Autonomous ElectricVTOL Transport Aircraft

Roadmap Creators: Allison Tsay, Conor Briggi, Johannes Galatsanos

Time Stamp: 4 December 2023

Autonomous Electric Vertical Take-off and Landing (eVTOL) Transport Aircraft

Roadmap Overview

Autonomous Electric Vertical Take-off and Landing (eVTOL) Transport Aircraft are a wide category of unpiloted, electrically powered aircraft for the purpose of transporting goods or organisms. They may fall under the Cargo Air Vehicle (CAV) or Passenger Air Vehicle (PAV) categories. The aircraft have relatively small footprints and are well suited for navigation in urban environments. They are currently in development by various companies ranging from traditional aerospace companies (Airbus and Boeing) to new competitors from different backgrounds (Amazon to Rolls-Royce) and widely believed to have a huge impact on the future of mobility. While individual components of the technology are well developed, the focus here is the assembly and integration of autonomy, which requires increased efficiency, increased reliability, improved infrastructure, and significant cost reductions from the current state.

Image Source: https://wisk.aero/aircraft/

DSM Allocation

This would be related to the following existing roadmaps: 2SEA, 2BEV, 2SPA, 2EVL, 3ESB, 3BAS.

The 2-AETA tree from the DSM shows it as a subste of autonomous urban transportation (1AUT). It consists of various major subsystems, including airframe (3AF), avionics (3AVC), mechanical controls (3MFC), and the propulsion system (3PS). Those subsystems require various component level technologies, including lift surface (4LS), communication system (4CS), sensors (4SRS), software (4SW), electric motor (4EM), propeller (4PRP), and battery (4BAT).

Roadmap Model using OPM

Figures of Merit (FOM)

Battery Energy Density FOM

We estimate that electric battery technology is currently slowing and nearing the stagnation point. Based on the current achievable energy densities of Li-ion batteries, we are at or near the theoretical limit unless there is a major breakthrough in solid-state technologies or non-conventional oxide chemistries. The maximum theoretical specific energy density for a max 4.2V battery is estimated to be between 380-460 Wh / kg. Current understanding of technology has the densest lithium-ion batteries generally hovering below 300 Watt hours per kilogram (Wh/kg); however a few companies (CATL and Amprius) claim batteries boasting a 500 Wh/kg density, which could potentially mean regional electric transport could become viable in the near future.

Lithium-ion batteries emerged onto the commercial market in the 1990s and since then, the energy density has been doubling every 10-15 years.

Payload and Range FOMs

Alignment with Company Strategic Drivers

Autonomous eVTOL transportation aircraft serve a large number of functions and, as such, can align to diverse strategic drivers. Cargo air vehicles can serve an increasingly time sensitive delivery industry, shorten the "last mile" delivery network for companies like Amazon, or simply reach previously geographically inaccessible locations for goods transportation (military or remote environments). Passenger air vehicles are expected to improve integration of urban environments, especially those heavily congested by ground vehicle traffic or geographic limitations.

In order to generate strategic advantages for firms, this technology must generate increased value for customers or reduce costs of current solutions. Primarily, this technology has the capability to deliver increased efficiency (time back to customers) at the expense of higher cost (sitting in a regular taxi or shipping through traditional methods is expected to stay less expensive). Early in the technology adoption phase, this will be picked up by the most affluent customers who are willing to pay the cost differential for the time savings. As the technology grows, the market share should grow with it. In addition, due to the positive environmental impact from electric solutions, there is potential for government subsidies to the technology that could offset costs or provide additional advantages for aircraft manufacturers and their customers.

Currently, there are a number of companies who are competing to be first to market; these are the pioneers who are paving the way through the initial barriers. However, they are severely limited by the focus areas outside of the aircraft manufacturer's direct control (see Focus Areas below). As such, these companies tend to be startups funded by venture capital firms who are willing to take the risk associated with technology development. Alternatively, some major aircraft competitors are attempting to be fast followers, allowing the battery technology, infrastructure, and regulations to mature before committing significant resources to this. These include Bell Helicopter, Sikorsky Helicopter, Boeing, and Airbus (the last two do have contenders, but are not committing a large portion of relative resources available to these projects). Defenders would be small scale helicopters and traditional ground transportation, but due to the novelty of this technology, they have not made significant strides to deter growth. Finally, low cost providers are attempting to find their own position on the competitive landscape.

