Continuous Security Monitoring

Continuous Security Monitoring

Roadmap Overview

A Continuous Security Monitoring (CSM) tool is critical to provide near-real-time surveillance and analysis of an environment to flag potential security threats. A CSM tool is an integral part of any modern cybersecurity framework. The technology affords automation as central to its operation, ensuring that the tool offers ongoing insights in the security posture of an environment and improves an organization's ability to manage potential risks.

The technology functions with behavior analytics to monitor environmental activities in order to pinpoint potentially malicious or anomalous actions. The future of the technology includes advanced predicted analysis using Machine Learning (ML) and Artificial Intelligence (AI) tools where the tool can shift from reactive to proactive intelligence. In the long-term, quantum computing preparedness will be key to ensuring the tool can manage threats in a post-quantum computing world. The tool may also possess the ability to automatically repair itself, thought it currently operates in tandem with human intervention for optimal performance.

Further, the increasing regulation of cyber space and introduction of cybersecurity policy suggest the CSM tool may also be a requirement for regulatory compliance and would allow environments to stay updated with evolving cybersecurity laws and regulations.

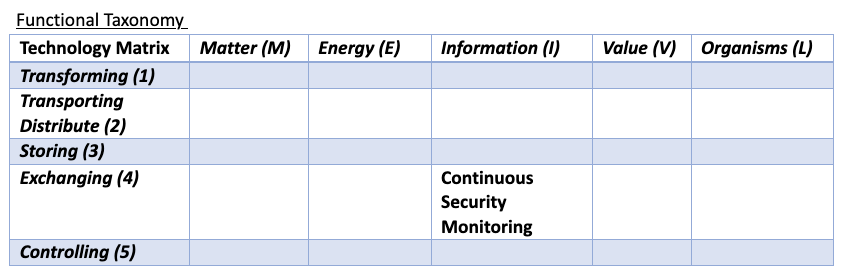

The visual below offers insight on where the CSM tool exists in the 5x5 matrix:

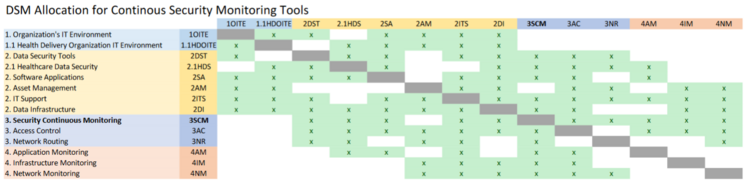

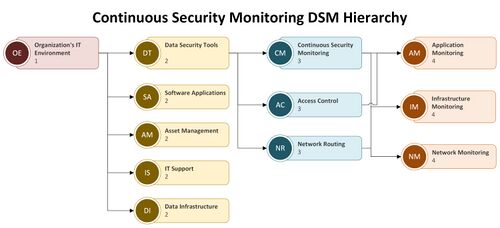

DSM Allocation

The most inter-dependencies are with the Healthcare Data Security (2HDS) roadmap. The Healthcare Data Security roadmap is narrowed in to a specific industry whereas we are focused on the more generalized industrial application but a deeper technical level of data security, Continuous Security Monitoring. The higher levels are essentially the same across roadmaps, but industry specific vs generalized. As such, we’ve marked the Healthcare specific roadmap items as subcategories underneath the non-industry specific version. We decided to omit the industry specific items, such as Medical Device Protection, from our DSM.

A more detailed view of the levels for the roadmap interactions is provided in hierarchy form.

