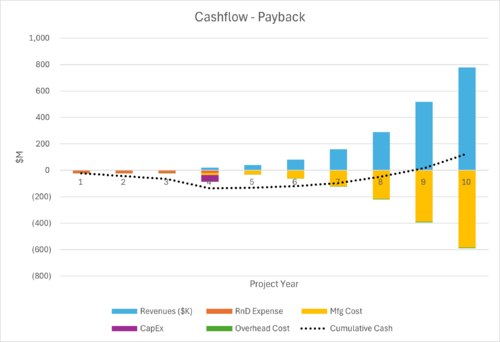

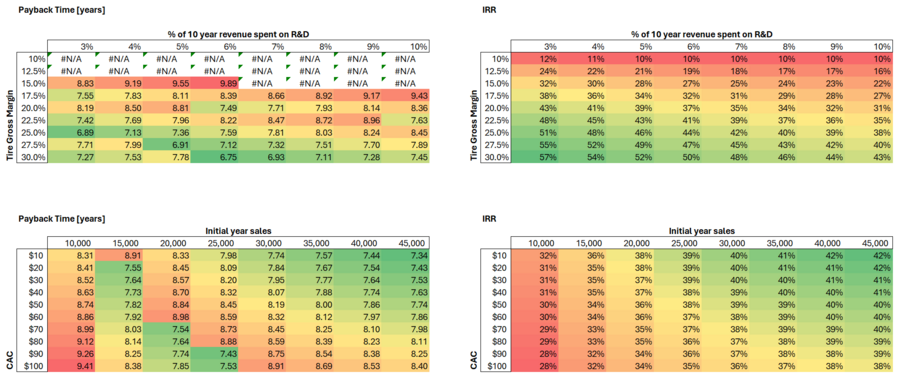

==Financial Model== | ==Financial Model== | ||

Introducing new technology into tire manufacturing requires upfront R&D expenditure (chemical and mechanical engineering) as well as capital investment to create production equipment. | |||

To illustrate a typical near term development project targeted at the growing EV segment, we use a 10 year development cycle of either: | |||

(1) an ultra low-rolling resistance tire | |||

(2) a quieter passenger car tire | |||

The assumptions are as follows: | |||

* 4 year development timeline with capital expenditure in the last year of development | |||

* 5 year straight-line depreciation, maintenance CapEx rolled into decreasing R&D spend after coming to market | |||

* WACC assumptions: | |||

** Established tire manufacturers: 8%-10%. | |||

** Smaller or less diversified companies: 10%-12%. | |||

** Start-up or high-risk ventures: 12%-15%. | |||

* Gross Margin range: 15-25% | |||

* Tire companies typically spend 3-10% of revenue on R&D | |||

The sensitivity analyses can help us price the tire and set a budget for its development, given market projections and R&D spend. | |||

[[File:1TIRES FinancialModel.png|900px]] | |||

[[File:1TIRES FinancialModelPlot.png|500px]] | |||

[[FIle:1TIRES_FinancialModelSensitivies.png|900px]] | |||

==Future Projects and R&D== | ==Future Projects and R&D== | ||

Tire technology development can be roughly segmented into two main areas: production-related improvement and end user improvement, each with varying levels of feasibility and readiness. | |||

From a tire production standpoint, there is incentive to differentiate on recyclability and use of more sustainable materials. | |||

On the customer side, enhancements include lower rolling resistance, noise reduction, sensor integration, and durability improvements to meet the low-maintenance demands brought on by EVs. | |||

{| class="wikitable" | |||

! Name | |||

! Technology Area | |||

! Description | |||

! Benefits | |||

! Challenges | |||

! Time | |||

! FOMs Affected | |||

! Feasibility | |||

|- | |||

| '''Low Rolling Resistance Tires''' | |||

| Energy Efficiency and Materials (TRL 7) | |||

| Design tires with advanced materials and tread patterns to minimize rolling resistance, enhancing fuel efficiency and electric vehicle range without compromising safety or durability. | |||

| Increases vehicle energy efficiency, extends EV range, reduces fuel consumption, and aligns with regulatory standards for emissions. | |||

