Difference between revisions of "Satellite Communications 5G NTN D2D"

| Line 1: | Line 1: | ||

Authors: Jonas Urbonas, Braden Brower, Vivek Sahay | Authors: Jonas Urbonas, Braden Brower, Vivek Sahay | ||

Roadmap Creation: 2024 Fall | Roadmap Creation: 2024 Fall | ||

Revision as of 23:17, 9 October 2024

Authors: Jonas Urbonas, Braden Brower, Vivek Sahay

Roadmap Creation: 2024 Fall

Roadmap Overview

Communication satellites play a critical role in enabling global telecommunications. These artificial satellites ensure connectivity even in the world's most remote regions. There are various uses for satellite communications technology, including TV broadcasting, telephone services, internet access, navigation, military tactical communications, and others. Recently, with 3GPP release 17 and the standardization of non-terrestrial 5G networks (5G NTN), a new frontier for satellite communications has been defined -- direct-to-device communications. This advancement has resulted in significant interest and investment from both new and established market players, all competing for the largest market share. Additionally, mobile device manufacturers are now developing compatible user equipment, creating a dynamic, double-sided market that is about to experience a significant expansion.

This roadmap focuses on Low Earth Orbit (LEO) communication satellites used in 5G Non-Terrestrial Networks (NTN) for direct-to-device communications. LEO satellites, operating at altitudes ranging from 180 to 2,000 kilometers, constitute the primary choice for non-terrestrial 5G applications. These satellites have attracted considerable attention because of their advantages, including lower latency and increased communication speeds, which are beneficial for real-time applications such as high-speed internet. By being in an LEO orbit, the coverage of a single satellite is reduced; however, deploying a satellite constellation working in tandem can enhance throughput and coverage. LEO satellites are also cheaper to build, and due to their size, they can often be sent to space as a secondary payload. This reduced cost and direct-to-device potential have led to new entrants to the satellite communications market, such as Lynk Global, AST SpaceMobile, and Amazon Kuiper, with the big existing player Starlink.

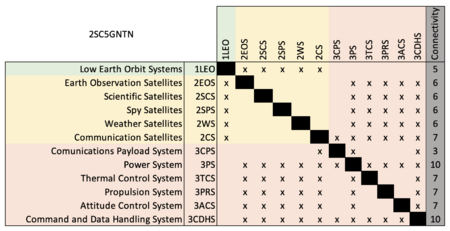

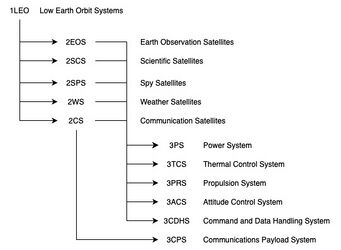

DSM Allocation

For the DSM allocation, the Level 1 roadmap was chosen as Low Earth Orbit Systems; this was a strategic choice to focus on technologies being developed with this particular orbital region in mind. However, it is understood that there will be links to roadmaps for systems in MEO and GEO. Working down the decomposition, the Level 2 roadmaps would align with the application-specific satellites. Finally, the Level 3 roadmap focuses on the individual subsystems. What can be appreciated from this connectivity is that 3PS, 3TCS, 3PRS, 3ACS, and 3CDHS are all common subsystems across all satellite classes. This indicates that the underlying technologies for these subsystems can come from different application domains, and improvement in any of these subsystems via one domain will improve the technology for all domains.

The 3CPS subsystem only applies to 2CS; this implies that improvements in this subsystem will only come from development from the Communication Satellites domain. As this roadmap looks at direct-to-device communications, improvements along the technology performance S-Curve will only come from dedicated development of the 3CPS subsystem.

Roadmap Model Using OPM

The diagram below shows the Roadmap OPM for SC5GNTND2D; it captures the main object (LEO Communications Satellite) FOMs (Cost of Transmission, Capacity Factor ...), major functions (receiving, transmitting, processing), subsystems (Communications payload system, power system, ...), and competitors (Lynk, Starlink, SpaceMobile...). For completeness, the OPL description of the roadmap is included below; it describes the same content as the OPM in a formal language.

FOMS

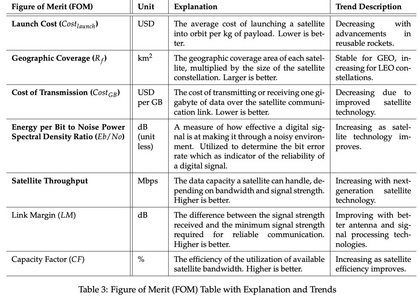

The figure below shows the FOMs by which Satellite Communications 5G NTN D2D systems can be assessed. The primary figures of merit of Launch Cost, Geographic Coverage and Cost of Transmission are bolded. The rationale for this selection came from looking at it from the perspective of the user; the two key characteristics of a useable technology would be 1) Geographic Coverage and 2) Cost of Transmission (which drives the price to the users). Furthermore, current operational costs are heavily weighted by the Launch Cost. Hence, our top three selections.

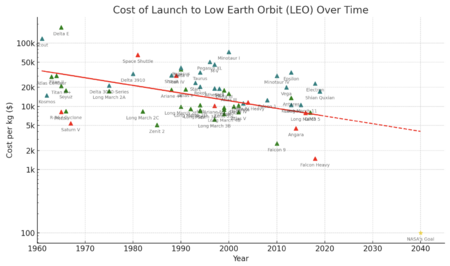

As the direct-to-device communications industry is nascent and many companies do not disclose many of the specifications of their constellations, it is challenging to come up with quantitative measures of the trends. One big exception is Launch Cost, as this data is public, trends over the last 60 years are shown in the diagram below (the graph is plotted on a logarithmic scale). As of 2024, the best-reported launch cost is from Falcon Heavy at $1500/kg. This is a significant reduction from the early days, but it is still 15x higher than the 2040 NASA target of $100/kg. The caveat with this goal is that the time value of money is not clear. It is not explicitly stated whether NASA accounted for a launch cost of $100 at the time of setting their goal or if this cost is assessed in terms of its adjusted value to 2040 dollars.