WorldWide eVTOL

Technology Roadmap Sections and Deliverables

- 2EVL Eletric Vertical take off and Landing

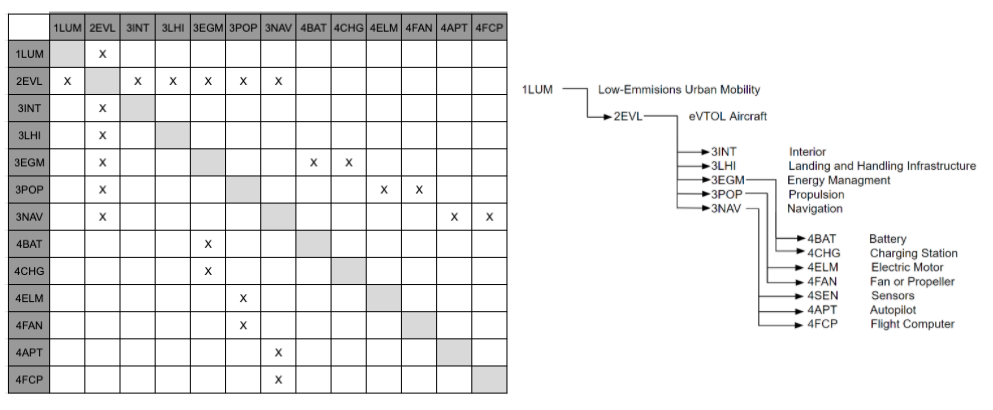

This indicates that we are dealing with a “level 2” roadmap at the product level (see Fig. 8-5), where “level 1” is a market level roadmap 1LUM (Low emissions Urban air Mobility)and “level 3” or “level 4” would indicate the specific technologies like vectored thrust, autonomous flight, electric propulsion etc.

Roadmap Overview

Enter description of the technology here:

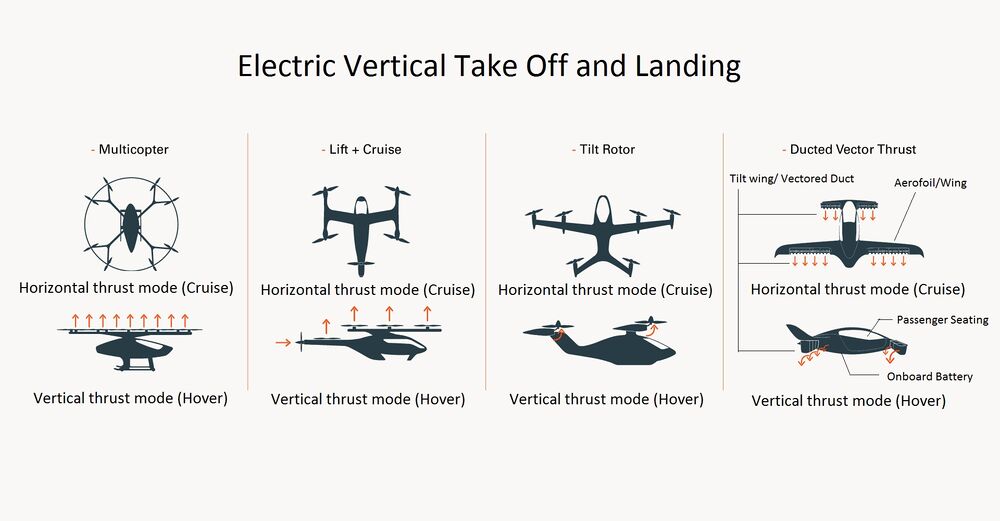

eVTOLS (electric Vehicle Take Off and Landing) are airborne vehicles that use electric vectored thrust to take off vertically and transition from vertical thrust to horizontal thrust, thus making it flexible and efficient for Urban air commute. <ref>https://en.wikipedia.org/wiki/EVTOL</ref> The vectored thrust eVTOLs have a wing for an efficient cruise and use the same propulsion system for both hover and cruise. They are conceptually simple but difficult and risky to control. The tail-sitters rotate the entire aircraft. They are conceptually simple but difficult and risky to control. The Harrier configuration is called vectored thrust because it can orientate mechanically the direction of the thrust. The tilt-wings rotate the entire wing, the engines and the propellers as a single piece. Rotating the wing in hover avoids the impinging of the propeller slipstream on it, a problem that reduces the thrust in the hover of tiltrotors. The lift produced by the wing is augmented, at high angles of attack, by the blowing effect of the propellers. Autonomous eVTOLs are more versatile and can be efficiently used to transport passengers and cargo without any human intervention yet are often available as optionally pilotable. <ref>Electric VTOL Configurations Comparison by Alessandro Bacchini</ref>