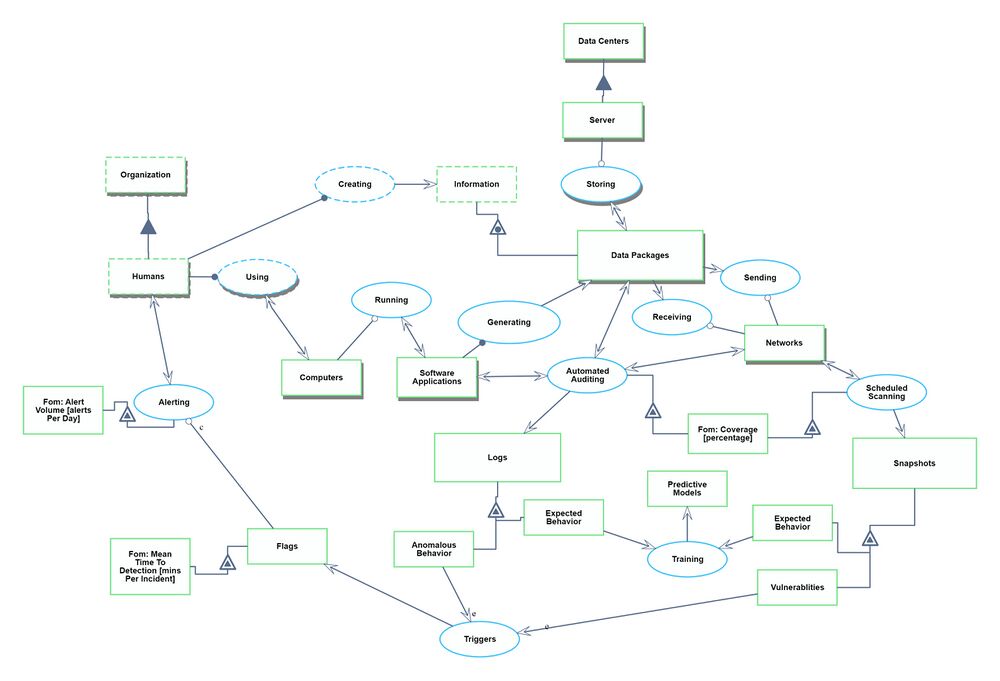

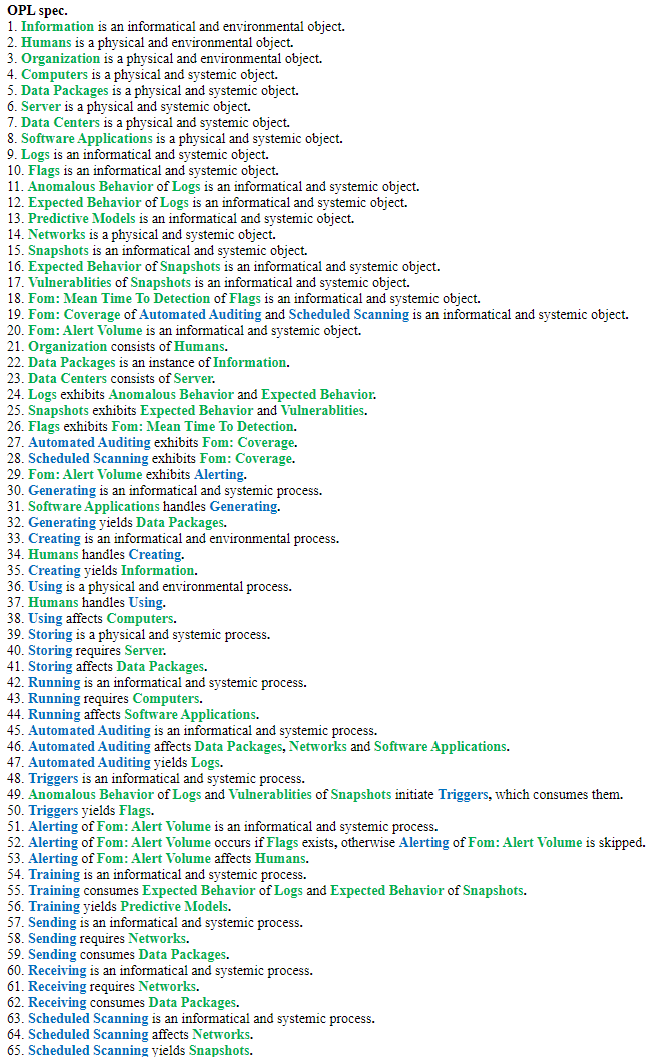

Roadmap Model using OPM (ISO 19450)

We defined a Continuous Security Monitoring (CSM) tool to sit within the environment of an organization's Information Technology (IT) infrastructure. The system contains the IT landscape at a high level, such as software applications, data infrastructure, and network routing. We narrowed to just the monitoring and alerting functionality of a CSM tool. There could be additional functionalities within data security such as root cause analysis, remediation, and pro-active repairs, but we have excluded those from our system.

Note: Automated Auditing refers to the automatic generation of logs and monitoring of networks and applications to ensure compliance with security policies and standards.

