Difference between revisions of "Ebikes"

| Line 1: | Line 1: | ||

The e-Bike (2EBK) roadmap is a level 2 roadmap | The e-Bike (2EBK) roadmap is a level 2 roadmap focusing on specific micromobility solutions (e.g., shared electric scooters, e-bikes). It is situated under the level 1 micromobility system market, representing the broader urban mobility market. Below e-Bikes exists the level 3 roadmaps that target the subsystems within these solutions (e.g., powertrain, connectivity, structural), and level 4 roadmaps delve into individual components (e.g., battery cells, sensors, motors). | ||

== Technology Roadmap Overview == | == Technology Roadmap Overview == | ||

Revision as of 21:56, 2 December 2024

The e-Bike (2EBK) roadmap is a level 2 roadmap focusing on specific micromobility solutions (e.g., shared electric scooters, e-bikes). It is situated under the level 1 micromobility system market, representing the broader urban mobility market. Below e-Bikes exists the level 3 roadmaps that target the subsystems within these solutions (e.g., powertrain, connectivity, structural), and level 4 roadmaps delve into individual components (e.g., battery cells, sensors, motors).

Technology Roadmap Overview

Micromobility refers to a range of small, lightweight vehicles operating at speeds typically below 25 km/h (15 mph) and driven by users personally. These include bicycles, e-bikes, electric scooters, electric skateboards, shared bicycles, and electric pedal-assisted bicycles. Micromobility represents a significant shift in urban transportation, offering flexible, sustainable solutions for short-distance travel that are ideal for city settings. Originating in the 19th century, micromobility has advanced into electric folding bikes and motorized vehicles. Today, micromobility solutions focus on shared, electric, and connected vehicles integrated into an urban network. Micromobility is interfacing with user data and contextual information more efficiently and seamlessly and is gaining traction in autonomous personal mobility. It is also venturing into other modes other than land mobility, such as air and water transportation. Micromobiliity is poised to play an increasingly important role in the future of urban mobility and smart cities. It is core to city planning, from historic city centers to today’s most transformative giga-projects.

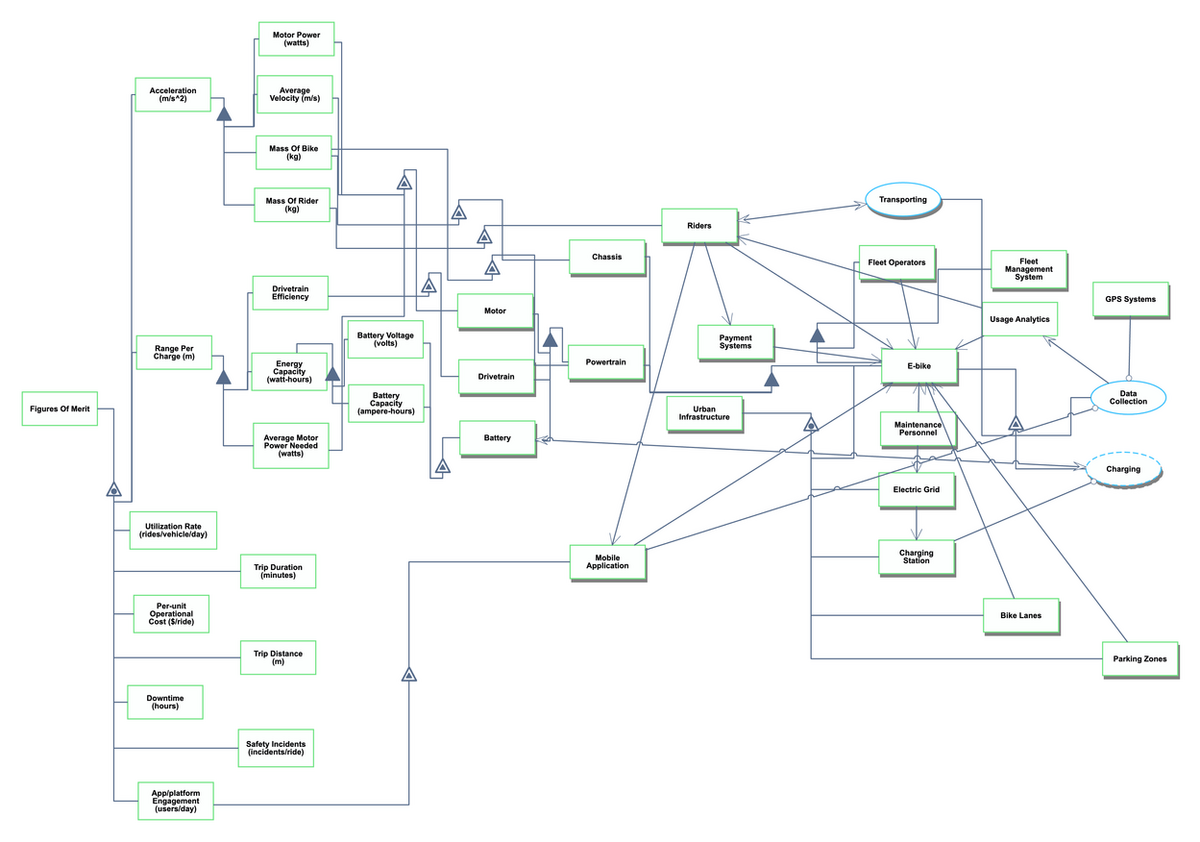

Roadmap Model using OPM

Below, we provide an object-process diagram (OPD) of the 2BKE roadmap. This diagram captures the main object of the roadmap, its decomposition into subsystems (powertrain, connectivity, structural, etc.), its characterization by Figures of Merit (FOMs), as well as the main processes and actors involved.