| Balancing low rolling resistance with durability, grip, and noise; ensuring affordability and scalability for mass production. | |||

| 2-4 years | |||

| Rolling Resistance, Durability, Fuel Efficiency | |||

| High | |||

|- | |||

| '''Advanced Noise Reduction Tire Design''' | |||

| Acoustic Engineering | |||

(TRL 7) | |||

| Develop tire designs that significantly reduce road noise through innovative tread patterns and internal structures, possibly incorporating sound-absorbing materials. | |||

| Improves comfort, complies with stricter noise regulations, and provides a competitive advantage. | |||

| Balancing noise reduction with other performance aspects, managing material costs, and handling design complexity. | |||

| 2-4 years | |||

| Noise, Comfort, Durability | |||

| High | |||

|- | |||

| '''Smart Tires with Embedded Sensors''' | |||

| Sensor Integration and IoT | |||

(TRL 6) | |||

| Develop tires with embedded sensors that monitor tire pressure, temperature, tread wear, and road conditions in real-time, communicating data to drivers or fleet managers. | |||

| Improves safety, enables predictive maintenance, enhances performance, and allows data collection for continuous improvement. | |||

| Ensuring sensor durability in harsh conditions, providing power supply for sensors, addressing data security concerns, and managing added costs. | |||

| 2-4 years | |||

| Safety, Durability, Maintenance | |||

| High | |||

|- | |||

| '''Development of Sustainable Tires Using Bio-Based Materials''' | |||

| Sustainable Materials | |||

(TRL 5) | |||

| Research and develop tires made from renewable, bio-based materials such as natural rubber alternatives, plant-based oils, and fillers like silica from rice husk ash. | |||

| Reduces environmental impact, decreases dependence on petroleum-based materials, appeals to eco-conscious consumers, and potentially improves performance. | |||

| Ensuring bio-based materials meet performance and durability standards, managing costs of sourcing and processing new materials, and scaling production. | |||

| 3-5 years | |||

| Environmental Impact, Durability, Performance | |||

| Medium to High | |||

|- | |||

| '''Recyclable Tire Design''' | |||

| Circular Economy and Recycling | |||

(TRL 4) | |||

| Design tires using materials and structures that facilitate easier recycling at the end of their life, enabling closed-loop recycling processes. | |||

| Promotes environmental sustainability, potentially reduces costs, and complies with future regulations. | |||

| Selecting appropriate materials, ensuring performance is not compromised, and establishing recycling infrastructure. | |||

| 3-6 years | |||

| Recyclability, Environmental Impact, Durability | |||

| Medium to High | |||

|- | |||

| '''Airless Tire Development (Non-Pneumatic Tires)''' | |||

| Non-Pneumatic Tire Technology | |||

(TRL 6) | |||

| Design and develop airless tires that eliminate the need for air pressure by using structures like honeycomb or spokes to support the vehicle's weight. | |||

| Eliminates flats and blowouts, reduces maintenance, increases safety, and potentially extends tire life. | |||

| Managing ride comfort and noise, addressing heat dissipation, preventing material fatigue over time, and handling higher manufacturing costs. | |||

| 5-7 years | |||

| Safety, Maintenance, Comfort | |||

| Medium | |||

|- | |||

| '''Self-Healing Tire Materials''' | |||

| Advanced Materials | |||

(TRL 3) | |||

| Research and develop tire materials capable of self-healing minor cuts and punctures using polymers that react to damage by sealing the breach. | |||

| Increases tire lifespan, reduces need for repairs or replacements, and enhances safety. | |||

| Developing materials that self-heal under varying conditions, ensuring long-term durability, and managing the cost of advanced materials. | |||

| 5-10 years | |||

| Durability, Maintenance, Safety | |||

| Medium to Low | |||

|- | |||

| '''Enhanced Run-Flat Tire Technology''' | |||

| Run-Flat Systems | |||

(TRL 8) | |||

| Improve run-flat tire technology to extend the distance and speed that can be maintained after a puncture while reducing weight and maintaining ride comfort. | |||

| Increases safety, offers convenience, and potentially eliminates the need for spare tires, saving space and weight. | |||