<ref>Lilliumjet, architecture design principles</ref>

Design Structure Matrix (DSM) Allocation

The 2-EVL tree that we can extract from the DSM above shows us that the eVTOL (2EVL) is a solution to larger more fuel efficient methods of urban mobility (1LUM), and requires the following major subsystems: 3INT Interior, 3LHI Landing and Handling Infrastructure, 3EGM Energy Management, 3POP Propulsion, and 3NAV Navigation. These require the following level four component technologies: 4BAT Battery, 4CHG Charging Station, 4ELM Electric Motor, 4FAN Fan or Propeller, 4SEN Sensors, 4APT Auto-pilot and 4FCP Flight Computer.

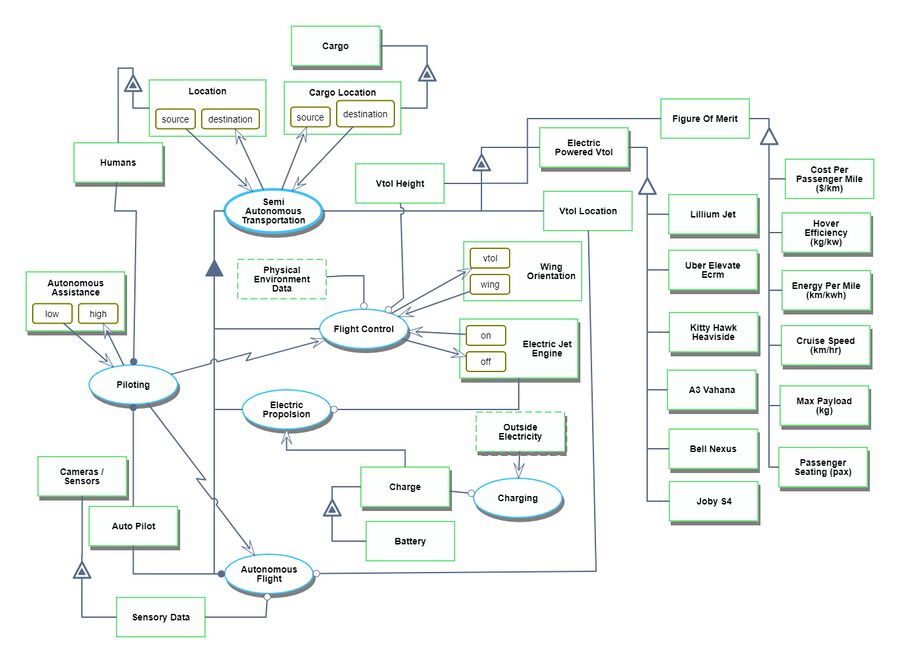

Roadmap Model using OPM

We provide an Object-Process-Diagram (OPD) of the 2EVL roadmap in the figure below. This diagram captures the main object of the roadmap (eVTOL), its various instances including main competitors, its decomposition into subsystems (wing, flight-control, autonomous control, electric propulsion), its characterization by Figures of Merit (FOMs) as well as the main processes (hovering, wing tilt).

An Object-Process-Language (OPL) description of the roadmap scope is auto-generated and given below. It reflects the same content as the previous figure, but in a formal natural language.

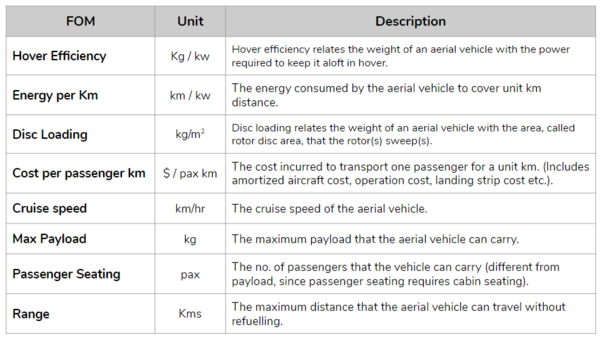

Figures of Merit

The table below show a list of FOMs by which electric VTOL can be assessed. The first two and the last two are used to assess the aircraft itself. They are very similar to the FOMs that are used to compare traditional aircraft which are propelled by fossil fuels, the big difference being that 2EVL is essentially emissions free during flight operations. The other rows represent subordinated FOMs which impact the performance and cost of eVTOL but are provided as outputs (primary FOMs) from lower level roadmaps at level 3 or level 4, see the DSM above.

