Inventory Management System

Technology Roadmap

Roadmap Overview

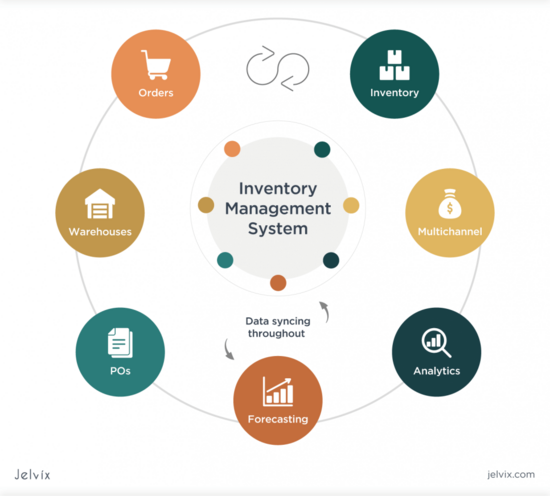

Inventory management system is a critical component of business operations' supply chain management that ensures efficient flows of materials and products from vendors to customers. .

Key Goals of the SCM – inventory management system are:

- Providing timely, complete, and accurate inventory levels to managements

- Minimizing carrying costs while ensuring product availability.

- Reducing stockouts and overstock situations.

- Enhancing supply chain visibility and responsiveness.

- Streamlining operations and reducing inefficiencies.

- Lowering costs while maintaining service levels.

- Meeting customer demand accurately and on time.

- Adapting to changes in demand, supply, and market conditions.

Effective management systems provide the right products at the right time and place to meet growing customer demand. It is a critical aspect of modern business operations and plays a crucial role in achieving profitability and customer satisfaction.

*image-source - https://jelvix.com/blog/automated-inventory-management-system

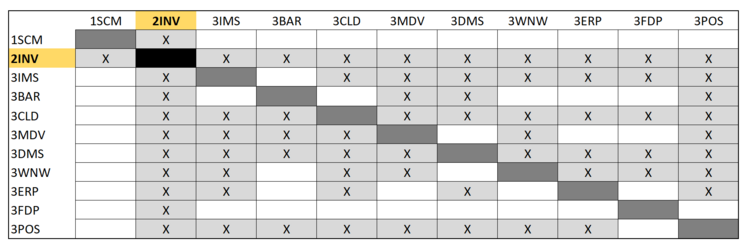

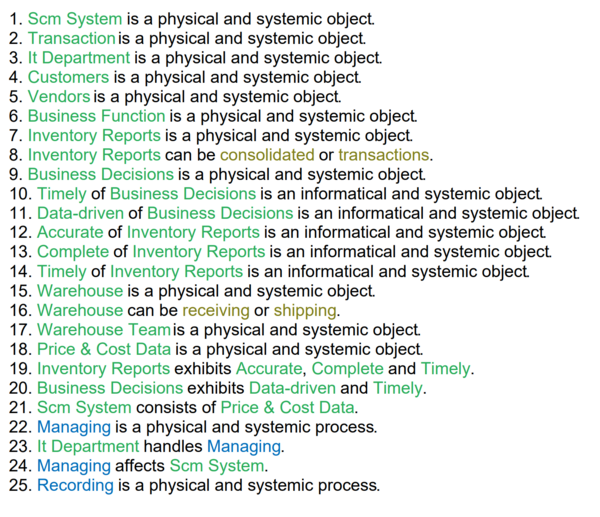

Design Structure Matrix (DSM) Allocation

DSM of the Inventory Management System:

The tree structure of the Inventory Management System.