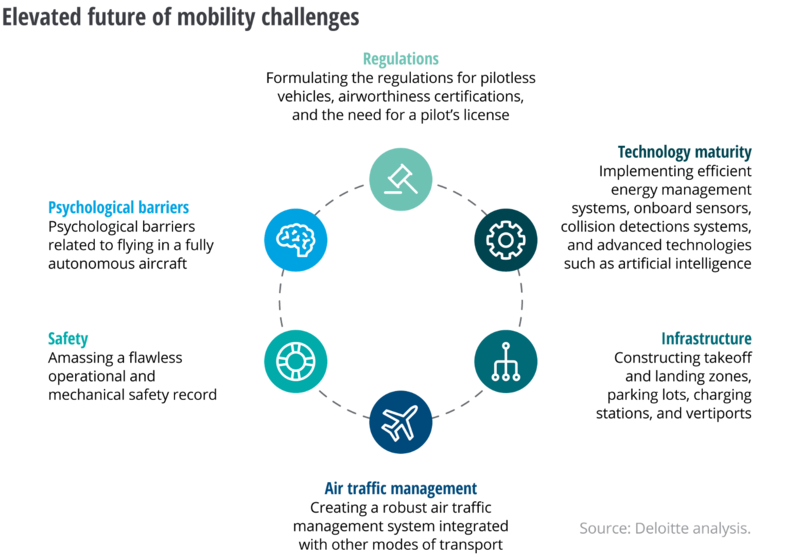

Focus Areas

This technology has six focus areas that must be developed to enable mass deployment and adoption. For aircraft manufacturers, some of the technologies are outside of traditional areas of expertise. As such, it is recommended that they partner with those that currently have primary ownership in those areas or start gathering resources and developing expertise in the areas for future vertical integration of the system.

| Number | Focus Area | Primary Ownership | Description |

|---|---|---|---|

| 1 | Aircraft Propulsion and Control Technology Maturity | Aircraft Manufacturers | This covers the development of the integrated air vehicle, combining electric propulsion systems with high quality producible aircraft. In addition, this covers propulsion system and flight control system development, which will be primary drivers of FOMs. |

| 2 | Battery Technology Maturity | Battery Manufacturers | This is working directly to improve battery energy density, which is a primary driver of aircraft capabilities. |

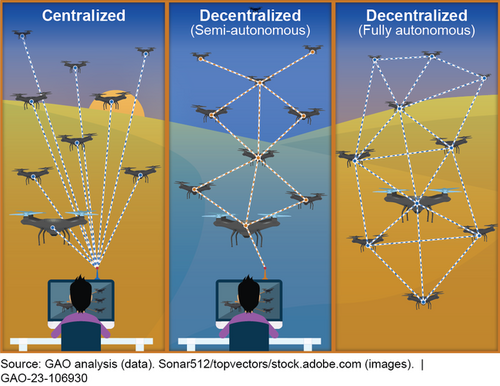

| 3 | Automation of Flight | Aircraft Manufacturers and General Technology Companies | The automation of piloting systems must be improved to the point of high reliability, adaptability, and modularity. |

| 4 | Infrastructure Development | Local Governments and Aircraft Manufacturers | This consists of building the landing and loading zones, charging stations, and hangers in the deployed environment. |

