Inventory Management System

Technology Roadmap

Roadmap Overview

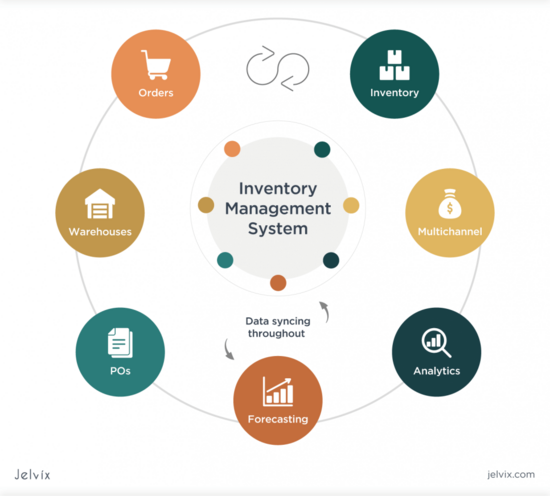

Inventory management system is a critical component of business operations' supply chain management that ensures efficient flows of materials and products from vendors to customers.

Key Goals of the SCM – inventory management system are:

- Providing timely, complete, and accurate inventory levels to managements

- Minimizing carrying costs while ensuring product availability.

- Reducing stockouts and overstock situations.

- Enhancing supply chain visibility and responsiveness.

- Streamlining operations and reducing inefficiencies.

- Lowering costs while maintaining service levels.

- Meeting customer demand accurately and on time.

- Adapting to changes in demand, supply, and market conditions.

Effective management systems provide the right products at the right time and place to meet growing customer demand. It is a critical aspect of modern business operations and plays a crucial role in achieving profitability and customer satisfaction.

