Retail Payment system

Technology Roadmap

Roadmap Overview

The U.S. financial system processes millions of transactions each day to facilitate purchases and payments. In general terms, a payment system consists of the means for transferring money between suppliers and users of funds through the use of cash substitutes, such as checks, drafts, and electronic funds transfers.

A payment system is a system exhanges / tradess value changing the ownership of money. It consists of a set of instruments, banking procedures, and, typically, interbank funds transfer systems that ensure the circulation of money. These systems allow for the processing and completion of financial transactions.

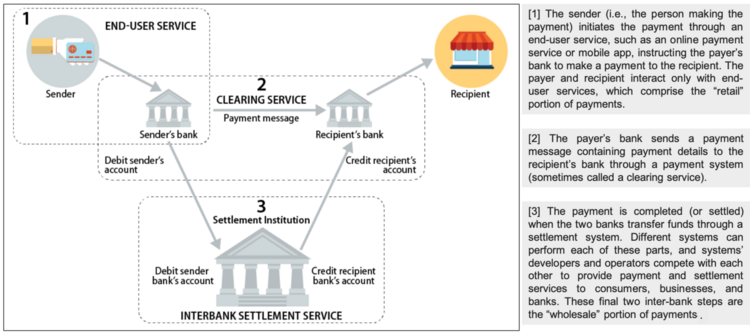

From the typical consumer’s perspective, making a payment is simple. A person swipes a card, clicks a button, or taps a mobile device and the payment is approved within seconds. However, the infrastructure and technology underlying the payment systems are substantial and complex. To simplify, a payment system has three parts (see Figure below).

Design Structure Matrix (DSM) Allocation

The DSM of retail payment system provided by banks is depicted in the image below.

Object Process Model (OPM)

The OPM diagram captures the main object of the roadmap, its decomposition into systems (squares), as well as the main processes (ovals).

Figures of Merit (FOM)

The table below show a list of FOMs by which satellite data communication can be assessed.

| Merit | Figure of Merit | Units |

|---|---|---|

| Utilization | Value of transactions processed per annum | US$ |

| Capacity | Number of transactions processed per annum | # |

| Efficiency | Average cost per transaction | US cents |

| Transaction settlement period | Seconds | |

| Reliability | System downtime per year | Seconds |

| Payment conversion rate | % | |

| Safety | Fraud rate | % |