The Object-Process Model above can be written in natural language as follows:

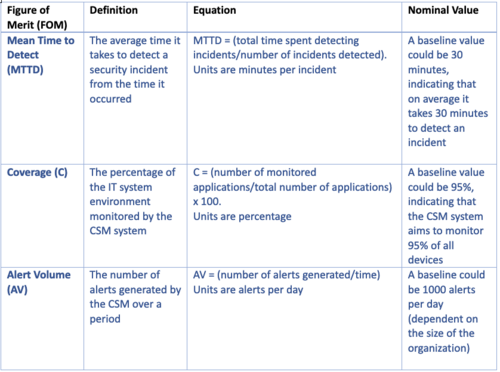

Figures of Merit (FOM): Definition (name, unit, trends dFOM/dt)

The table below delineates three critical Figures of Merit (FOM) for a CSM tool, in order of priority:

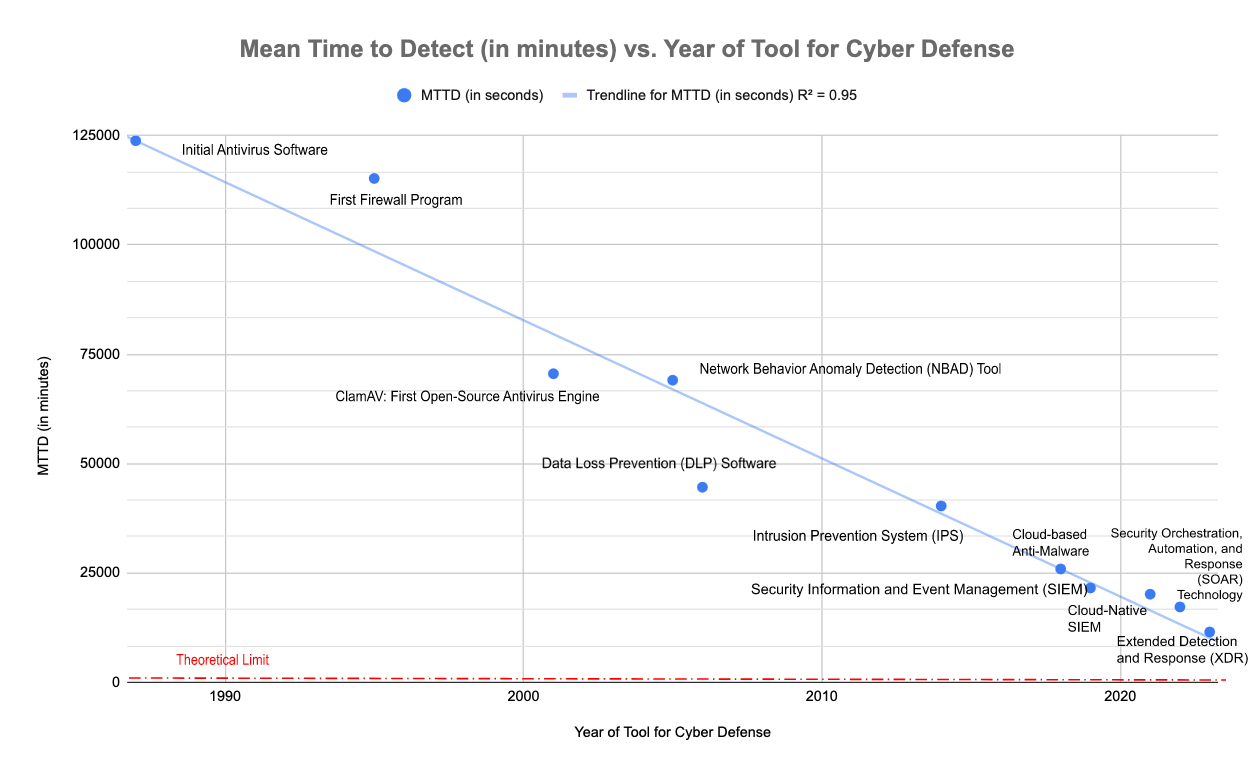

The FOM for Mean Time to Detect (MTTD) is plotted below as the evolution of the technology has afforded a decreased value for MTTD, approaching the theoretical limit of zero, or instantaneous detection. However, reaching an absolute zero MTTD may not be possible due to constraints such as processing time, network latency, and inherent limitation in detection algorithms. The sensitive nature of cybersecurity makes publicly available data a challenge, as well as data sharing. The novelty of the technology in the cybersecurity domain also contributes to the dearth of data and lack of historical data for the technology. Therefore, the resources listed in References informed the construction of the graph below.