Figures of Merit

This table outlines the key metrics for evaluating the performance and effectiveness of micromobility systems.

| Figure of Merit (FOM) | Unit | Description |

|---|---|---|

| Acceleration | m/s^2 | The acceleration that the vehicle is capable of. |

| Range per charge | m | The distance that the vehicle is able to travel on a single charge. |

| Pedal Assistance | watts | Measures how much the e-bike is assisting when pedaling. |

| Utilization Rate | rides/vehicle/day | Indicates how frequently a vehicle is used on average in a shared system. |

| Trip Duration | minutes | Represents the average time taken for a typical trip by users. |

| Trip Distance | meters | Measures the average distance covered during a single trip. |

| Per-Unit Operational Cost | $/ride | Calculates the cost associated with maintaining and operating the vehicle for each ride. |

| Downtime | hours | Represents the amount of time a vehicle is unavailable for use, typically due to maintenance or charging. |

Alignment with Company Strategic Drivers: FOM targets

Overview

The table below provides the high-level strategic drivers and alignment for the 1MMS and 2EBK technology roadmap. There are additional detailed drivers that provide more context for the FOM targets with a multi-horizon lens.

| Number | Strategic Driver | Alignment |

|---|---|---|

| 1 | Urban Mobility and Smart City Integration: Increasing congestion and the need for flexible last-mile solutions highlight e-bikes as a compact, efficient option. | E-bikes allow users to bypass traffic, reduce parking needs, and improve the flow of urban transport, meeting the demand for quick, point-to-point solutions in crowded city centers. This creates a data-driven mobility solution that supports safer, sustainable urban living. |

| 2 | Advancements in Technology and Manufacturing: Support the battery, motor systems, and electronic controls for more optimal and efficient electric transportation systems | Advances in battery technology, motor efficiency, and lightweight materials enable extended range, improved speed, and reduced recharging times, making e-bikes a more attractive, competitive choice for daily commutes and recreational use. |

| 3 | Environmental Sustainability Impact: As cities strive to meet emissions targets and reduce pollution, e-bikes present an environmentally friendly alternative to short car trips. | Sustainable urban transit with electric-powered bicycles that significantly lower CO₂ emissions. |

By focusing on these strategic drivers and capability milestones, the e-bike industry can continue to innovate and expand its market presence over the next decade, addressing key challenges in urban mobility, sustainability, and technological integration.