*image-source - https://jelvix.com/blog/automated-inventory-management-system

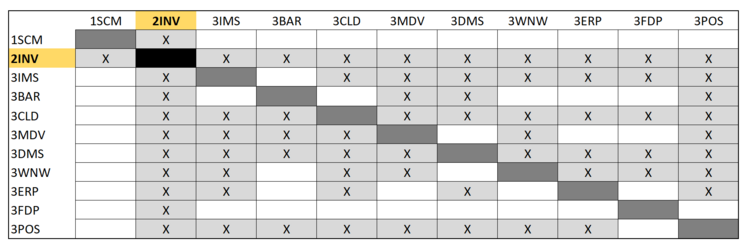

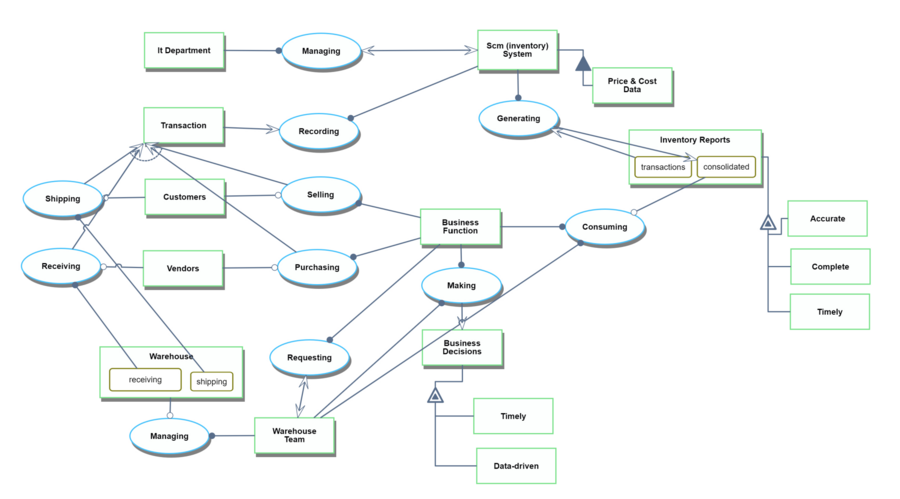

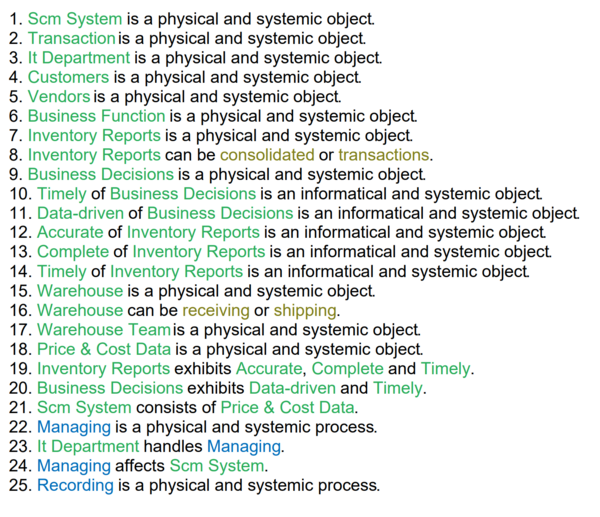

Design Structure Matrix (DSM) Allocation

DSM of the Inventory Management System:

The tree structure of the Inventory Management System.

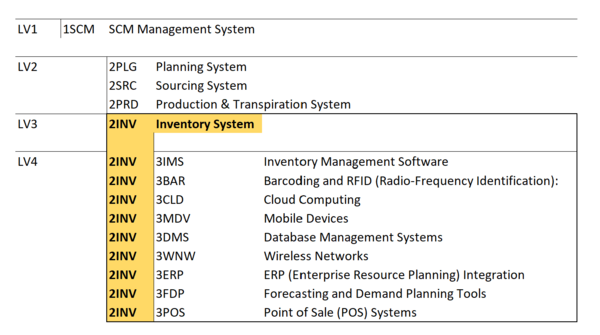

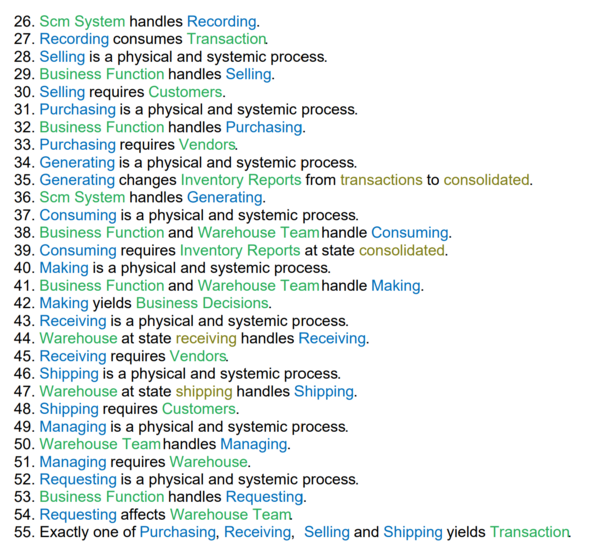

Object Process Model (OPM)

This OPM represents the Inventory Management System:

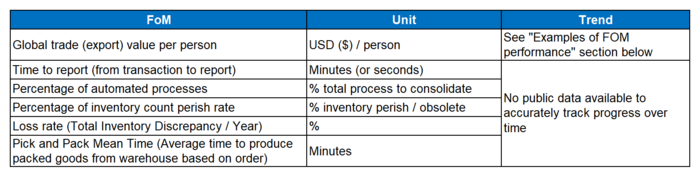

Figures of Merit (FoM)

The table below show a list of FOMs by which can assess an Inventory Management System technology:

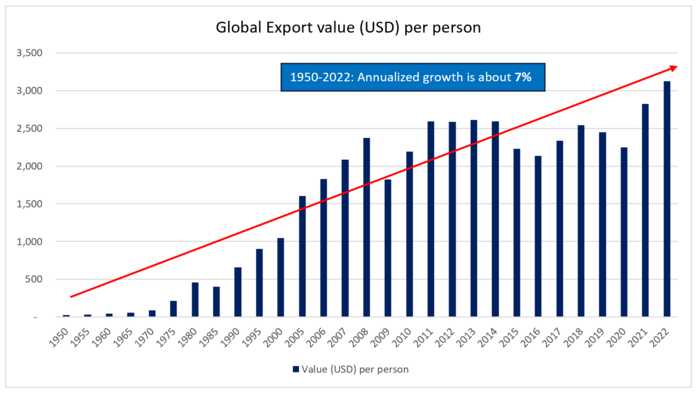

Examples of FOM performance

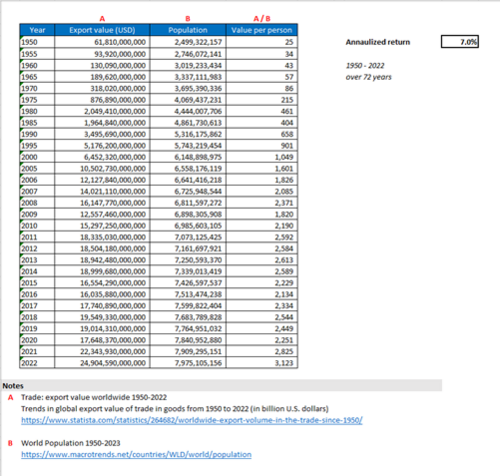

Over the last 52 years, inventory management system was improved by about 7% annualized growth based on the FoM trend indicated below:

This is an indirect approach to track technological progress as there is only limited data available related to inventory variances, time to report, % automation, etc. This information is company specific and not generally publicly available. As such, we selected the Total trade (export) value (in USD) per person with two assumptions: (1) all reported “Trade (export) value” were processed and consolidated using supply chain management systems – included in the figure means that the transactions were recorded and processed; and (2) improvements in the system can be represented with fewer resources (people) needed to process and consolidate the same amount of data. Said differently, technological progress and rate of improvement can be supported by one person processing more transaction volumes. Note that year-over-year export values can be influenced by various economic statuses.

Company Strategic Objectives

We identified strategic objectives that can stand the test of time. We want our clients to understand that we are constant, unchanging, something they can depend on. As technology improves, we can change the respective FOM and targets, without changing our strategic objectives. The table below shows our strategic objectives:

| Strategic Objective | Alignment and Targets |

|---|---|

| An efficient payment system that processes and settles transactions in near real-time. | Currently we have a transaction settlement period of 1 day and aim to decrease this to 90 seconds. |

| Our clients trust us to process their transactions in a safe and secure manner where they do not lose money. | We aim to maintain System downtime per year to less than 480s (i.e. 8 hours). In the next year we will improve our fraud prevention ratio (by at least 0.5%) and machine learning accuracy (by at least 5%) whilst maintaining or decreasing our cost base. |

| Our clients can make payments to anyone, anywhere. | We continue to grow the number of payments we process pa to more than 1bn, servicing more than 750k individual and 10k business clients in 76 countries. Our goal is to process 1% of all payments made as reported by the Bank of International Settlements. |

Positioning of Company vs. Competition

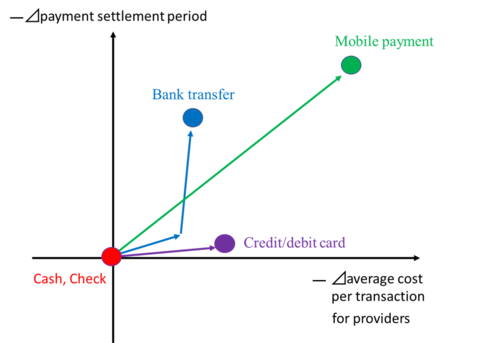

First, the following vector chart shows the competitive situation among different types of payment. The mobile payment has improved both the average cost per transaction and the payment settlement period. When it comes to a bank transfer, it gradually improved productivity, but recently banks offered RTP network, a faster clearing system in the US, so it has shortened the payment settlement period. Credit/ debit card has improved average cost per transaction by raising the precision of fraud detection.