Alignment with “company” Strategic Drivers: FOM targets

Through the lens of a hypothetical company, alignment with strategic drivers such as risk management, customer trust, operational efficiency, and scalability are all significant forces needed to ensure that the CSM tool would meet the market need and support the "company's" long-term objectives.

Assessing risk management and operational efficiency is captured in Mean Time to Detect (MTTD) and Mean Time to Respond (MTTR). The company would want a tool with the least value for MTTD to detect anomalous behavior as fast as competitors' tools in the marketplace. Similarly, the best tool on the market would also offer the smallest MTTR. Further, a CSM tool with the least MTTD would reign as a top product on the market and create customer trust.

Meanwhile, to ensure scalability of the tool, the company will want clients to implement the CSM tool throughout their networks. Dependency is a powerful form of equity and clients who integrate the tool to the maximum-level possible of coverage for their networks will rely on the tool in the present and future.

In summary:

Risk Management Alignment:

Target: Achieve industry-leading Mean Time to Detect (MTTD) for all categories of security threats

Action: Invest in analytics and threat intelligence to reduce MTTD, update threat databases, and improve algorithms for prediction

Customer Trust Alignment:

Target: Establish a trust score that is above industry average

Action: Request feedback, offer transparent communication of security updates, and maintain best practices for incident response

Operational Efficiency Alignment:

Target: Reduce Mean Team to Respond (MTTR) to incidents

Action: Automate incident response and ensure integration with other operational tools to produce unified security

Scalability Alignment:

Target: Verify the CSM tool can support maximum endpoints on a network without performance degradation

Action: Design tool to interoperate with cloud environments, which can be validate with stress testing

Market Need Alignment:

Target: Capture a set percentage of the market within a specified period of time

Action: Conduct market research to compete on the product, utilize a competitive pricing strategy, and maintain active campaigns

Long-Term Objectives Support:

Target: Achieve sustainable growth to maintain a positive revenue stream

Action: Diversify the product's capabilities to keep up with emerging security threats and innovate with artificial intelligence to offer predictive capabilities

Positioning of Company vs Competition: FOM charts

The Continuous Security Monitoring (CSM) market is notably saturated with a plethora of one-off tools and emerging startups, each offering varied monitoring solutions. To refine our analysis, we will zero in on detection and our "company" will offer a tool for endpoint detection for continuous security monitoring. The CSM tool is critical to monitor end-user devices like desktops, laptops, and mobile devices from malicious activity.

In evaluating the competitive landscape of the CSM tool, we will focus on the Mean Time to Detect (MTTD) as a primary Figure of Merit (FOM) in our roadmap. However, given the challenges associated with collecting comparable MTTD data across various companies, due to the high dependency of MTTD on the specific environment and setup, we will pivot to utilizing Gartner’s Magic Quadrant analysis of Endpoint Protection tools. The Magic Quadrant uses criteria of Ability to Execute which includes Product/Service, Overall Viability, Sales Execution/Pricing, Market Responsiveness/Record, Marketing Execution, Customer Experience, and Operations plus Completeness of Vision which includes Marketing Understanding, Marketing Strategy, Sales Strategy, Offering (Product) Strategy, Business Model, Vertical/Industry Strategy, Innovation, and Geographic Strategy.

The above left is the the Magic Quadrants for Endpoint Protection Platforms in 2007. The right is the Magic Quadrant for endpoint protection platforms as of October 2022. The Magic Quadrant shows 18 providers placed in either the Leaders, Challengers, Visionaries or Niche Players. Providers are positioned based on ability to execute and completeness of vision.

An examination of the evolution within the Magic Quadrant from 2007 to 2022 reveals significant shifts. Initially, in 2007, Microsoft was positioned as a challenger but has ascended to the top leader spot in 2022. In contrast, CrowdStrike, another top leader in 2022, was not even listed in 2007. This raises the question of the strategic moves over those 15 years that have redefined the market standards.

Microsoft leveraged its existing market presence by integrating Network Access Protection into its widely used Windows operating system, synergizing endpoint protection with its suite of enterprise and consumer products. Microsoft’s strategy, coupled with the pervasive use of its platforms for essential services, facilitated the seamless adoption of its endpoint protection solutions.