| Enhancing ride comfort, managing costs, dealing with material complexity, and gaining consumer acceptance. | |||

| 2-3 years | |||

| Safety, Durability, Performance | |||

| High | |||

|} | |||

==Technology Strategy Statement== | ==Technology Strategy Statement== | ||

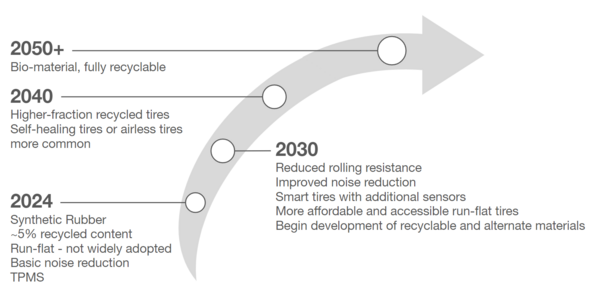

The overall goals of tire technology are to improve performance while reducing the environmental footprint to an eventually sustainable and fully recyclable point. Near-term improvements involve integrating and proliferating existing technology like sensors and run-flat construction, while developments in materials are long-term endeavors. | |||

[[File:1TIRES Swoosh.png|600px]] | |||

Latest revision as of 18:22, 5 December 2024

Roadmap creators: Roch Desrousseaux Ivan Goryachev Allie Stasior

Time stamp: October 9, 2024

Roadmap Overview

Although tires may seem like a simple form of technology, they are complex engineered products primarily composed of rubber (both natural and synthetic), carbon black, steel wire, fabric cord, and various chemical additives. The manufacturing process involves mixing these raw materials, extruding and calendaring the rubber compounds, building the tire structure layer by layer (including the inner liner, body plies, belt package, and tread), and finally curing the assembled tire in a mold under heat and pressure to vulcanize the rubber and create the final shape and tread pattern. This process results in a product that serves multiple crucial functions: providing traction for acceleration and braking, supporting the vehicle's weight, absorbing road shocks for improved comfort, and offering low rolling resistance for better fuel efficiency while ensuring durability and safety across various operating conditions.

The evolution of tire technology has progressed from solid rubber tires of the early 19th century to today's sophisticated pneumatic designs. Early automobiles used basic rubber tires, but the introduction of synthetic rubbers, radial construction (which replaced bias-ply designs), and advanced tread patterns has dramatically improved performance, longevity, and safety. Modern innovations focus on reducing rolling resistance for better fuel economy, developing run-flat capabilities for safety, and using sustainable materials to decrease environmental impact. Beyond automotive applications, tire technology impacts numerous markets, including aviation (where specialized tires must withstand extreme temperatures and pressures), agriculture (where tires must provide traction while minimizing soil compaction), construction equipment, bicycles, and even space exploration, with each application requiring unique design considerations and specialized materials.

Design Structure Matrix (DSM) Allocation

Our DSM Allocation for tires is based on a modern tire, with the different levels of technologies highlighted in different colors.

The following DSM shows the interdependencies between the different technologies that intervene in 1TIRE.

Roadmap Model using OPM

We have our Object Process Diagram (OPD) for the 1TIRE roadmap below. This strives to capture the various components of tires, and how they relate to relevant Figures of Merit (FOMs).

An Object Process Language (OPL) description for 1TIRE can be found below. This translates the OPD into a natural language.

Figures of Merit

Relevant figures of merit can be seen in the table below.

Strategic Drivers

The drivers below capture the most critical strategic elements that the company must pursue in order to innovate in the tire industry. At a high level, the push towards more sustainable practices is what differentiates the company from others on the market. In order to stay competitive, the company must retain competitive pricing -- this will be quite challenging -- as well as a low rolling resistance coefficient and other key FOMs (speed capacity, load capacity, and allowed vehicle range.

Comparison with Competitors and FOMs

The table above shows the values of different FOMs, for different companies and products. Data about rolling resistance was not easily accessible, as it is often kept a secret by companies, so we used as a proxy the mileage warranty. This parameter seems not to be strongly correlated with price (which was our initial assumption), but it might be due to marketing reasons.

