Difference between revisions of "Inventory Management System"

| Line 96: | Line 96: | ||

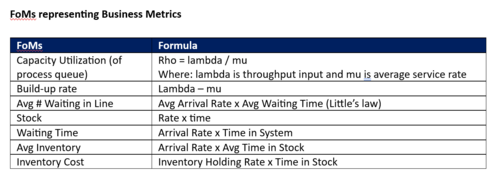

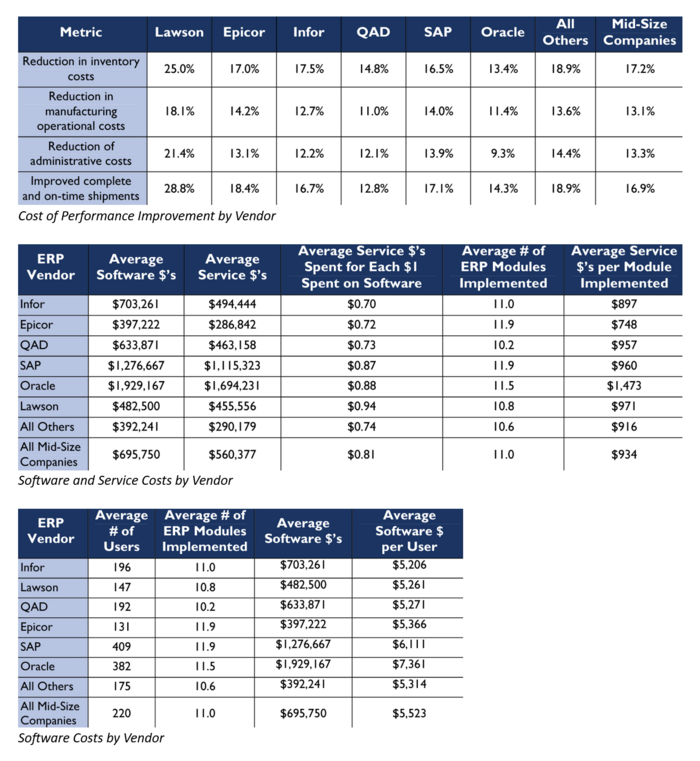

As mentioned above, FoMs that businesses look at when purchasing an IMS are not dependent on the raw technical capability of the technology but on it’s net impact in driving business metrics for the company’s operations. Such impact is measured in terms of queue and inventory analytics for operations and metrics for finance. Below are samples of such metrics measured in order to compare and contrast the competitive landscape of ERP IMS systems. | As mentioned above, FoMs that businesses look at when purchasing an IMS are not dependent on the raw technical capability of the technology but on it’s net impact in driving business metrics for the company’s operations. Such impact is measured in terms of queue and inventory analytics for operations and metrics for finance. Below are samples of such metrics measured in order to compare and contrast the competitive landscape of ERP IMS systems. | ||

[[File:Competitive Positions.png|thumb| | [[File:Competitive Positions.png|thumb|700px|center]] | ||

==Patents and papers== | ==Patents and papers== | ||

Revision as of 18:01, 2 November 2023

Technology Roadmap

Roadmap Overview

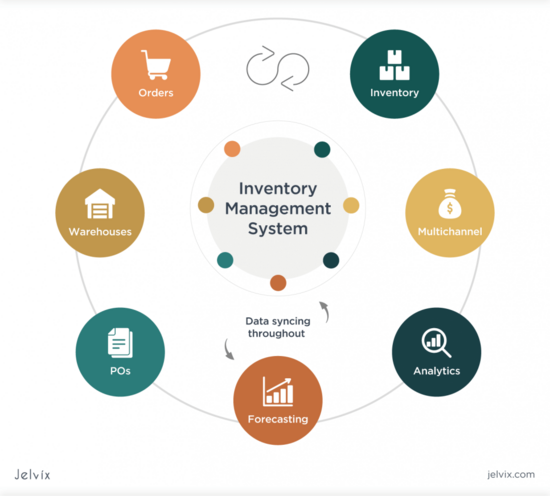

Inventory management system is a critical component of business operations' supply chain management that ensures efficient flows of materials and products from vendors to customers.

Key Goals of the SCM – inventory management system are:

- Providing timely, complete, and accurate inventory levels to managements

- Minimizing carrying costs while ensuring product availability.

- Reducing stockouts and overstock situations.

- Enhancing supply chain visibility and responsiveness.

- Streamlining operations and reducing inefficiencies.

- Lowering costs while maintaining service levels.

- Meeting customer demand accurately and on time.

- Adapting to changes in demand, supply, and market conditions.