CrowdStrike, on the other hand, has carved out its leadership through a dedicated focus on cybersecurity. As a specialized entity, it has been able to channel deep industry knowledge into the development of robust security products tailored to specific security needs. This focus has allowed it to distinguish itself and create products that resonate with the evolving demands of cybersecurity. The endpoint protection market itself has evolved from a collection of disparate software applications, such as antivirus programs, to more integrated solutions. Major platforms now commonly offer these protections as built-in features, both for consumer security and in tiered services for enterprise clients. The pricing strategies in this market vary, with some providers offering a flat fee up to a certain usage level followed by activity-based pricing, while others charged based on the scale of usage – such as the number of applications monitored, users, or endpoints.

Companies like CrowdStrike, with its Falcon tool, emphasize a security-centric portfolio, whereas Microsoft’s Defender is part of a broader software ecosystem. Observing the market through the lens of Gartner’s Magic Quadrant over time not only highlights the dynamic shifts in leadership positions, but also underscores the underlying technology strategies that have influenced these changes. Ultimately, the trend towards consolidation, seen in the acquisition of specialized startups by larger firms, suggests a movement towards coalescence in the market, reshaping the competitive landscape.

Our hypothetical "company" would compete more with CrowdStrike in its attempt to offer expertise solely in cybersecurity in order to produce the best CSM tool on the market, given that it's business model is more security-centric rather than a broad software ecosystem. However, key to recognize from the Magic Quadrant is that a leader dominates in this industry only if it scores highest in the following criteria: Ability to Execute which includes Product/Service, Overall Viability, Sales Execution/Pricing, Market Responsiveness/Record, Marketing Execution, Customer Experience, and Operations plus Completeness of Vision which includes Marketing Understanding, Marketing Strategy, Sales Strategy, Offering (Product) Strategy, Business Model, Vertical/Industry Strategy, Innovation, and Geographic Strategy; thus, the "company" must compete with ingenuity, quality, and expertise to challenge CrowdStrike.