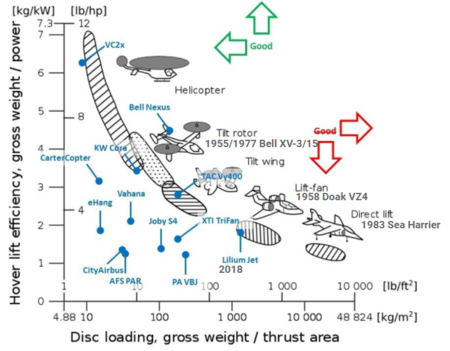

<ref>Back to the Future: A rough comparison of 70s VTOL concepts to current eVTOL designs - Mykhaylo Filipenko</ref>

<ref>Back to the Future: A rough comparison of 70s VTOL concepts to current eVTOL designs - Mykhaylo Filipenko</ref>

Alignment with Company Strategic Drivers

Strategic drivers Description goes here

| Number | Strategic Drivers | Alignment targets |

|---|---|---|

| 1 | To develop hover and cruise configurations to lower the net cost to the passenger for intercity flights in a limited service radius. The design of the eVTOL itself should enable reduced CAPEX costs and OPEX costs for a flight over a limited radius. The current air transportation modes either result in high CAPEX (Airports) or high OPEX (Helicopters, multirotors) that drive the cost up. | This roadmap will target the technology selection that would address the need for high hover efficiency for take-off and landing and high cruise efficiency for covering higher distances. The state of the art technology of tilt rotors and tilt wing aircrafts seem to enable the use of a common propulsion system for hover and cruise, leveraging the best of both aircrafts and rotorcraft(conventional). This roadmap evaluates various configurations of eVTOLs and this driver is aligned with this roadmap. |

| 2 | To target higher PAX capacities while keeping a balance with a decent range to enable cost effective transportation to surrounding cities, making the hub & spoke transportation model a reality. Efficient propulsion systems would increase the efficiency of the eVTOL creating room for more passengers or higher ranges. | The development of the Li-ion batteries with higher energy density is crucial to increased payload capacity of eVTOLs. THe Li-ion energy density has tripled since 2010 to 300Wh/Kg. To achieve a long range flight, a target of 500Wh/Kg is expected by 2025. The weight of the eVTOL itself plays a major role in this. Use of lighter materials like aluminum and carbon fiber are expected for the construction of the eVTOL. This driver is in alignment of the 2EVL roadmap |

| 3 | To develop low noise hover systems with lower disc loading in order to allow for the eVTOL to take off from various landing ports in urban areas. THe reduced noise and disc loading will enable the construction of compact landing pads in buildings or courtyard without disrupting normal urban life. | The discloading of the aircraft severely impacts the noise level generated by the hover. The harrier jet generates 125 dB of noise when hovering at 100ft, whereas helicopters generate 108 dB at ground level. Reduction of these to 78 dB is required in order to achieve the desirable noise level. This driver is currently not aligned with the eVTOLs. |

Positioning of Company vs. Competition

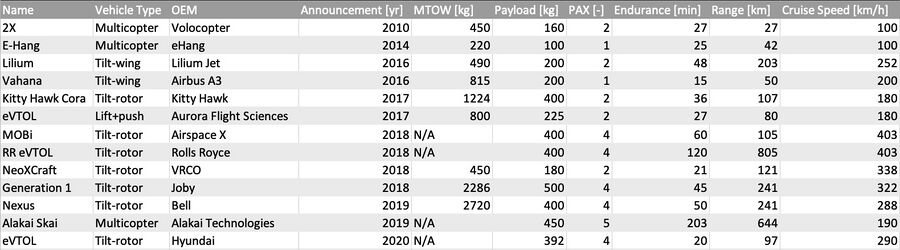

The table below contains publicly available high level specification data for the key e-VTOL aircraft designs currently in the R&D, prototyping or production technology developmental phases.