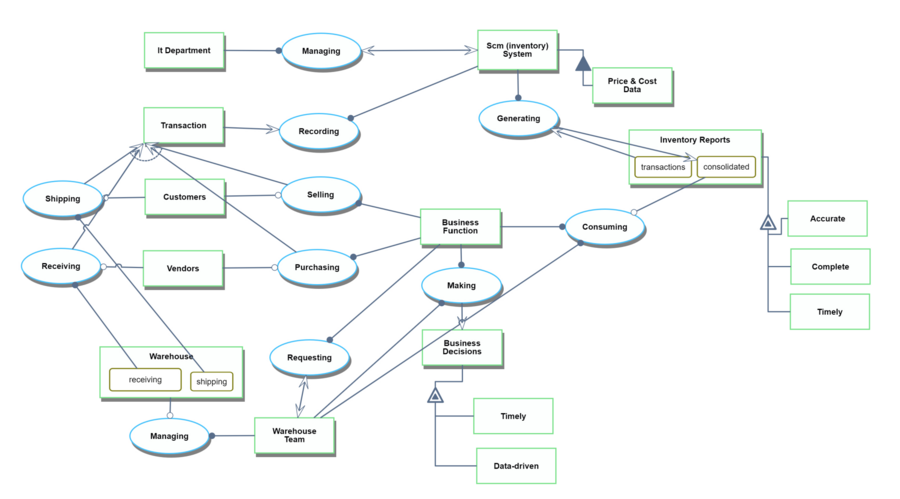

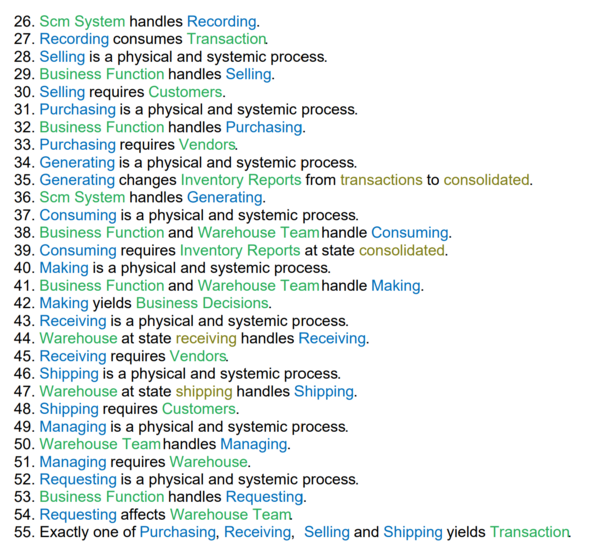

Object Process Model (OPM)

This OPM represents the Inventory Management System:

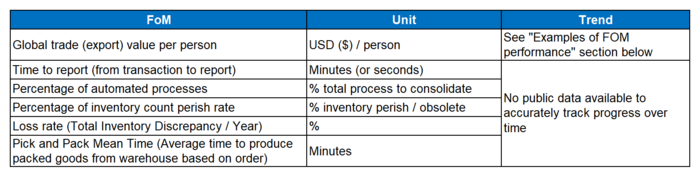

Figures of Merit (FoM)

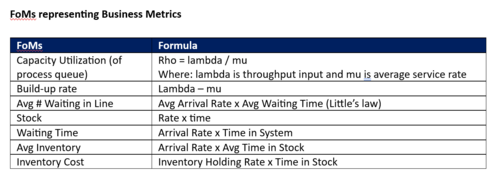

The table below show a list of FOMs by which can assess an Inventory Management System technology:

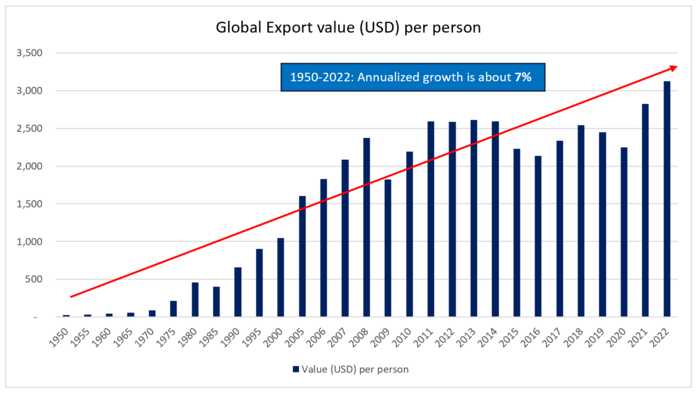

Examples of FOM performance

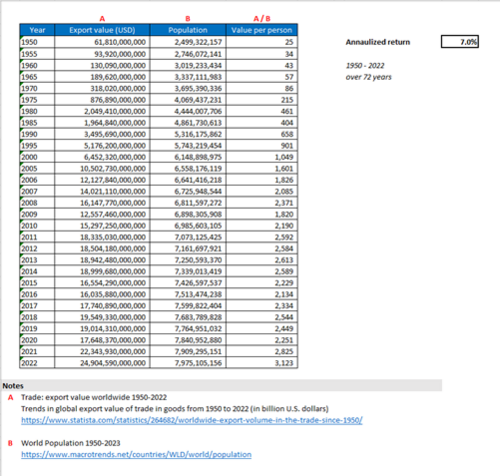

Over the last 52 years, inventory management system was improved by about 7% annualized growth based on the FoM trend indicated below:

This is an indirect approach to track technological progress as there is only limited data available related to inventory variances, time to report, % automation, etc. This information is company specific and not generally publicly available. As such, we selected the Total trade (export) value (in USD) per person with two assumptions: (1) all reported “Trade (export) value” were processed and consolidated using supply chain management systems – included in the figure means that the transactions were recorded and processed; and (2) improvements in the system can be represented with fewer resources (people) needed to process and consolidate the same amount of data. Said differently, technological progress and rate of improvement can be supported by one person processing more transaction volumes. Note that year-over-year export values can be influenced by various economic statuses.

Company Strategic Objectives

Historically, FOMs of Inventory Management Systems were constrained by and therefore packaged with hardware components and their interconnectivity. Transaction storage, responsiveness of reports, and data access times mostly depended on the infrastructure platform it was being run. However, as cloud technologies have become the norm, wherein enterprise IMS systems now run off IaaS offerings and SMB IMS systems run as SaaS, hardware constraints have become virtually unlimited. Even with billions of records, Big Data platforms now exist that enable IMS reporting to be extremely capable. Because of this, FOMs for IMS have become business-centric instead of technology-centric.

From an investment perspective, financial considerations focus on the Total Cost of Ownership (TCO) FoM, which could be decomposed into: license costs, deployment costs, servicing costs, support costs, training costs. TCO is often mapped at a 5-15 time horizon.

From an operational perspective, FoMs center around efficiency improvements enabled by the IMS. Such as “Time to process” wherein existing systems are compared to new proposed systems where they measure how much time it will take a processor (end-user) to complete the same process on the two systems. These processing efficiencies can be decomposed with standard queue analytics such as the ones below:

| Strategic Objective | Alignment and Targets |

|---|---|

| To develop a real-time cross-location inventory state management to make more timely business decisions. | We are targeting real-time inventory visibility and management across all branches with an SLO-driven response time of < 1 second. This visibility and control should be available from HQ to branch and branch to branch with proper management and permissions using an Identity Access Management system (IAM). |

| To develop a stock flow management module with the ability to visualize historical and forecasted stock movements for more data-driven decisions. | Visibility and proactive pattern management of stock flow from warehouses, distribution centers, and branches. With improved IMS pattern recognition, we aim to lower cost of overage and underage of stock by 5% to give a return on switching costs. |

| To enable our system to perform predictive analysis of our stock cycles to minimize holding and landed costs. | Lower holding and landed costs of products by 2% based on branch-level stock cycle monitoring as opposed to current-state consolidated stock cycle monitoring. |

| To enable our system to timely identify correlation on stock demands and outages of complementary products to prevent stock shortage. | Identify correlation on stock demand and stock outages of complementary products with at least 60% accuracy.