Technical Model: Morphological Matrix & Tradespace

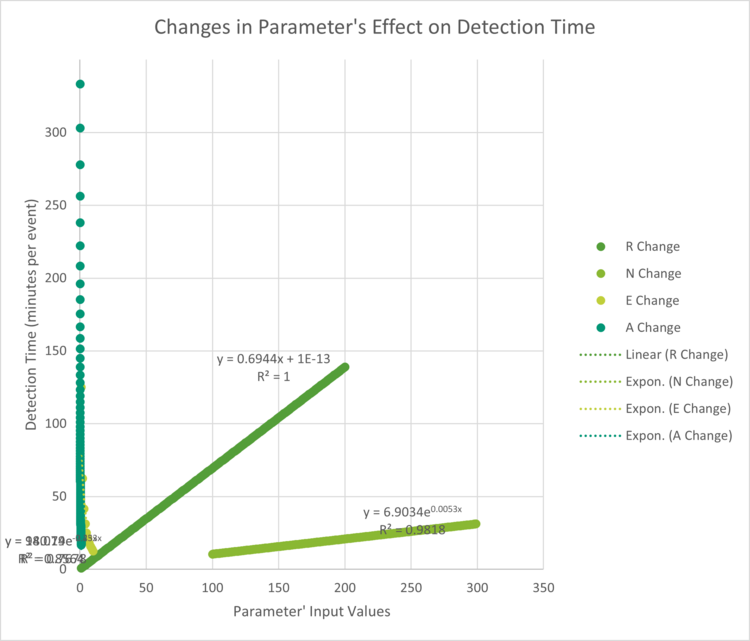

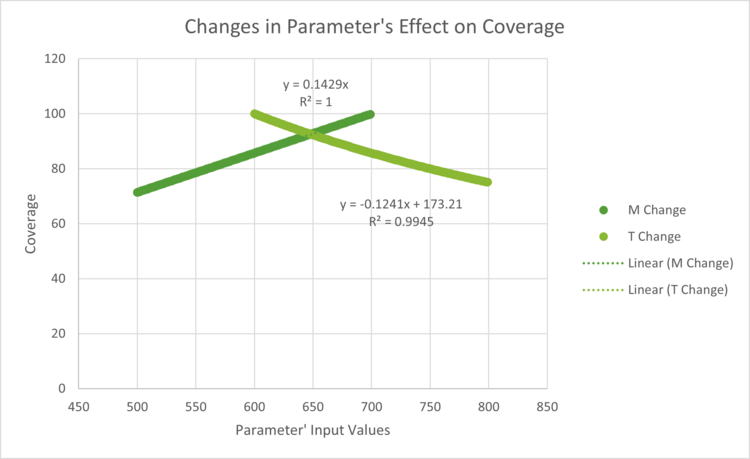

Of the variables in MTTD, only Incident Detect Time (also called Detection Time) is within a tooling’s control. The Number of Incidents and Incident Start Time is more often determined by external factors. For a baseline design, say we have an Incident that starts on one of our endpoints. Our tool scans every 30 minutes (R). Each scan has 600 network events (N). The efficiency (E) of data processing is the ability of the tool to quickly analyze those total network events to only the relevant ones. Efficiency is rated on a scale of 1-10 where 1 is the least efficient such as a human manually reviewing the network events for processing and 10 is the most efficient using a supercomputer for data processing. Our baseline design has an efficiency coefficient of 6, which equates to a modern cloud processing engine but it is not fully optimized. Accuracy (A) is the measurement of how likely the identified relevant events are true security incidents vs false negatives or false positives. Our baseline design has an 80% accuracy. For the baseline design, what is the likely time passed from incident start until detection (IDetect)? 62.5 minutes per event. Changes in the parameters and their effect on Detection Time is below.

While this can help us find theoretical optimizations within technical constraints limit, it does not consider business related impacts and decisions. For example, a high Efficiency of 10 would require a supercomputer and the average companies and CSM tools cannot afford that at this time. Likewise scanning every minute improves the Rate of scanning and thereby the Detection Time, but scanning every minute is not always feasible cost wise because scanning that much generates a lot of unnecessary data, slows performance overall of the system, and increases the cost since CSM tools sometimes cost by scan or network activity. Because of these business costs, customers must make judgment calls on their own risk to cost benefit of decreasing the Rate or increasing the Efficiency. The Detection Time can also only be on parts of the customer’s system that is monitored. Coverage is an FOM that measures the percentage of the network system that is monitored by a tool vs total activities within the system.

If we extend the baseline design from the MTTD, the 600 events for N for Number of network activities becomes the Monitored Activities in the Coverage governing equation. We will assume a baseline design where Total Activities in the System is 700. This design has a coverage of 85.7%.

Similar to the Detection Time, the governing equations and optimizations for Coverage do not take into account the business impact of these inputs. For example, the least risky Coverage would be to have 100% of all activities within the system. This is not always feasible due to cost constraints or data processing, similar to the constraints on Number of Network Activities in Detection time. Companies may also define coverage differently whether they are accounting for coverage of open-source or third-party connections. Companies that use third-party tooling might assume that the tool company has complete coverage within their system, which is an assumption of risk. Customers need to make their own judgement call of cost to risk when determining the leverage of coverage required in their system.

Key Publications and Patents

Upon searching for “Security Monitoring Tools” in Google patents, the Chinese patent CN108449345B ^1 was the first search result and presented a distinctive approach to safeguarding network assets. The method specializes in the continuous safety monitoring of shadow assets on internet platforms. It conducts comparisons between the current state of shadow assets and historical data to emphasize the transition the assets undergo. The comparative analysis is instrumental to highlight potential differences between previously documented security threats and those that are actively monitored. Such insight is crucial to detect emerging vulnerabilities or breaches.

The next result from the same search terms yielded the Korean patent CN107493265B ^2, which merges big data analytics and artificial intelligence (AI) to create a proactive defense mechanism against continuous cyber-attacks. The patent offers real-time response capability for a Continuous Security Monitoring (CSM) tool by allowing a system to not only be equipped to identify threats as they occur, but to also learn from incidents and better prepare for future attacks. Thus, the inclusion of AI creates an adaptive security posture, which is critical to the cybersecurity landscape in which threats evolve rapidly. The big data analytics also enhances the tool’s ability to process vast amounts of network data and identify patterns and anomalies that could signal an impending attack. The holistic view provided by AI can reduce the time to detect and respond, which can minimize potential damage from security incidents. CN107493265B follows CN108449345B in how they both afford real-time monitoring and analysis, yet the Korean patent adds the dimension of big data and AI to provide predictive security.

A second Chinese patent emerged from the results, CN107493265B ^3, which supports a security monitoring method for industrial control systems (ICS). The method monitors internally, performs a safety analysis, and generates associated safety management if abnormal behavior is found to block the abnormal behavior. This patent is prioritized third because while industrial control systems are crucial to cybersecurity, the area is niche. Nevertheless, the value in the patent lies in its potential to secure environments that are not only data-centric but also operationally critical, such as power grids, water treatment facilities, and manufacturing plants. The patent also builds on the two priors in that they all offer real-time monitoring capabilities, thus building off one another.