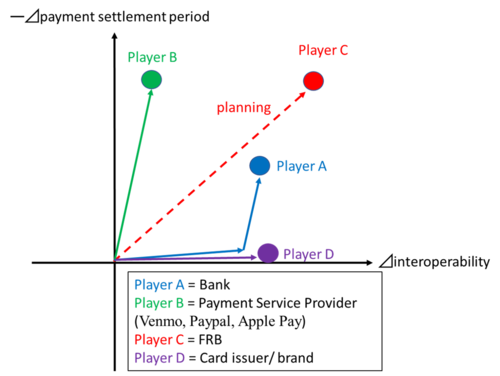

Second, the following vector chart shows the competitive situation among different companies of payment services. Here, we compare the payment settlement period and interoperability. Interoperability is related to cost because it takes money and time to get the system interoperable with other systems or services. Player C announced that it would offer a real-time payment system for everyone, including small commercial banks that are sometimes difficult to access the interbank system because of the cost level. Player A launched a faster clearing system to compete with it. Player B offers faster payment services without interoperability with other payments. Player C has extended the acceptance of merchants where users can use their payment.

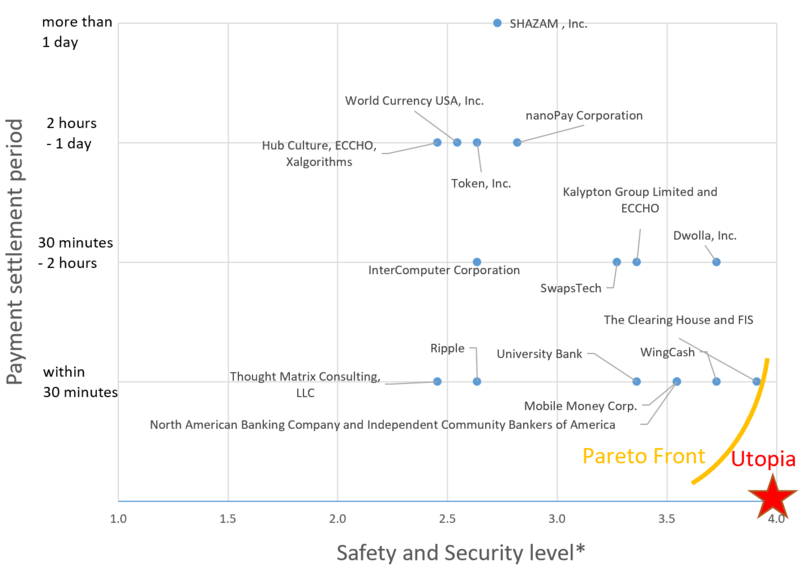

The following figure shows the trade space of the proposals for FedNow. In 2016, the Faster Payments Task Force asked for proposals of FedNow, and more than 30 companies offered the proposals. The figure shows 16 open cases of them. Due to data limitation, we used “Safety and Security level*” as the alternative for the FOM of Safety & Security, Sustainability ratio.

* We calculated “Safety and Security level” as the average level of assessment results for the following assessment criteria.

Assessment criteria:

S.1 Risk Management / S.2 Payer Authorization / S.3 Payment Finality / S.4 Settlement Approach / S.5 Handling Disputed Payments / S.6 Fraud Information Sharing / S.7 Security Controls / S.8 Resiliency / S.9 End-User Data Protection / S.10 End-User/Provider Authentication / S.11 Participation Requirements (https://fasterpaymentstaskforce.org/effectiveness-criteria-and-solution-proposals/)

The number of levels is defined as follows.

4: Very Effective / 3: Effective / 2: Somewhat Effective / 1: Not Effective

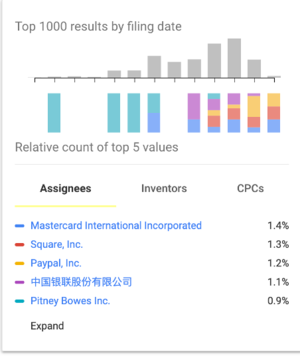

Patents and papers

Extensive information is available pertaining to "payment systems":

- Google Scholar yielded 31,800 results when searching for “Payment System” from 2016 (excluding references in citations and patents).