However, this provides useful insights for our company trying to enter the car tire market. A few takeaways that we can gather from this are that we should target a maximum price of $250, as we cannot afford to be more premium than the most premium brands in the market. But it shows that the market might benefit from a player with an even higher mileage warranty: this could be our niche.

Looking at the scatter plot of tire prices versus warranty miles, there's a price range from $160 to $250 USD, with several tires clustered around the $250 mark (Michelin, BF Goodrich, and Firestone). The mileage warranty ranges from 50,000 to 70,000 miles, with no clear positive correlation between price and warranty length - in fact, the most expensive tires don't offer the highest warranties. There appears to be two main clusters: a high-price cluster around $250 with varying warranties (50,000-55,000 miles), and a lower-price cluster between $160-$180 (Goodyear and Hankook) that actually offers higher warranties (65,000-70,000 miles). This suggests that higher prices might be driven by factors other than warranty length, such as brand reputation or tire performance characteristics.

Technical Model and Morphological Tradespace

In order to assess the feasibility of technical (and financial) targets at the level of the 1TIRE roadmap it is necessary to develop a technical model. The purpose of such a model is to explore the design tradespace and establish what are the active constraints in the system. The first step can be to establish a morphological matrix that shows the main technology selection alternatives that exist at the first level of decomposition, see the figure below.

It is interesting to note that the architecture and technology selections for a bike tire or a truck tire are quite different. Truck tires use more advanced materials and processes, in order to reduce the rolling resistance of the tires. This comes at the expense of the price. Bike tires however focuses on simpler products to be able to reach a lower price. Having fewer materials involved also allows for a higher use of recycled materials. The rolling resistance is less important for a bike tire, as a rider very rarely rides their bike for more than a few miles.

The technical model centers on how the rolling resistance is impacted by the velocity of the vehicle, and the size of the wheel.

The following tornado chart has been established and shows the sensitivity of the rolling resistance with the velocity and the size of the wheel. This shows that the wheel diameter has a greater influence on the rolling resistance, than the vehicle load.

Key Publications and Patents

Foundational Patents

1. Charles Goodyear's Vulcanization Patent (1844): U.S. Patent No. 3633, "Improvement in India-Rubber Fabrics" Description: Goodyear's discovery of vulcanization transformed natural rubber into a durable material resistant to temperature extremes. Relevance: This process made rubber viable for a multitude of applications, including tires, by enhancing its elasticity, strength, and resilience.

2. Robert William Thomson's Pneumatic Tire Patent (1845): British Patent No. 10990, "Aerial Wheels" Description: Thomson patented the first pneumatic (air-filled) tire, which provided a cushioned ride by using air pressure. Relevance: Although ahead of its time and not commercially successful then, it laid the groundwork for future pneumatic tire developments.

3. John Boyd Dunlop's Pneumatic Tire Patent (1888): Patent: British Patent No. 10607 Description: Dunlop reinvented the pneumatic tire to improve the comfort of bicycle rides. Relevance: His design was practical and commercially successful, leading to widespread adoption in bicycles and eventually in automobiles.

4. Michelin Brothers' Removable Pneumatic Tire Patent (1891): French Patent No. 211,582 Description: The Michelin brothers introduced the first removable pneumatic tire, simplifying tire repair and replacement. Relevance: This innovation was crucial for the practical use of pneumatic tires in motor vehicles.

Key Technological Advancements

5. Harvey Firestone's Non-Skid Tread Design Patent (1909): U.S. Patent No. 914,024 Description: Firestone's patent introduced a tire tread pattern designed to prevent skidding. Relevance: This non-skid tread improved vehicle safety by enhancing traction, especially on slippery surfaces.

6. Philip Strauss's Combination Tire and Inner Tube Patent (1911)t: U.S. Patent No. 1,047,710 Description: Strauss patented a tire system combining an inner tube with an outer tire, which became the standard for pneumatic tires. Relevance: This design improved reliability and ease of maintenance.

7. B.F. Goodrich's Silvertown Cord Tire (1916): Related patents on cord fabric construction Description: The introduction of cord fabric in tire construction enhanced tire strength and durability. Relevance: The "Silvertown Cord" tire reduced blowouts and became a significant safety advancement.