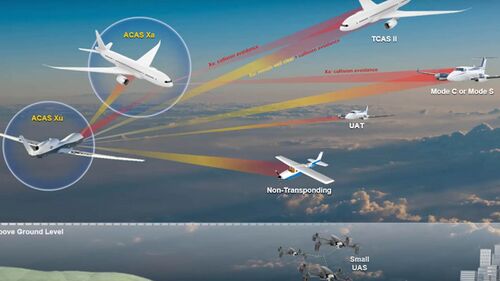

| 5 | Air Traffic Management and Regulation Improvement | National and Global Regulatory Bodies | With a number of automated aircraft in the same airspace, significant improvement in the regulatory systems is required to ensure appropriate pathing, directional guidance, and object avoidance. |

| 6 | Operational Safety and Psychological Barriers | General Public and Aircraft Manufacturers | The aircraft must not only be extremely safe and reliable, meeting current commercial aircraft safety and reliability standards, but the customers must be comfortable flying in a pilotless aircraft in a more congested and volatile environment. |

Strategic Drivers

Listed below are the strategic drivers for aircraft manufacturers, and the alignment targets of our roadmap with these drivers. Note, the primary focus areas are those where aircraft manufacturers have direct control.

| Number | Focus Area | Strategic Drivers | Alignment targets |

|---|---|---|---|

| 1 | Airframe Technology Maturity | To develop hover and cruise configurations to lower the net cost to the passenger for intercity flights in a limited service radius. The design of the eVTOL itself should enable reduced CAPEX costs and OPEX costs for a flight over a limited radius. The current air transportation modes either result in high CAPEX (Airports) or high OPEX (Helicopters, multirotors) that drive the cost up. | This roadmap will target the technology selection that would address the need for high hover efficiency for take-off and landing and high cruise efficiency for covering higher distances. The state of the art technology of tilt rotors and tilt wing aircrafts seem to enable the use of a common propulsion system for hover and cruise, leveraging the best of both aircrafts and rotorcraft(conventional). This roadmap evaluates various configurations of eVTOLs and this driver is aligned with this roadmap. |

| 2 | Battery Technology Maturity | To target higher PAX capacities while keeping a balance with a decent range to enable cost effective transportation to surrounding cities, making the hub & spoke transportation model a reality. Efficient propulsion systems would increase the efficiency of the eVTOL creating room for more passengers or higher ranges. | The development of the Li-ion batteries with higher energy density is crucial to increased payload capacity of eVTOLs. THe Li-ion energy density has tripled since 2010 to 300Wh/Kg. To achieve a long range flight, a target of 500Wh/Kg is expected by 2025. The weight of the eVTOL itself plays a major role in this. Use of lighter materials like aluminum and carbon fiber are expected for the construction of the eVTOL. This driver is in alignment of the roadmap |

| 3 | Aircraft Technology Maturity | To develop low noise hover systems with lower disc loading in order to allow for the eVTOL to take off from various landing ports in urban areas. The reduced noise and disc loading will enable the construction of compact landing pads in buildings or courtyard without disrupting normal urban life. | The discloading of the aircraft severely impacts the noise level generated by the hover. The harrier jet generates 125 dB of noise when hovering at 100ft, whereas helicopters generate 108 dB at ground level. Reduction of these to 78 dB is required in order to achieve the desired noise level. Improved research in this area with different designs of the propulsion systems and noise dissipation can significantly reduce noise levels. This driver is currently aligned with the roadmap. |

| 4 | Air Traffic Management and Regulation Improvement | To enable safe, efficient, and regulated Air Traffic Management systems to help eVTOLs navigate seamlessly in an urban environment. With 100s of eVTOLs buzzing above populated cities, the risk of potential crashes increases significantly. Unlike airports and helicopters, eVTOLs would be deployed in large quantities and the heliports would space out in the most populated areas. An advanced ATC system can increase operational efficiency safely | The current state of the art relies heavily on human intervention to manage Air Traffic. Switching to Level 5 Autonomous Navigation would improve the predictability of flight patterns of eVTOLs making it easier to automate the Air Traffic management with minimal human supervision This driver is currently aligned with the eVTOLs. |