Effective management systems provide the right products at the right time and place to meet growing customer demand. It is a critical aspect of modern business operations and plays a crucial role in achieving profitability and customer satisfaction.

*image-source - https://jelvix.com/blog/automated-inventory-management-system

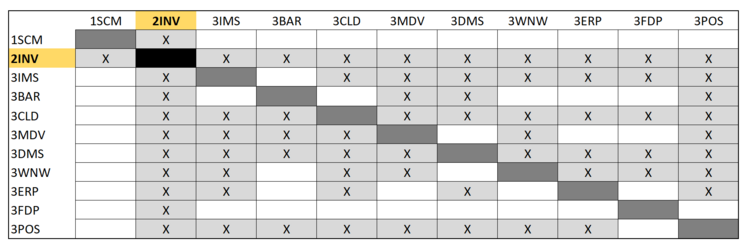

Design Structure Matrix (DSM) Allocation

DSM of the Inventory Management System:

The tree structure of the Inventory Management System.

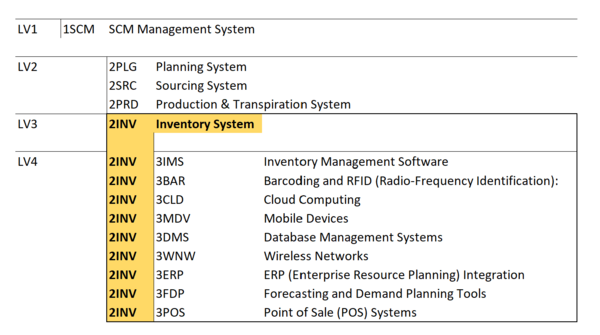

Object Process Model (OPM)

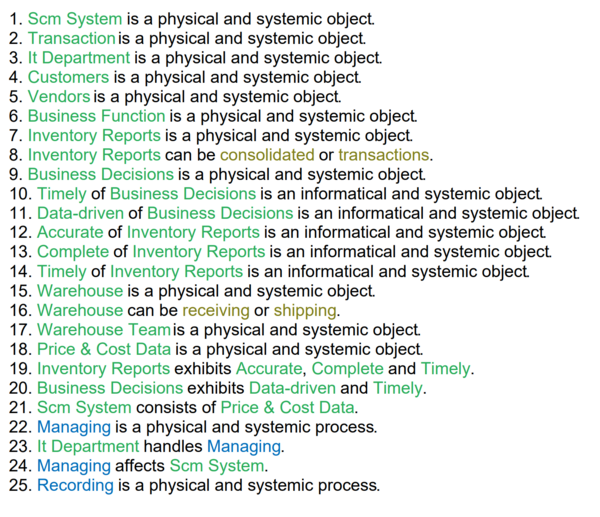

This OPM represents the Inventory Management System:

Figures of Merit (FoM)

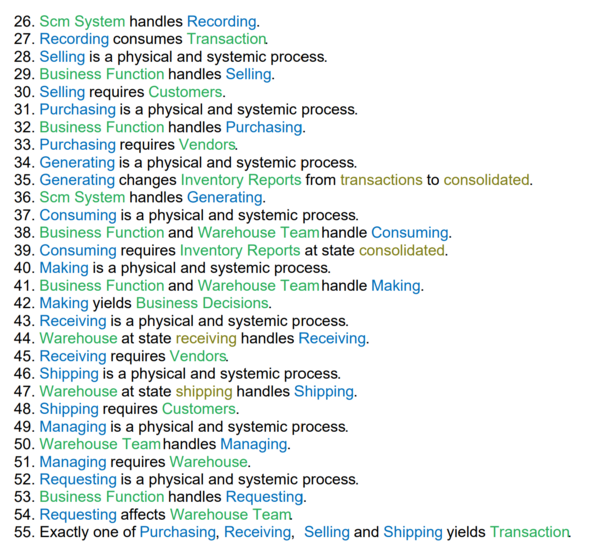

The table below show a list of FOMs by which can assess an Inventory Management System technology:

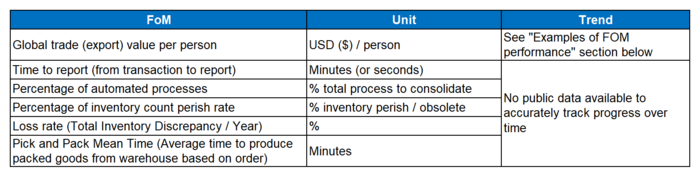

Examples of FOM performance

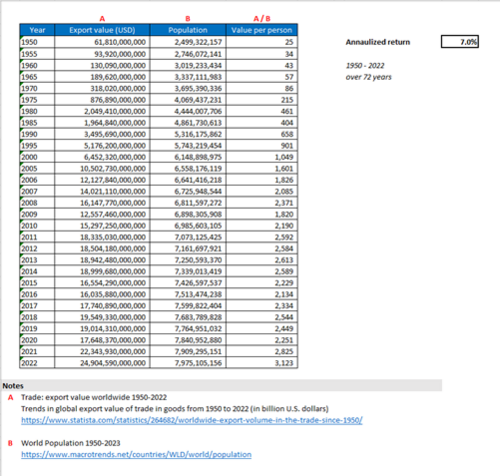

Over the last 52 years, inventory management system was improved by about 7% annualized growth based on the FoM trend indicated below:

This is an indirect approach to track technological progress as there is only limited data available related to inventory variances, time to report, % automation, etc. This information is company specific and not generally publicly available. As such, we selected the Total trade (export) value (in USD) per person with two assumptions: (1) all reported “Trade (export) value” were processed and consolidated using supply chain management systems – included in the figure means that the transactions were recorded and processed; and (2) improvements in the system can be represented with fewer resources (people) needed to process and consolidate the same amount of data. Said differently, technological progress and rate of improvement can be supported by one person processing more transaction volumes. Note that year-over-year export values can be influenced by various economic statuses.

Company Strategic Objectives

Historically, FOMs of Inventory Management Systems were constrained by and therefore packaged with hardware components and their interconnectivity. Transaction storage, responsiveness of reports, and data access times mostly depended on the infrastructure platform it was being run. However, as cloud technologies have become the norm, wherein enterprise IMS systems now run off IaaS offerings and SMB IMS systems run as SaaS, hardware constraints have become virtually unlimited. Even with billions of records, Big Data platforms now exist that enable IMS reporting to be extremely capable. Because of this, FOMs for IMS have become business-centric instead of technology-centric.

From an investment perspective, financial considerations focus on the Total Cost of Ownership (TCO) FoM, which could be decomposed into: license costs, deployment costs, servicing costs, support costs, training costs. TCO is often mapped at a 5-15 time horizon.

From an operational perspective, FoMs center around efficiency improvements enabled by the IMS. Such as “Time to process” wherein existing systems are compared to new proposed systems where they measure how much time it will take a processor (end-user) to complete the same process on the two systems. These processing efficiencies can be decomposed with standard queue analytics such as the ones below:

| Strategic Objective | Alignment and Targets |

|---|---|

| To develop a real-time cross-location inventory state management to make more timely business decisions. | We are targeting real-time inventory visibility and management across all branches with an SLO-driven response time of < 1 second. This visibility and control should be available from HQ to branch and branch to branch with proper management and permissions using an Identity Access Management system (IAM). |

| To develop a stock flow management module with the ability to visualize historical and forecasted stock movements for more data-driven decisions. | Visibility and proactive pattern management of stock flow from warehouses, distribution centers, and branches. With improved IMS pattern recognition, we aim to lower cost of overage and underage of stock by 5% to give a return on switching costs. |

| To enable our system to perform predictive analysis of our stock cycles to minimize holding and landed costs. | Lower holding and landed costs of products by 2% based on branch-level stock cycle monitoring as opposed to current-state consolidated stock cycle monitoring. |

| To enable our system to timely identify correlation on stock demands and outages of complementary products to prevent stock shortage. | Identify correlation on stock demand and stock outages of complementary products with at least 60% accuracy.

|

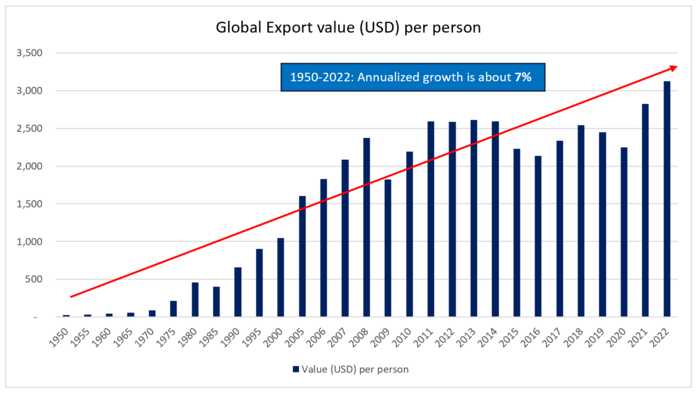

Positioning of Company vs. Competition

As mentioned above, FoMs that businesses look at when purchasing an IMS are not dependent on the raw technical capability of the technology but on it’s net impact in driving business metrics for the company’s operations. Such impact is measured in terms of queue and inventory analytics for operations and metrics for finance. Below are samples of such metrics measured in order to compare and contrast the competitive landscape of ERP IMS systems.