Thus, the prioritization of the patents reflects a progression from general network asset monitoring to the integration of AI and big data for advanced threat detection and then to specialized applications for industrial control systems. Each step builds upon the foundation, reflecting how the technologies evolve from basic monitoring to sophisticated, predictive tools tailored to specific environments.

Publications have also influenced the development of Continuous Security Monitoring Tools. A collaborative search with an MIT librarian identified the 2021 paper, “Leveraging Information Security Continuous Monitoring to Enhance Cybersecurity,i” which exemplifies the role of CSM tools to establish data-driven risk management by offering near-real-time cyber situational awareness. The paper is aligned with our technology roadmap because of its recognition of the impact of CSM tools through its advocacy that federal government agencies adopt the technology. The authors highlight the tool’s ability to integrate massive amounts of diverse data from different sources and construct a comprehensive view of the agency’s security posture. The second result from the search for Continuous Security Monitoring Tools in the MIT Libraries database was “APIRO, a Framework for Automated Security Tools API Recommendation ii,” highlighting how CSM tools can be integrated into Security Operation Centers (SOCs) to constantly scan, detect, and respond to cybersecurity threats. The authors recommend the most suitable APIs for integration to accelerate operational activities to ensure that a detected threat is addressed within a SOC. The paper is relevant to the scope of CSM tools because it encompasses the process of selecting and integrating the appropriate tools, which is a foundation step for effective continuous monitoring. The third paper, “Monitoring for Security Intrusion Using Performance Signatures iii,” introduces an innovative approach to detect security breaches by examining performance signatures, which are unique patterns indicative of a system’s operational state. The finding is that a deviation from the performance signature can be flagged as a potential security incident and would then be compared to known patterns of attack. The paper is third in the list of priority because it is more specialized in the detection phase of continuous monitoring.

i: https://ieeexplore.ieee.org/document/9799002

ii: https://dl-acm-org.libproxy.mit.edu/doi/10.1145/3512768

iii: https://dl-acm-org.libproxy.mit.edu/doi/10.1145/1712605.1712623

References

[1] Cybersecurity Ventures. 2020. History of hacking and defenses. Retrieved from https://cybersecurityventures.com/the-history-of-cybercrime-and-cybersecurity-1940-2020/

[2] Statista. 2023. Median time from compromise to discovery in days of larger organizations worldwide from 2014 to 2019. Retrieved from https://www.statista.com/statistics/221406/time-between-initial-compromise-and-discovery-of-larger-organizations/

[3] Gartner. 2023. List of Critical Capabilities for Cloud Access Security Brokers. Retrieved from https://www.gartner.com/document/4366499?ref=solrAll&refval=381285986&qid=

[4] Oberheide, J., & Cooke, E. 2008. CloudAV: N-Version Antivirus in the Network Cloud. Retrieved from https://www.semanticscholar.org/paper/CloudAV%3A-N-Version-Antivirus-in-the-Network-Cloud-Oberheide-Cooke/1ca0b25bd4fe4994f7f5e334987588776a1a123c

[5] Secureworks. 2017. The Evolution of Intrusion Detection & Prevention. Retrieved from https://www.secureworks.com/blog/the-evolution-of-intrusion-detection-prevention

[6] ISACA. 2021. The Evolution of Security Operations and Strategies for Building an Effective SOC. ISACA Journal, 5. Retrieved from https://www.isaca.org/resources/isaca-journal/issues/2021/volume-5/the-evolution-of-security-operations-and-strategies-for-building-an-effective-soc

[7] Pure Storage. 2023. What is SOAR? Retrieved from https://www.purestorage.com/knowledge/what-is-soar.html

[8] Brand Essence Research. 2023. Security Orchestration, Automation and Response Market. Retrieved from https://brandessenceresearch.com/security/security-orchestration-automation-and-response-market

[9] CrowdStrike. 2023. Falcon Insight XDR. Retrieved from https://www.crowdstrike.com/products/endpoint-security/falcon-insight-xdr/

[10] CrowdStrike. 2023. CrowdStrike Announces General Availability of Falcon XDR. Retrieved from https://www.crowdstrike.com/press-releases/crowdstrike-announces-general-availability-of-falcon-xdr/