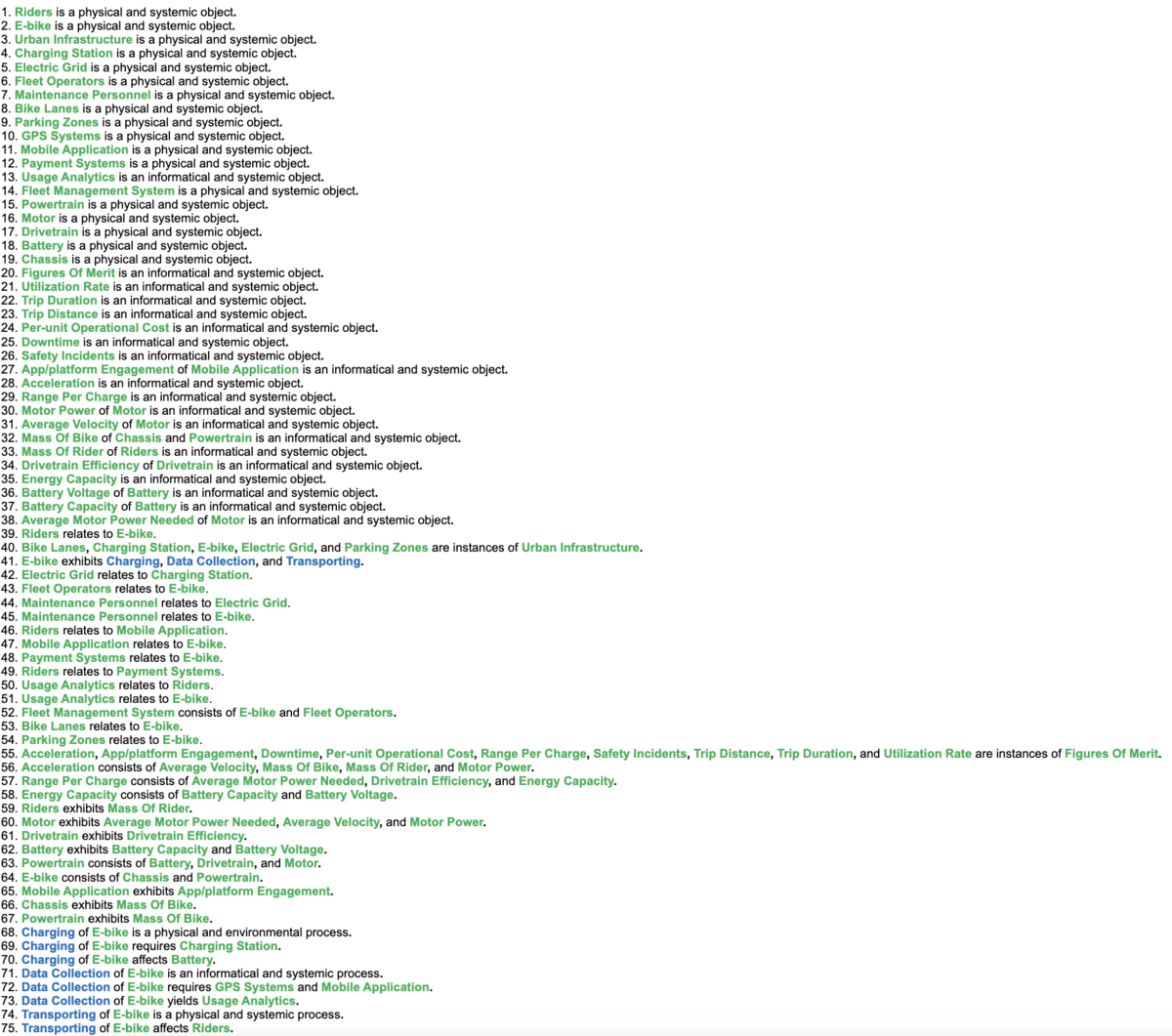

Strategic Driver FOM Targets by Time Horizon

The following is a detailed list of FOM targets by time horizon relative to the broader technology roadmap that connects to the strategic drivers. The planned roadmap would take a phased horizon approach with separate swimlanes for various technical, system integration, and connectivity drivers.

| Time Horizon | FOM Targets |

|---|---|

| Near-term |

|

| Mid-term |

|

| Long-term |

|

The figure below is a representation of the roadmap that is currently being built:

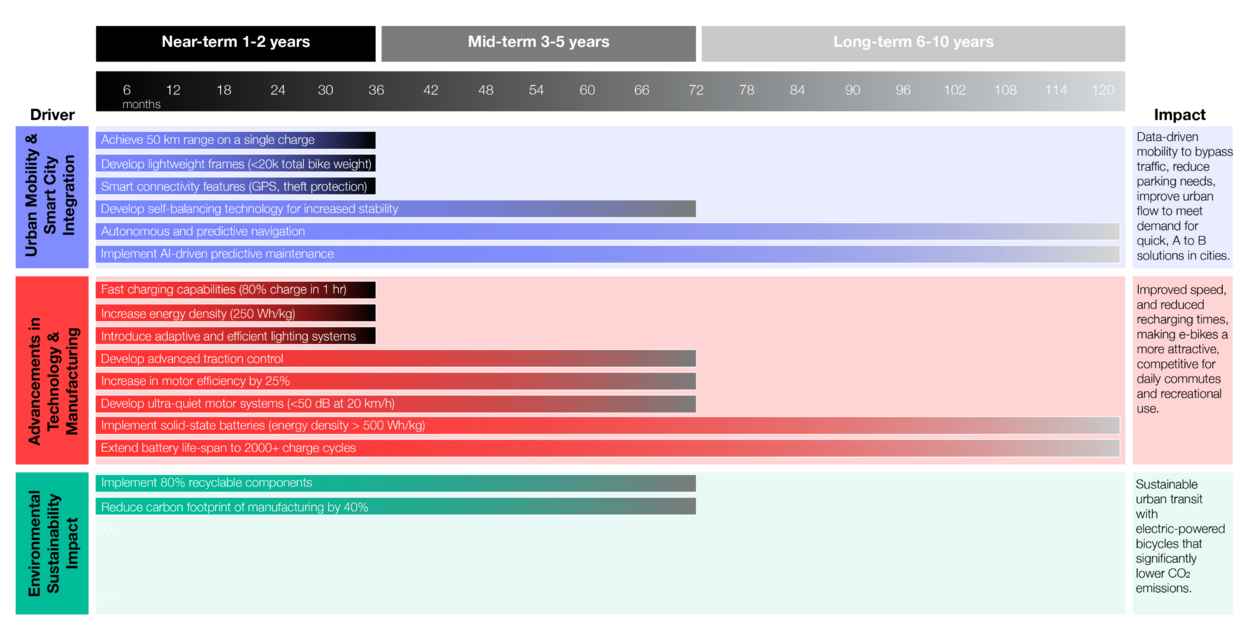

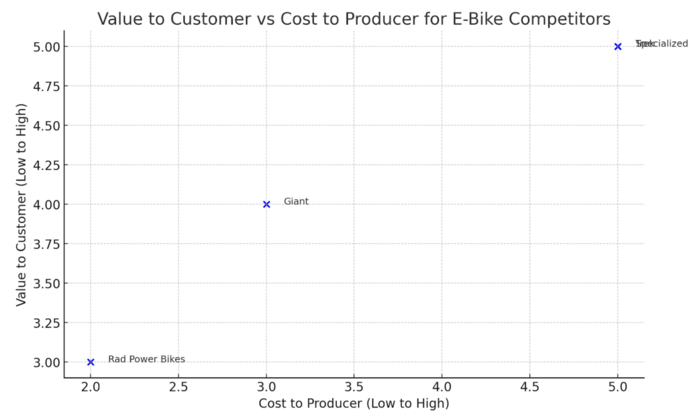

Positioning of Company vs. Competition: FOM charts

To effectively position our e-bike offering within the micromobility market, analyzing the value provided to customers against the cost incurred by producers is essential. Below is a conceptual representation of this relationship, highlighting our position relative to key competitors:

| Brand | “Company” | Rad Power | Trek | Specialized | Giant |

|---|---|---|---|---|---|

| Best Seller | “Model X” | RadRover 6 | Allant+ 9.9S | Turbo Vado 5.0 | FastRoad E+ EX Pro |

| Bike Weight (kg) | Targets TBD | 32.2 | 23.4 | 25.4 | 18.6 |

| Charge Time (hrs) | Targets TBD | 6 | 4.5 | 4 | 5 |

| Range (km) | Targets TBD | 72-88 | 120-180 | 145 | 120-180 |

| Battery Capacity (Wh) | Targets TBD | 672 | 625 | 710 | 500 |

| Price Range | Targets TBD | $1,000-2,000 | $2,500-12,000 | $3,000-$14,000 | $2,000-10,000 |

| Value to Customer | Targets TBD | Medium | High | High | Medium |

| Cost to Producer | Targets TBD | Low | High | High | Medium |

We aim to occupy a unique position by delivering high customer value through innovative features and affordability while keeping production costs manageable. This strategy aims to attract a broad user base seeking cost-effective and efficient urban transportation solutions.

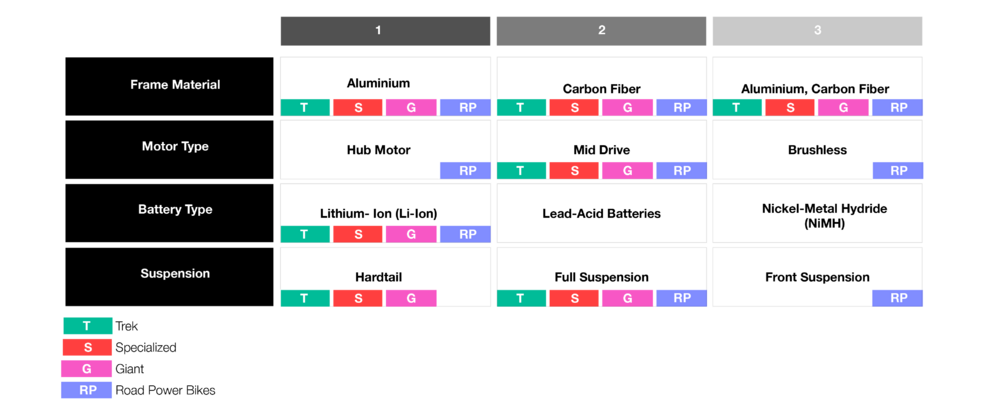

Technical Model: Morphological Matrix and Tradespace

Below is a morphological matrix for leading e-bike manufacturers: Trek, Specialized, Giant, and Rad Power Bikes. This matrix outlines the different design choices each company makes across various components. A myriad of different component decisions must be considered when designing an e-bike. We chose the top four of the most important decision areas in the matrix below. For each, we listed three possible solution types under each component.