|

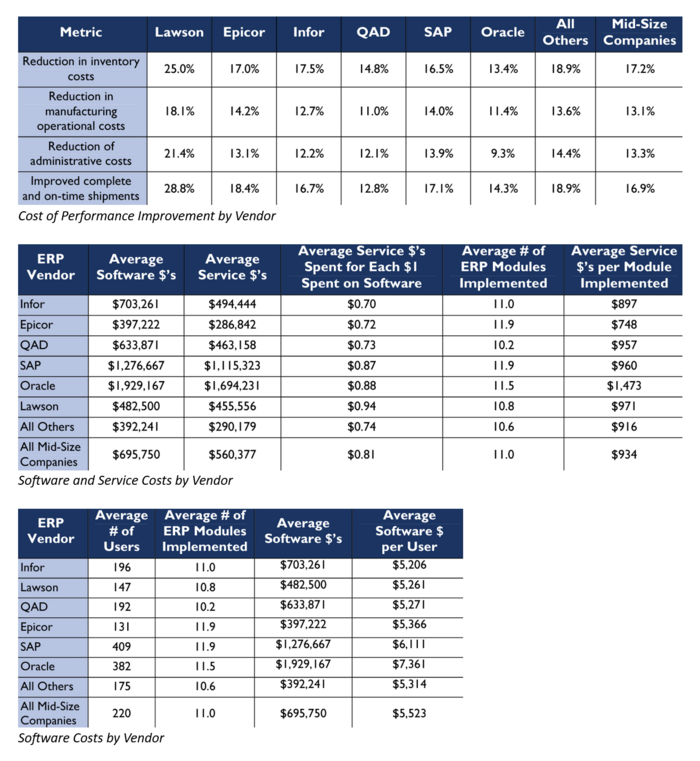

Positioning of Company vs. Competition

As mentioned above, FoMs that businesses look at when purchasing an IMS are not dependent on the raw technical capability of the technology but on it’s net impact in driving business metrics for the company’s operations. Such impact is measured in terms of queue and inventory analytics for operations and metrics for finance. Below are samples of such metrics measured in order to compare and contrast the competitive landscape of ERP IMS systems.

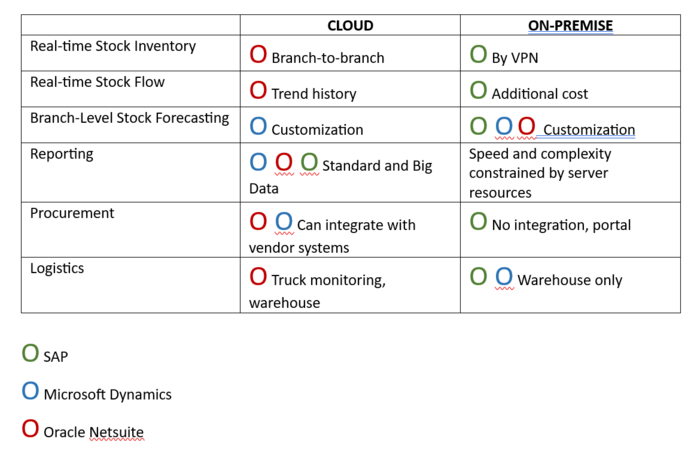

Technical model

The following morphological model shows two primary options businesses face when implementing inventory management systems: cloud vs on-premise.

Selecting the top 3 ERPs with Inventory Management Systems, we compared critical functionalities that customers need today from these IMS which not involve not just stock monitoring but stock flow management and forecasting. These functionalities are very dependent on connectivity, which we highlighted as a critical technological constraint above.

We also showed the implementation and alternatives needed to implement such features based on cloud vs on-premise.

Financial model

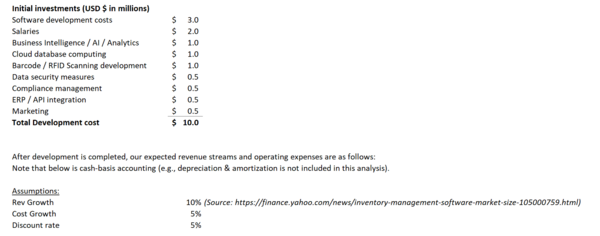

For developing a new "Inventory Management System (IMS)", the development cost of $10MM will be spent in the first year to the following areas. Please note that the $ amounts herein are NPV demonstrative purpose only as there is a wide range of IMS's with limited public information available.

Assumptions

- Investment:

- US$10m investment and 24-month build period is benchmarked against the cost of conceptualizing, building and launching a platform business within a bank.

- Revenue:

- A fixed transaction facilitation and data processing fee of US$0.99 (sales cost) per transaction.

- Currently payment processors take a fixed fee and/or % of transaction value.

- Benchmarked against various payment platforms (Cybersource, Paypal, Venmo).

- Growth is relevant to number of states/countries, users, and growth of transactions per user. Different ramp-up targets and constraints include:

- Launch in a new state/country every month until we have a presence in 200 states / countries.

- 1st day transaction processing starts with 584 transactions per day, and this is to grow by 1% per month within each state / country.

- Maximum transactions per state/country is capped at 100,000 transactions per day.

- A fixed transaction facilitation and data processing fee of US$0.99 (sales cost) per transaction.

- Costs:

- Bank fees of 5.00% per transaction.