| 5 | Operational Safety and Psychological Barriers | To remove the psychological barrier surrounding Urban Air Mobility and autonomous flying. To enable mass adoption of autonomous eVTOLs, the passengers need to be comfortable with giving up control to a machine. The decision making or the "moral machine" of the systems need to be state of the art to resolve conflicts in the case of unexpected malfunctions. Moreover, this decision might also involve the consideration of potential crashes in the urban environment making it harder for the residents to accept autonomous flying machines over their houses. | Numerous studies for the moral machine of self-driving cars with level 5 autonomy conducted apply to UAM as well. These decision-making principles govern the onboard AI to resolve conflicts in the decision making in an unexpected scenario like a bird strike, equipment malfunction. Numerous social experiments are required to perfect this moral machine to remove the psychological barrier in the potential passengers. This driver is currently NOT aligned with the eVTOLs. |

One of the main benefits of eVTOLs is the integration of the heliports in the urban environment that reduces the CAPEX cost. As mentioned in the overview, eVTOLs can have various configurations for various advantages and this directly impacts the infrastructure around UAM. The improvements in the propulsion systems and the battery technology are the most important for the technology Maturity ensuring that our technology is as close to the Pareto Front as possible thus providing an edge over various the competitors in this domain. The tight integration of UAM in the urban context also calls for improvements in ATC in order to enable safe operations of 100s eVTOLs operating over cities, this would more or less determine whether the UAM service can be permitted to operate. Added to this, noise reduction is another important aspect to improve the psychological barrier.

Positioning of Company vs. Competition

The image gallery below depicts various industry leading eVTOL aircraft that fit this category and have successfully completed first flight.

The designs are very different, and it doesn't seem like there's a leading layout for all competitors, like for classical passenger aircrafts or automotives. Instead, there are designs that take more from small drones/hexacopters, vector thrust and propeller aircraft like the below three examples:

Lilium Jet Eagle

Ehang 216-S

Airbus Vahana Alpha

Aska A-5

The table and graph below compiles publicly available data on the aircraft and some key Figures of Merit. The table consists of a large variety of aircraft, including different propulsion types and cargo/passenger aircraft.

Note, many critical FOMs are not publicly available for these aircraft. Consequently, full technology development cannot be mapped. For example, the Voltline Skyla-V2 sacrifices performance for cost advantage (based on observable airframe structure) - this is not captured for the pareto front because unit cost has not been defined yet. In addition, the values provided are released in media, but not validated through test. By limiting scope to only tested aircraft, and not conceptual mockups, the reporting error should be minimized, but will still be present without a reliable means of confirming provided data.

In the graph below, color shading and marker type are used to indicate year of first flight and type of aircraft, respectively. X are the aircraft for cargo vs with a dot are for person use. Note: No lines are drawn to represent the pareto front because the lack of precision in publicly available data may mislead designers.

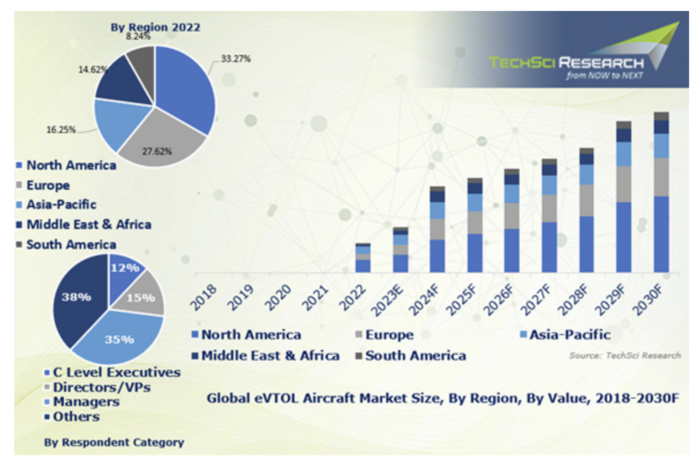

Overall the market outlooks are pretty strong with a CAGR(2023-2030) of 49.29%. The main demand is for improved urban air mobility, but also medical services and police use. Last but not least, there is a growing demand for military use, which is not in scope of this roadmap, but does drive some of the investments in this space as seen in the growth of the overall market size [10].