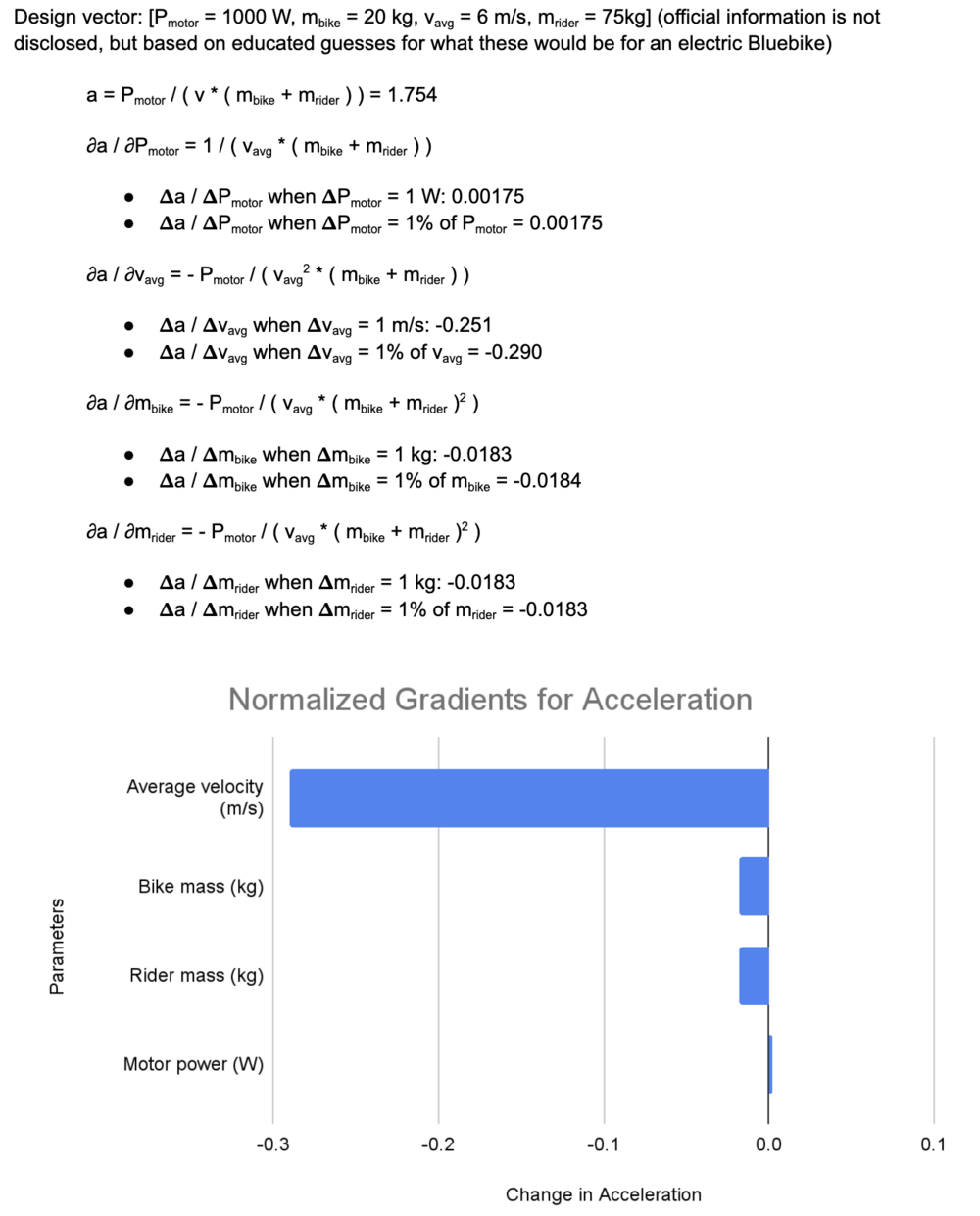

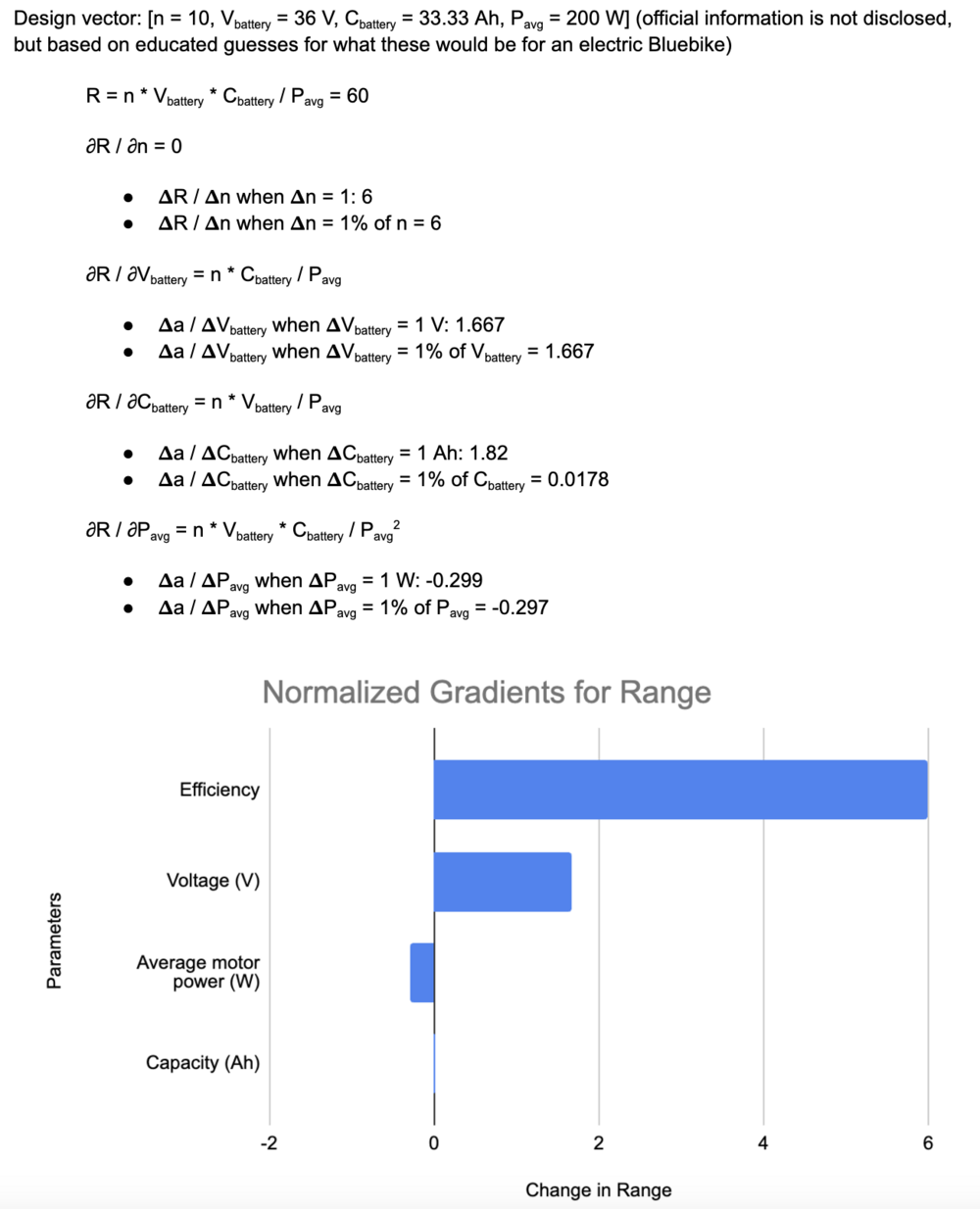

Governing Equations

We also provide two a mathematical breakdown of two governing equations for the e-bike space: acceleration and range.

Acceleration

Range

Keys Publications and Patents

The search for relevant patents was initially conducted using keywords such as “ebike” and “electronic bicycle” using the US Patent and Trademark Office Patent Public Search tool, as well as Google Scholar and Google Patent. This revealed hundreds of records, many of which were related to the growth of technology and, more so on the growth of the space in recent years. To better focus on more relevant technologies, the search focused on more recent updates in the technology, especially targeting component updates, such as electronic integrations, connectivity, and battery. This revealed a smaller subset of patents with more direct ties to recent designs.

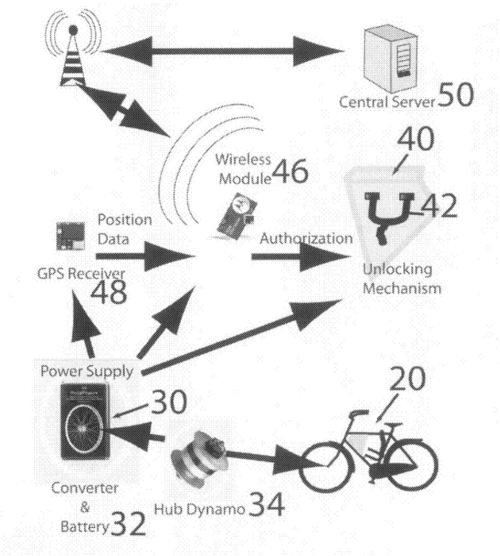

Bike Sharing Patent - Insights into the Full Urban Integration