- Sales tax at 6.25%.

- Variable costs related to IT infrastructure where 3rd party cloud infrastructure to be used. Costs of additional infrastructure per transaction is fixed and can be directly passed onto these providers ($0.25 per transaction).

- Expenses related to salaried employees, equipment, office space, travel allowance to see clients.

- 1% of Revenue pa to be spend on Research & Development.

- Discount rate:

- The discount rate is the Required rate of return (12%).

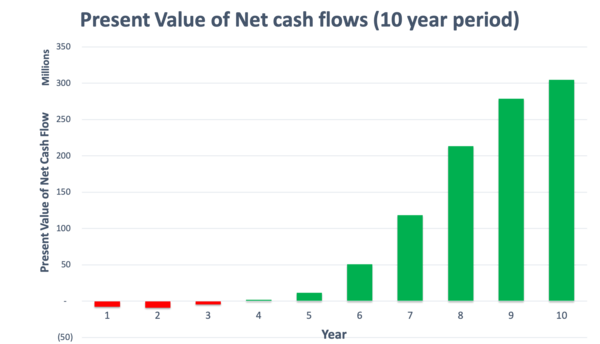

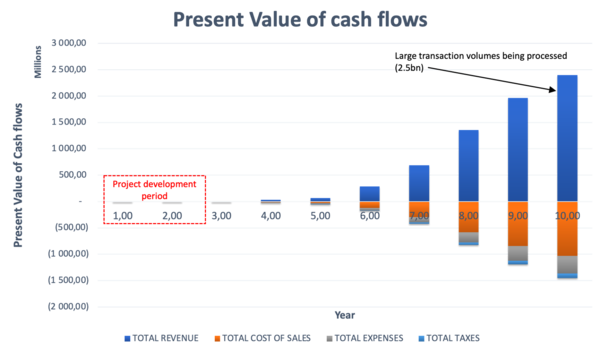

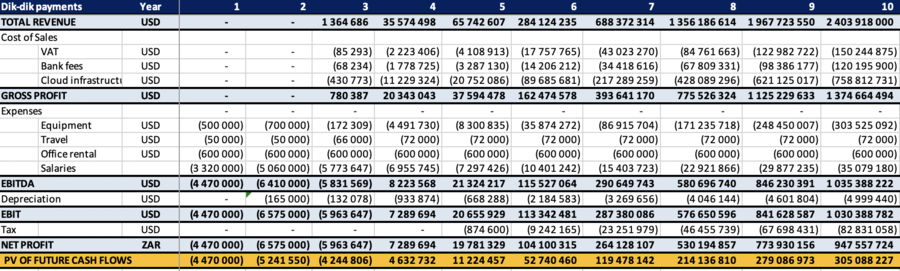

Cash flow models

The figure below contains a NPV analysis underlying the Retail Payment system roadmap.

After 10-years, this still represents less than 5% expected of the US market size and we expect growth will continue. We believe the exponential growth nature of this curve will last longer than the period highlighted here as the trend towards digital payments (opposed to physical cash and cheque payments) will continue to accelerate.

Annual Profit & Loss statement

The annual forecasted profit & loss statement is as follow:

R&D Projects

The R&D projects their anticipated FOM impact, feasibility, cost estimates and Net Benefit (NB) values are:

| # | Project Name | Value of Transactions | Number of Transactions | ML Accuracy | Cost per transaction | Transaction settlement period | System downtime | Payment conversion rate | Fraud prevention | Feasibility | Project Cost ($m) | NB per dollar |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Fed Interbank infrastructure | +0.27% | +0.27% | < 30 minutes | 95% | $1,400 | $8.94 | |||||

| 2 | APIs | +0.5% | +0.5% | -0.5% | 80% | $7 | $8.14 | |||||

| 3 | Advanced AML/CTF monitoring | +0.01% | +0.01% | -1% | 80% | $8 | $7.64 | |||||

| 4 | Biometric authentication | +0.25% | +0.25% | -3% | 90% | $8 | $4.66 | |||||

| 5 | Red team | +0.01% | +0.01% | +2.5% | 85% | $1 | $3.60 | |||||

| 6 | Voice authentication | +0.25% | +0.25% | -3% | 80% | $10.5 | $2.86 | |||||

| 7 | Digital risk management | -0.5% | -4% | 75% | $20 | $1.25 | ||||||

| 8 | Advanced fraud monitoring | -10% | -0.1% | < 30 minutes | 80% | $8.5 | $0.92 | |||||