8. Synthetic Rubber Production Patents (1930s-1940s) Patents: Various, including developments in Buna-S synthetic rubber Inventors: Multiple chemists and engineers worldwide Significance: With natural rubber supplies threatened during World War II, synthetic rubber became essential. Patents in synthetic rubber production allowed tire manufacturers to continue operations and spurred innovation in tire materials.

9. Michelin's Radial Tire Patent (1946): French Patent No. 1,056,236 Description: The radial tire featured cords arranged perpendicular to the direction of travel and steel belts under the tread. Relevance: This design provided better handling, increased mileage, and improved fuel efficiency, revolutionizing tire performance.

10. Goodyear's Polyester Cord Belted Bias Tire Patent (1967): U.S. Patent No. 3,322,186 Description: Goodyear introduced a tire combining bias-ply construction with belt layers. Relevance: This improves tread stability and tire life while maintaining ride comfort.

Latest Innovations

Run-Flat Tire Patents (1980s onwards) Patents: Various, including U.S. Patent No. 4,111,249 Inventors: Multiple, including major tire manufacturers like Bridgestone and Michelin Description: reinforced sidewalls can bear the automobile’s weight and allow the tire to continue functioning for a limited distance. Relevance: This technology enhances safety by reducing the risk associated with sudden tire deflation.

12. Goodyear's Aquatred Tire Patent (1992): U.S. Patent No. 5,196,000 Description: The Aquatred tire featured a deep, wide groove in the center, improving traction on wet roads. Relevance: This innovation addressed hydroplaning risks and enhanced driving safety in wet conditions.

13. Tire Pressure Monitoring Systems (TPMS) Patents (1990s-2000s) Patents: Various, including U.S. Patent No. 6,292,102 Inventors: Multiple, including Beru AG and Schrader Electronics Description: TPMS technology monitors tire air pressure and alerts drivers to under-inflation. Relevance: Mandated in new vehicles in many countries, TPMS improves safety, fuel efficiency, and tire longevity.

14. Self-Sealing Tire Patents Patents: Various, including U.S. Patent No. 2,232,768 Inventors: Multiple Description: Self-sealing tires incorporate a sealing layer inside the tire that automatically seals punctures from objects like nails Relevance: this technology helps to prevent air loss and maintains tire pressure.

15. Airless (Non-Pneumatic) Tire Patents Patents: Various, including Michelin's Tweel technology (U.S. Patent No. 7,201,194) Inventors: Michelin and other manufacturers Description: Airless tires eliminate the need for air pressure, using a flexible spoke system to support the load. Relevance: These tires resist flats and blowouts, offering potential for reduced maintenance and increased safety.

Financial Model

Introducing new technology into tire manufacturing requires upfront R&D expenditure (chemical and mechanical engineering) as well as capital investment to create production equipment.

To illustrate a typical near term development project targeted at the growing EV segment, we use a 10 year development cycle of either:

(1) an ultra low-rolling resistance tire (2) a quieter passenger car tire

The assumptions are as follows:

- 4 year development timeline with capital expenditure in the last year of development

- 5 year straight-line depreciation, maintenance CapEx rolled into decreasing R&D spend after coming to market

- WACC assumptions:

- Established tire manufacturers: 8%-10%.

- Smaller or less diversified companies: 10%-12%.

- Start-up or high-risk ventures: 12%-15%.

- Gross Margin range: 15-25%

- Tire companies typically spend 3-10% of revenue on R&D

The sensitivity analyses can help us price the tire and set a budget for its development, given market projections and R&D spend.

Future Projects and R&D

Tire technology development can be roughly segmented into two main areas: production-related improvement and end user improvement, each with varying levels of feasibility and readiness.

From a tire production standpoint, there is incentive to differentiate on recyclability and use of more sustainable materials.