This patent explored the current innovation in the shared transportation and ridesharing space, that is not reliant on e-dock/hub. Instead this introduced a bike share system with the flexibility to anchor the rental bike anywhere at the end of the trip, employing a remotely operable lockbox which incorporates a wireless communication card with a GPS receiver.

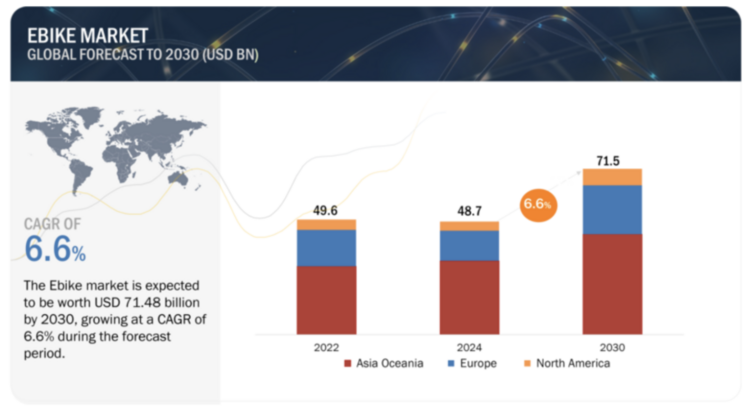

Additionally, some key market data came from Stastisa and Markets and Markets. These provided an overall view of the space and provided market sizing. The initial market size valuation for 2024 is valued at $48.7B and is expected to reach $71.5B by 2030, growing at a CAGR of 6.6%. This indicates that the global demand for e-bikes has increased rapidly, especially during COVID-19, as users saw them as a low-cost, eco-friendly solution for commuting. Government bodies worldwide have also supported initiatives for bicycle infrastructure, such as integrated lanes in urban environments.