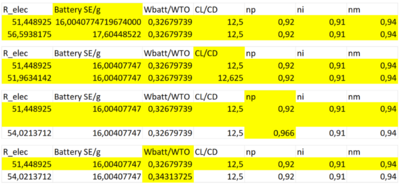

Technical Model: Morphological Matrix and Tradespace

We are restricting the analysis to the FOMs of Max Range[mi] and Max Payload [lbs].

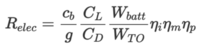

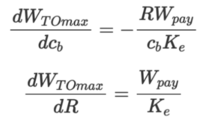

For our FOM Max. Range [mi] we can use the Breguet Range Equation and take partial derivatives to determine the sensitivity analysis for weight.

Breguet Range equation adapted for eVTOLs:

- CLCD is the lift to drag ratio

- cb is the battery specific energy (energy / mass)

- Wbatt,WTO are the battery weight, takeoff weight

- ηi,ηm,ηp are the inverter, motor, and propulsive efficiency

- g is the gravitational constant

We are interested in how the weight of an aircraft depends on the specific energy (energy mass density) of the battery, which is falling over time. We also care about the cost of increasing the range requirement of an aircraft (longer range aircraft need to be heavier):

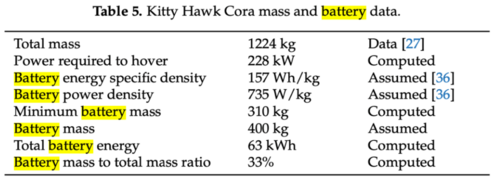

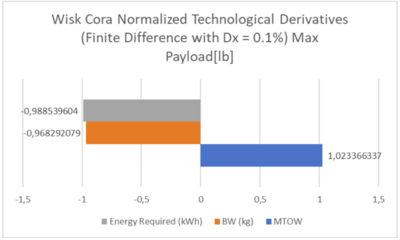

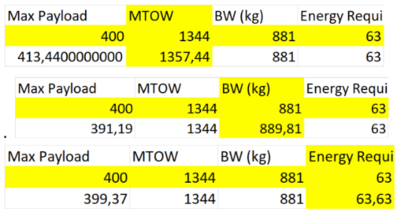

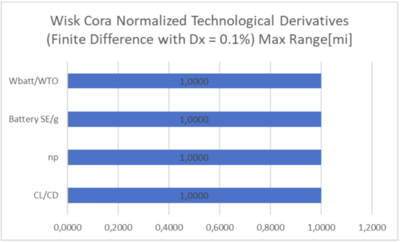

For these FOMs we will take the (Wisk) Kitty Hawk Cora as a particular design vector. According to our simulations in the Appendix, we come with following tornado chart.

For Max Range:

The Tornado chart for Max Range indicating the relative performance increases.

For Max Payload:

The Tornado chart for Max Payload indicating the relative performance increases is constant, due to the linear formula.

Financial Model

Assuming that the Autonomous eVTOL company will be the owner and operator of these aircraft, the following financial model and NPV analysis was performed based on current operational / R&D spending and projected future profits.

Inputs & Assumptions:

- 2 Million Passenger Miles starting in 2030

- $3 per passenger mile

- Deployment in a large metropolitan area (i.e. NYC)