On the customer side, enhancements include lower rolling resistance, noise reduction, sensor integration, and durability improvements to meet the low-maintenance demands brought on by EVs.

| Name | Technology Area | Description | Benefits | Challenges | Time | FOMs Affected | Feasibility |

|---|---|---|---|---|---|---|---|

| Low Rolling Resistance Tires | Energy Efficiency and Materials (TRL 7) | Design tires with advanced materials and tread patterns to minimize rolling resistance, enhancing fuel efficiency and electric vehicle range without compromising safety or durability. | Increases vehicle energy efficiency, extends EV range, reduces fuel consumption, and aligns with regulatory standards for emissions. | Balancing low rolling resistance with durability, grip, and noise; ensuring affordability and scalability for mass production. | 2-4 years | Rolling Resistance, Durability, Fuel Efficiency | High |

| Advanced Noise Reduction Tire Design | Acoustic Engineering

(TRL 7) |

Develop tire designs that significantly reduce road noise through innovative tread patterns and internal structures, possibly incorporating sound-absorbing materials. | Improves comfort, complies with stricter noise regulations, and provides a competitive advantage. | Balancing noise reduction with other performance aspects, managing material costs, and handling design complexity. | 2-4 years | Noise, Comfort, Durability | High |

| Smart Tires with Embedded Sensors | Sensor Integration and IoT

(TRL 6) |

Develop tires with embedded sensors that monitor tire pressure, temperature, tread wear, and road conditions in real-time, communicating data to drivers or fleet managers. | Improves safety, enables predictive maintenance, enhances performance, and allows data collection for continuous improvement. | Ensuring sensor durability in harsh conditions, providing power supply for sensors, addressing data security concerns, and managing added costs. | 2-4 years | Safety, Durability, Maintenance | High |

| Development of Sustainable Tires Using Bio-Based Materials | Sustainable Materials

(TRL 5) |

Research and develop tires made from renewable, bio-based materials such as natural rubber alternatives, plant-based oils, and fillers like silica from rice husk ash. | Reduces environmental impact, decreases dependence on petroleum-based materials, appeals to eco-conscious consumers, and potentially improves performance. | Ensuring bio-based materials meet performance and durability standards, managing costs of sourcing and processing new materials, and scaling production. | 3-5 years | Environmental Impact, Durability, Performance | Medium to High |

| Recyclable Tire Design | Circular Economy and Recycling

(TRL 4) |

Design tires using materials and structures that facilitate easier recycling at the end of their life, enabling closed-loop recycling processes. | Promotes environmental sustainability, potentially reduces costs, and complies with future regulations. | Selecting appropriate materials, ensuring performance is not compromised, and establishing recycling infrastructure. | 3-6 years | Recyclability, Environmental Impact, Durability | Medium to High |

| Airless Tire Development (Non-Pneumatic Tires) | Non-Pneumatic Tire Technology

(TRL 6) |

Design and develop airless tires that eliminate the need for air pressure by using structures like honeycomb or spokes to support the vehicle's weight. | Eliminates flats and blowouts, reduces maintenance, increases safety, and potentially extends tire life. | Managing ride comfort and noise, addressing heat dissipation, preventing material fatigue over time, and handling higher manufacturing costs. | 5-7 years | Safety, Maintenance, Comfort | Medium |

| Self-Healing Tire Materials | Advanced Materials

(TRL 3) |

Research and develop tire materials capable of self-healing minor cuts and punctures using polymers that react to damage by sealing the breach. | Increases tire lifespan, reduces need for repairs or replacements, and enhances safety. | Developing materials that self-heal under varying conditions, ensuring long-term durability, and managing the cost of advanced materials. | 5-10 years | Durability, Maintenance, Safety | Medium to Low |

| Enhanced Run-Flat Tire Technology | Run-Flat Systems

(TRL 8) |

Improve run-flat tire technology to extend the distance and speed that can be maintained after a puncture while reducing weight and maintaining ride comfort. | Increases safety, offers convenience, and potentially eliminates the need for spare tires, saving space and weight. | Enhancing ride comfort, managing costs, dealing with material complexity, and gaining consumer acceptance. | 2-3 years | Safety, Durability, Performance | High |

Technology Strategy Statement

The overall goals of tire technology are to improve performance while reducing the environmental footprint to an eventually sustainable and fully recyclable point. Near-term improvements involve integrating and proliferating existing technology like sensors and run-flat construction, while developments in materials are long-term endeavors.