| 9 | Block chain | +0.27% | +0.27% | -5% | < 30 minutes | 10% | $3,000 | ($0.49) | ||||

| 10 | Face authentication | +0.1% | +0.1% | -1% | 30% | $15 | ($0.96) |

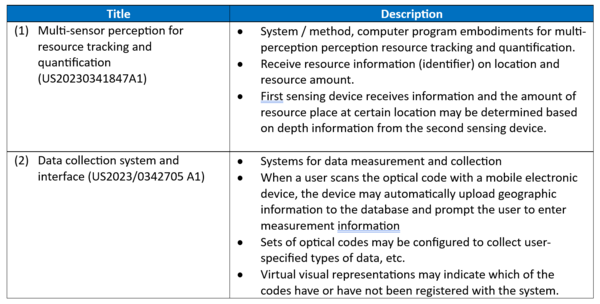

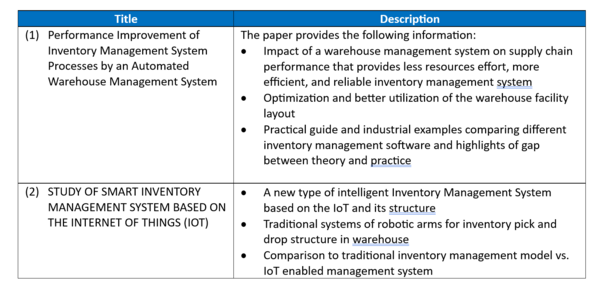

Patents and papers

As inventory management system is a vital part of today’s supply chain management, there are vast number of publications and patents available: Extensive information is available pertaining to "payment systems":

- 100,000+ “Inventory Management” results from Google Patents

- 200,000+ “Inventory Management System” results from Google Scholar

Examples of patents:

Source:

- (1) https://image-ppubs.uspto.gov/dirsearch-public/print/downloadPdf/20230341847

- (2) https://image-ppubs.uspto.gov/dirsearch-public/print/downloadPdf/20230342705

Examples of papers:

Source:

- (1) https://www.sciencedirect.com/science/article/pii/S2212827115012019

- (2) https://ejournal.lucp.net/index.php/ijrtbt/article/view/749

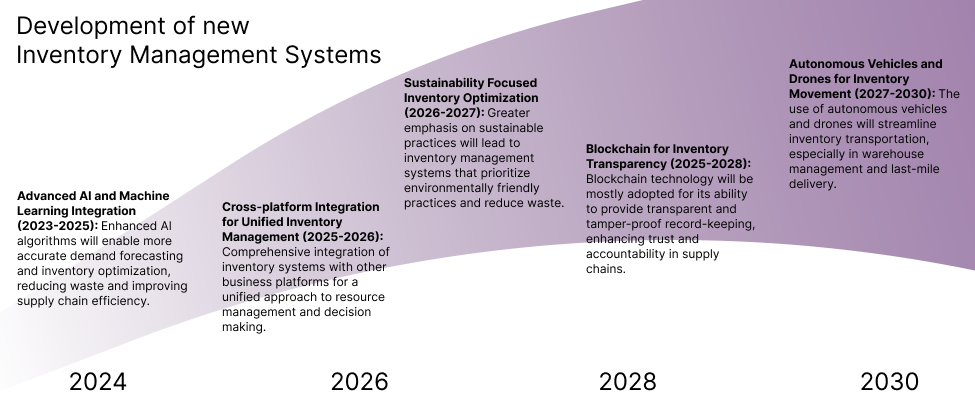

Technology Strategy Statement

Inventory management systems will continue to evolve by integrating business technology advancements into their ecosystem of functionality. We project that IMS manufacturers will be more closely adopting newer versions of their software to better integrate with AI, Blockchain, and Autonomous Vehicles and Drones. Better integration with ERP systems will enable more ubiquitous inventory management across different systems and channels. Also, a drive in supply chain resiliency, efficiency, and sustainability will change how inventory systems operate as newer and better best practices are developed by management and supply chain researchers.

Projected development of inventory management systems strategies from 2023 to 2030.