It is worth noting here that this table contains data for a variety of e-VTOL flight configurations. Each configuration has its pros and cons and the industry has not yet converged to an optimal configuration yet. Multicopter aircraft are typically designed to serve short-haul intra-city demand whilst tilt-wing, tilt-rotor and lift+push configurations achieve efficiency in cruise flight and therefore typically serve inter-city demand. Not all of these aircraft are in at the prototyping or production stages; some still remain conceptual. Performance specifications from such designs are subject to change in the future.

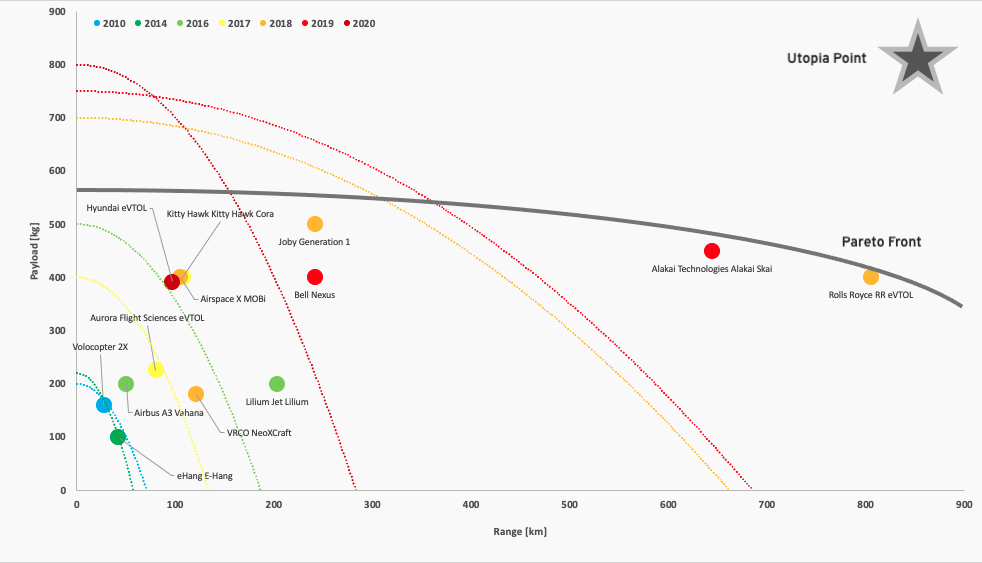

This figure highlights the trade-off that exists between flight range [km] and max payload capacity [kg] and presence of a pareto front that pushes to the top right of the chart. With e-VTOLs first making headlines in 2010 with the e-Hang announcement, players have adopted different methods to move closer to the utopia point. This chart is somewhat skewed by Alakai Technologies' Alakai Skai and Rolls Royce's e-VTOL aircraft. Both are still conceptual designs with to-market strategies in the late 2020's and early 2030's. Both promise exceptional range and PAX capacity with substantially larger aircraft airframes than what is currently seen on the market today. Alakai Skai is also unique in that it is the only e-VTOL with a hydrogen-powered fuel plant, a technology that underpins their bullish performance metrics.

Both Volocopter and e-Hang are focused on the intra-city short-haul transportation market whilst players such as Lilium and Joby are more focused on inter-city operations. In the early 2010's, we see a focus on range over PAX capacity in an effort to dissolve doubts around operational feasibility. With that said, more recent e-VTOL designs sport large PAX capacities for similar or more range, signaling a shift from technological development and R&D focused on core performance parameters such as range to more operational considerations such as PAX capacity. This industry has not yet seen any notable consolidation efforts in part because it remains a nascent industry without any realized demand. With that said, as certification processes begin to hinder to-market strategies, consolidation may occur between players with compatible technology or operational synergies. Furthermore, whilst the market is crowded with feasible e-VTOL designs, competition is not necessarily fully realized in as the industry grows as players will likely benefit from co-existence. We can expect to see synergies between direct competitors with regards to certification processes, driving customer and public acceptance and any infrastructure-related investment that is required at the industry level.