- Google Patents yielded 95,500 results. More than half of these were generated from 2010.

- U.S. Trademark and Patent Office yielded 406 results in “Payment System”.

- MIT Libraries yielded the following results for a “Payment System” search: Books and media (88,910), Articles and journals (131,263) and Archives and manuscripts (62)

Other credible sources of public information include:

- US Federal Reserve (Fed)

- World Bank Group

- Bank of International Settlements (BIS)

Examples of patents:

- Methods and systems for IOT enabled payments (US 2018/0197175) by Mastercard International Corporation.

- The inventor of the patent is Peter Groarke (a Mastercard employee based in Dublin, Ireland). The patent was also filed in the European Union.

- This patent addresses a method and system for placing and processing orders for a product in which the processing of the payment is delayed until the product has been successfully received. There exists a need for a payment system that does not require the intervention of a card holder or financial institutions to reverse the payment when an order is not successfully completed.

- The burden to remove incorrectly processed payments is removed.

- It is a utility patent, in that the respective methods and processes to place and process a specific payment transaction is provided.

- System and method for linking payment card to payment contract (United States 3,778,595 on 11 December 1973) by Yoshihiro Hatanaka and Akio Ueba. This is the initial patent for an Automatic Bank Teller (ATM) system.

- Digital fiat currency (US 2020/0151682) by Visa International Service Association. Techniques are disclosed which include receiving, by a central entity computer, a request for digital currency.

- Dynamic provisioning of wallets in a secure payment system (US 2020/0065819) by Radpay , Inc. The patent describe methods and systems for securely conducting a transaction requiring approval via a personal device of a purchaser is provided.

- Electronic funds transfer instruments (US 005677955A) by the Financial Services Consortium, The First National Bank of Boston and Bell Communications Research, Inc.

- This patent is old and basic one related to funds transfer from payers to payees with electronic instruments. The process includes the process of an electronic signature, automated authentication of users, and the integrated fraud prevention measures.

- The process enables customers to do transmit and deposit their money without going to a bank branch. Interestingly, in the patent, the concept of API function was also articulated.

- The patent has been cited by 1235 other patents and it include basic and general contents, so it is one of the basements in the area of payment.

Examples of papers:

- U.S. Payment System Policy Issues: Faster Payments and Innovation (September 23, 2019) by Cheryl R. Cooper, Marc Labonte and David W. Perkins on behalf of the Congressional Research Reserve. This report examines technological innovation and the regulatory environment of US payment systems generally and particular policy issues as a result of retail (i.e, point of sale) payment innovation.

- Fast payments – Enhancing the speed and availability of retail payments (November 2016), by the Committee on Payments and Market Infrastructures from the Bank of International Settlements. This report highlights the role central banks can take in a the payment system: a catalyst role, an oversight role, and an operational role. It also reaffirms the role and how central banks should enable and support faster payment systems.

- The U.S. path to faster payments - PART ONE (January 2017), by the Faster Payments Task Force. The paper describes the task force’s mission and process, and provides greater detail about the motivation behind the task force’s work in the context of the current payments landscape — explaining why the task force came together to identify and evaluate effective faster payments solutions in the United States. The motivation of the task force is to solve the problem that wide range of end-user needs are not satisfied, to enhance innovation, and to improve the flow of commerce and position of the US by designing payment system with high interoperability and efficiency. The task force was organized by various stakeholders in the United States. In order to design a new payment system, the task force used 36 “effectiveness criteria” to identify relevant solutions from industry.

- The U.S. path to faster payments - PART TWO: A Call to Action (July 2017), by the Faster Payments Task Force. This second paper from the Faster Payments Task Force presents a roadmap for achieving safe, ubiquitous, faster payments that encourages competition among a variety of solutions, as opposed to endorsing a single approach.