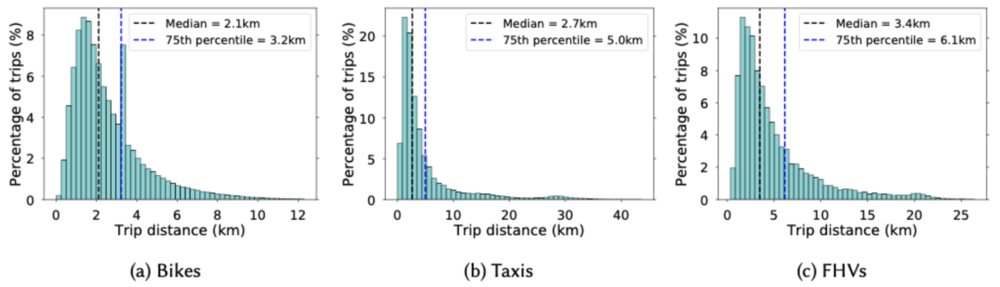

For publications, it was valuable to dive deep into the core of micromobility and the drivers behind more short-term transport. For example, the trip distance metrics and feasibility analysis of computed distributions of trip distances for bike, taxi, and FHV car-sharing datasets should be reviewed. It was valuable to understand some key needs and areas of competition necessary for future improvements in the roadmap.

Financial Model

Market Growth and Revenue Trajectory

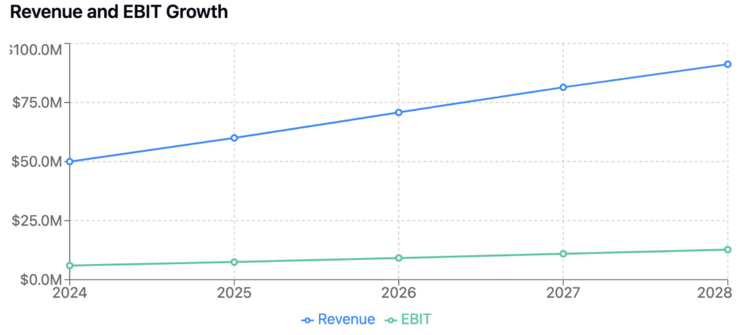

The e-bike industry projects robust growth from $50 million in 2024 to $91.2 million by 2028, following a CAGR that moderates from 22% to 12% as the market matures. This growth trajectory, while showing natural market evolution, remains significantly higher than traditional manufacturing industries, reflecting strong sustained demand for e-bikes and related technologies. The pattern accounts for increasing market penetration, growing consumer acceptance of e-bikes as primary transportation solutions, and expanding applications across both consumer and commercial sectors.

Research and Development Investment Framework

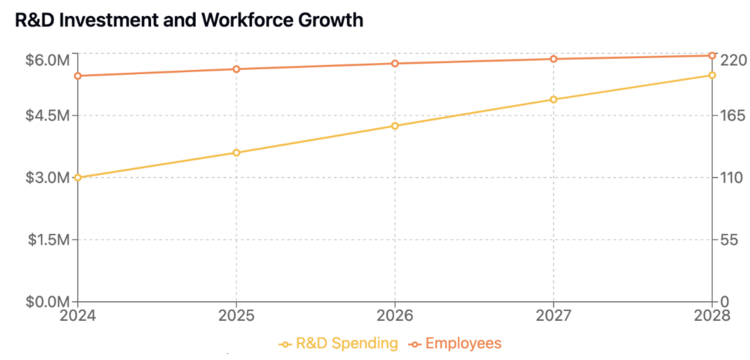

The e-bike industry maintains a strategic R&D intensity of 6% of revenue, with investment growing from $3 million in 2024 to $5.47 million in 2028, significantly exceeding traditional bicycle industry rates. This elevated R&D commitment reflects the technology-intensive nature of e-bikes and the constant need for innovation in a competitive market while balancing technological leadership with financial sustainability. The consistent 6% R&D intensity throughout the period demonstrates a long-term commitment to innovation and product development, ensuring continuous improvement in key performance areas while supporting new feature development and manufacturing optimization.

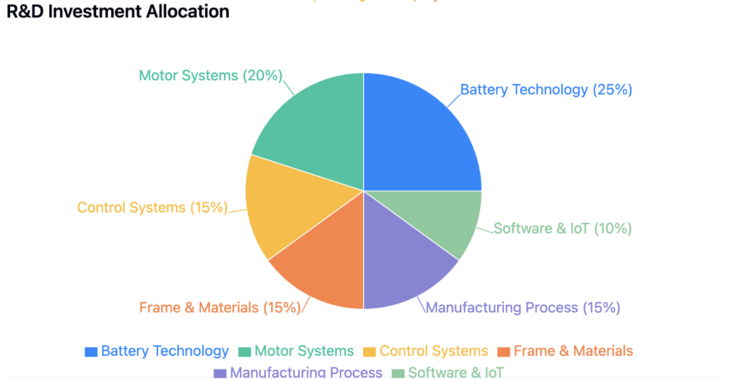

Strategic R&D Investment Allocation

The R&D budget is strategically distributed across six key technology areas, with the largest allocations directed to battery technology (25%) and motor systems (20%), reflecting their critical importance in market competitiveness. The remaining budget is balanced across control systems, frame and materials development, and manufacturing process improvements (15% each), with 10% dedicated to software and IoT integration, creating a comprehensive innovation strategy. This allocation acknowledges battery and motor technology as primary differentiators while maintaining strategic investment in manufacturing efficiency, structural innovations, and digital capabilities, positioning manufacturers for sustainable competitive advantage in an evolving market.