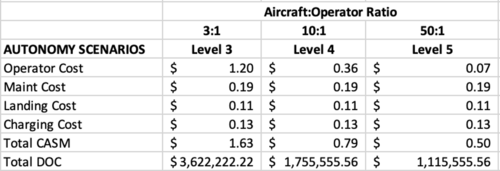

Key Drivers for Costs / Revenues

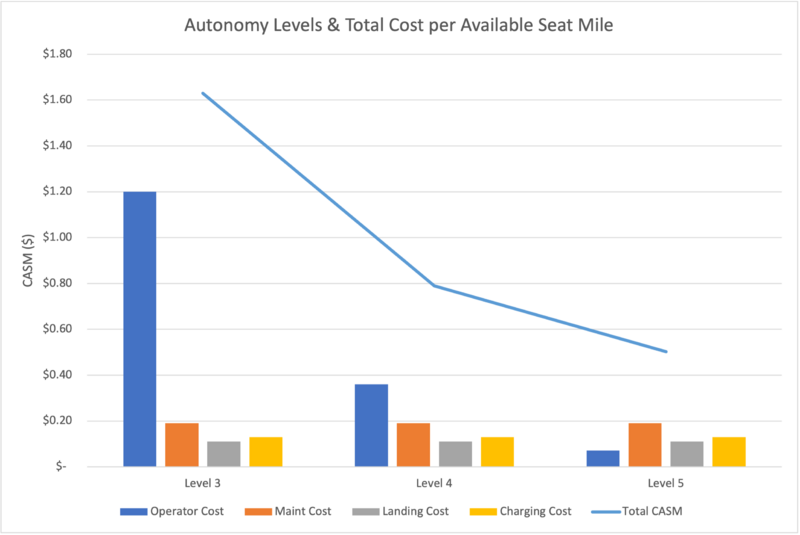

- Level of Autonomy (Operator:Aircraft Ratio)

- Maintenance Costs

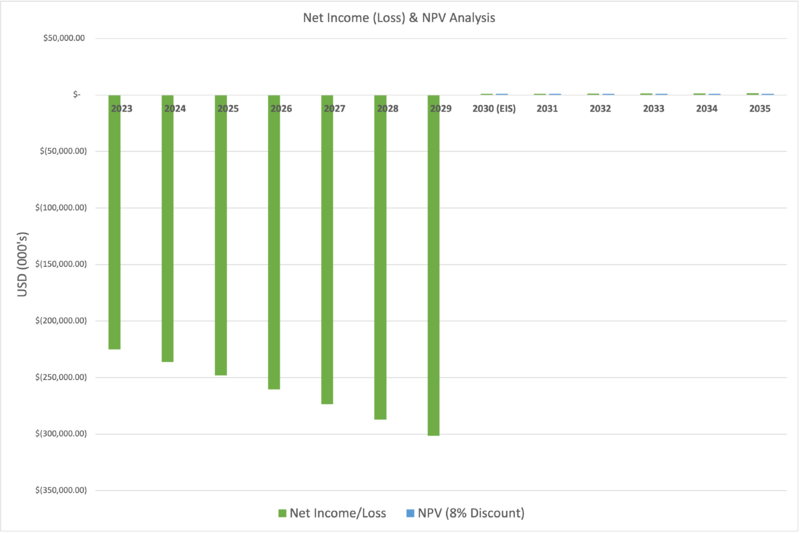

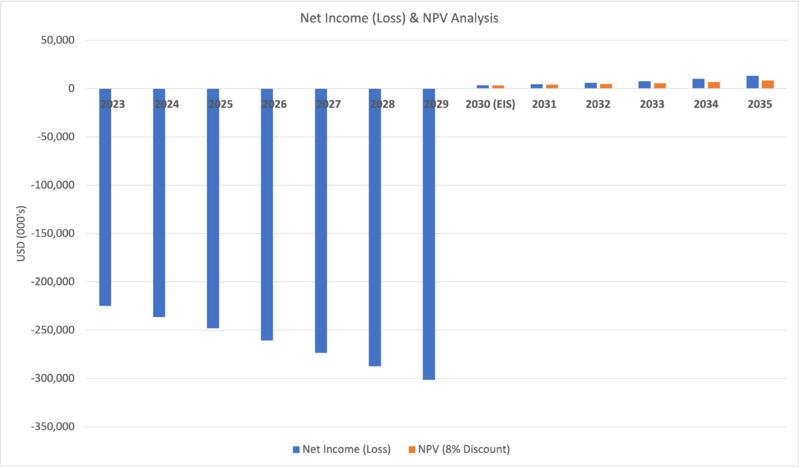

NPV Scenario Analysis

- Scenario 1: Level 3 Autonomy + 21% Margins + 10% Passenger Growth YoY

- Scenario 2: Level 4 Autonomy + 21% Margins + 30% Growth YoY

DOC Scenario Analysis (Varying Autonomy Advancements L3 - L5)