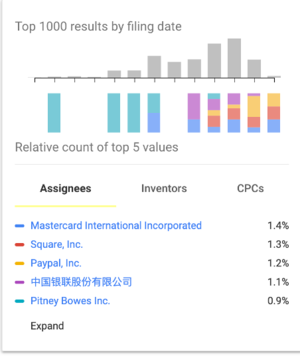

Patents and papers

Extensive information is available pertaining to "payment systems":

- Google Scholar yielded 31,800 results when searching for “Payment System” from 2016 (excluding references in citations and patents).

- Google Patents yielded 95,500 results. More than half of these were generated from 2010.

- U.S. Trademark and Patent Office yielded 406 results in “Payment System”.

- MIT Libraries yielded the following results for a “Payment System” search: Books and media (88,910), Articles and journals (131,263) and Archives and manuscripts (62)

Other credible sources of public information include:

- US Federal Reserve (Fed)

- World Bank Group

- Bank of International Settlements (BIS)

Examples of patents:

- Methods and systems for IOT enabled payments (US 2018/0197175) by Mastercard International Corporation.

- The inventor of the patent is Peter Groarke (a Mastercard employee based in Dublin, Ireland). The patent was also filed in the European Union.

- This patent addresses a method and system for placing and processing orders for a product in which the processing of the payment is delayed until the product has been successfully received. There exists a need for a payment system that does not require the intervention of a card holder or financial institutions to reverse the payment when an order is not successfully completed.

- The burden to remove incorrectly processed payments is removed.

- It is a utility patent, in that the respective methods and processes to place and process a specific payment transaction is provided.

- System and method for linking payment card to payment contract (United States 3,778,595 on 11 December 1973) by Yoshihiro Hatanaka and Akio Ueba. This is the initial patent for an Automatic Bank Teller (ATM) system.

- Digital fiat currency (US 2020/0151682) by Visa International Service Association. Techniques are disclosed which include receiving, by a central entity computer, a request for digital currency.

- Dynamic provisioning of wallets in a secure payment system (US 2020/0065819) by Radpay , Inc. The patent describe methods and systems for securely conducting a transaction requiring approval via a personal device of a purchaser is provided.

- Electronic funds transfer instruments (US 005677955A) by the Financial Services Consortium, The First National Bank of Boston and Bell Communications Research, Inc.

- This patent is old and basic one related to funds transfer from payers to payees with electronic instruments. The process includes the process of an electronic signature, automated authentication of users, and the integrated fraud prevention measures.

- The process enables customers to do transmit and deposit their money without going to a bank branch. Interestingly, in the patent, the concept of API function was also articulated.

- The patent has been cited by 1235 other patents and it include basic and general contents, so it is one of the basements in the area of payment.

Examples of papers:

- U.S. Payment System Policy Issues: Faster Payments and Innovation (September 23, 2019) by Cheryl R. Cooper, Marc Labonte and David W. Perkins on behalf of the Congressional Research Reserve. This report examines technological innovation and the regulatory environment of US payment systems generally and particular policy issues as a result of retail (i.e, point of sale) payment innovation.

- Fast payments – Enhancing the speed and availability of retail payments (November 2016), by the Committee on Payments and Market Infrastructures from the Bank of International Settlements. This report highlights the role central banks can take in a the payment system: a catalyst role, an oversight role, and an operational role. It also reaffirms the role and how central banks should enable and support faster payment systems.

- The U.S. path to faster payments - PART ONE (January 2017), by the Faster Payments Task Force. The paper describes the task force’s mission and process, and provides greater detail about the motivation behind the task force’s work in the context of the current payments landscape — explaining why the task force came together to identify and evaluate effective faster payments solutions in the United States. The motivation of the task force is to solve the problem that wide range of end-user needs are not satisfied, to enhance innovation, and to improve the flow of commerce and position of the US by designing payment system with high interoperability and efficiency. The task force was organized by various stakeholders in the United States. In order to design a new payment system, the task force used 36 “effectiveness criteria” to identify relevant solutions from industry.

- The U.S. path to faster payments - PART TWO: A Call to Action (July 2017), by the Faster Payments Task Force. This second paper from the Faster Payments Task Force presents a roadmap for achieving safe, ubiquitous, faster payments that encourages competition among a variety of solutions, as opposed to endorsing a single approach.