Future Projects and R&Ds

- E-Bike Solar Charging Demonstration: Sponsored by the Department of Energy and Environment, this aims to increase mobility options to shift away from single occupancy vehicles, improve air quality, and reduce greenhouse gas emissions.

- Rad Power Bikes' Rad Lab: An R&D facility focused on designing and testing e-bike components. The lab emphasizes rigorous testing protocols, including fatigue, durability, and impact assessments, to ensure product reliability and performance.

- MAHLE SmartBike Systems R&D Projects: Key objectives include developing ultralight and ultra-efficient systems, innovating 43V battery concepts, and creating new solutions with 43V e-bike motors.

- Yamaha's TY-E Electric Trials Bike: Through its "Evolving R&D" initiative, this project explores the potential of electric vehicles in trials competition, focusing on delivering powerful low-end torque and responsive acceleration. This is used for testing and refining electric propulsion technologies in competitive settings to further the technology.

- Project Triumph TE-1: The main objectives include developing electric motorcycle capabilities, innovative integrated solutions, and creating UK electric motorcycle capability.

- POEN Battery Remanufacture: To lead the eco-friendly battery industry by commercializing technology for remanufacturing electric vehicle waste batteries, establishing a robust environmental protection foundation, achieving a global standard circular economy, and focusing on sustainable practices in the electric vehicle industry.

- University of Nottingham's High Impact Demonstrators: Designed to to validate low-weight, high-energy-density powertrains for electric motorcycles. Their e-bike prototype placed second at the Isle of Man TT Zero, averaging close to 120 mph, demonstrating significant advancements in their electric motorbike performance.

- Soteria E-Bike Battery Safety: To reduce the risk of e-bike battery fires by developing a thermally insulating, fire-retardant blanket for battery cells, thereby improving overall battery safety.

- MIT's E-Bike Speed Controller with Regenerative Braking: Researchers at MIT designed a speed controller for e-bike motors that incorporates regenerative braking. This project aims to enhance energy efficiency by recharging the battery during braking, contributing to extended range and improved performance.

- Orbea Optimization Lab (OOLab): Started in 2022, OOLab is Orbea's R&D program for electric mountain bikes. They work with Shimano and focus on enhancing systems (e.g. motors, drivetrains, and batteries) to push the limits of e-bike performance.

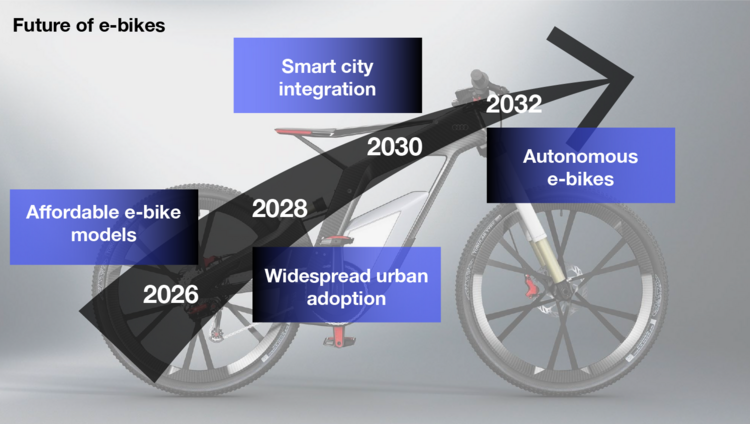

Technology Strategy Statement

The target is to develop next-generation electric bicycles that revolutionize urban mobility through progressive technological advancement and seamless integration with smart city infrastructure. Achieving autonomous e-bike capabilities requires advances in underlying technologies like battery efficiency, lightweight materials, smart connectivity, and AI-driven systems. The roadmap spans from near-term goals of achieving 50 km range and implementing basic smart features, through mid-term objectives of enhancing efficiency and adopting sustainable practices, to long-term aims of full smart city integration and autonomy. In the next 1-2 years, there will be a focus on affordability and fundamental improvements, including lightweight frames and fast charging. The subsequent 3-5 years will see the development of self-balancing technology, AI-driven maintenance, and significant increases in motor efficiency, alongside a strong push for sustainability with highly recyclable components. The 6-10 year vision culminates in the implementation of solid-state batteries, extended battery life spans, and autonomous navigation systems fully integrated with smart city infrastructure. This progression will enable data-driven mobility that bypasses traffic, reduces parking needs, and improves urban flow, making e-bikes more attractive for daily use while significantly lowering CO2 emissions. The strategy aims to transform urban transit, offering a sustainable, efficient, and technologically advanced alternative that seamlessly integrates with the smart cities of the future.