List of R&D Projects (incl. demonstrators)

1. Wisk Cora (most advanced autonomous eVTOL demonstration to date) Wisk Cora represents a groundbreaking advancement in autonomous electric vertical takeoff and landing (eVTOL) technology, standing out as one of the most sophisticated autonomous demonstrations in this field to date. Developed by Wisk Aero, a collaboration between Boeing and Kitty Hawk, Cora showcases the potential of autonomous air mobility. With its cutting-edge design and technology, Wisk Cora aims to revolutionize urban transportation by offering a safe, efficient, and environmentally friendly alternative.

2. Sikorsky Hex (hybrid-electric demonstrator) Sikorsky's Hex is a hybrid-electric demonstrator that underscores the aviation industry's commitment to sustainable and efficient air travel. As a product of Sikorsky, a renowned helicopter manufacturer, Hex combines traditional rotary-wing capabilities with modern electric propulsion systems. This hybrid-electric platform signifies a strategic move toward reducing environmental impact and exploring innovative propulsion solutions. Hex serves as a testbed for hybrid technologies that could potentially shape the future of vertical flight.

3. CityAirbus (Airbus): Airbus is at the forefront of the emerging electric vertical takeoff and landing (eVTOL) market with its CityAirbus project. The company aims to achieve certification for the CityAirbus NextGen, a four-seat eVTOL, by 2025, positioning it as a piloted urban air mobility solution. Airbus envisions CityAirbus as a transformative mode of transportation within metropolitan areas, and the aircraft is designed to seamlessly integrate into existing urban infrastructure. Airbus's commitment to certification by 2025 reflects its proactive approach to advancing air mobility and adapting to evolving regulatory frameworks, with plans to transition to autonomy when regulations permit uncrewed air taxi operations.

4. BETA & JOBY: BETA and JOBY stand out as formidable players in eVTOL, with both companies strategically poised for operations at-scale, with a targeted entry into service of 2025. Aside from architectural and power train differences, one of the most salient differentiators is the business model. JOBY will launch its own commercial passenger service in 2025. Meanwhile, BETA will remain an OEM and has garnered 500 orders of their aircraft.

Key Publications and Patents

Patents:

1. System And Method For Monitoring And Mitigating Pilot Actions In An Electric Aircraft - US 11801944 B1, 2023-10-31. This patent patents at a high level, a system for monitoring and mitigating pilot actions in an electric aircraft. It includes a computing device configured to detect at least a first flight datum and determine a current flight context as a function of that at least a first flight datum. It includes the computing device receiving a pilot input command, identifying a triggering event as a function of the current flight context and the pilot input command, and performing a mitigating response.

2. METHOD, APPARATUS AND COMPUTER PROGRAM TO DETECT DANGEROUS OBJECT FOR AERIAL VEHICLE - US 20230343230 A1 - 2023-10-26. This patent is about a method of detecting a dangerous object for an aerial vehicle. It sets an object detection area in air in which the aerial vehicle is in flight using a first sensor, a second sensor, and a third sensor; detecting an object in the set object detection area; generating detailed object information on the detected object; and determining whether the detected object is the dangerous object based on the generated detailed object information.

Papers:

1. Sarkar et. al., “A Data-Driven Approach for Performance Evaluation of Autonomous eVTOLs”, 2022. In this paper, a data-driven techniques to evaluate the performance of novel eVTOL configurations for executing autonomous missions in UAM environments is investigated. They considered real-world constraints to generate databases to be used by the proposed data-driven techniques.

2. Porat et. al., "Supervising and Controlling Unmanned Systems: A Multi-Phase Study with Subject Matter Experts", 2016. This paper seeks to quantify how many systems a single operator can supervise and control. It was found that an experienced operator can supervise up to 15 UASs efficiently using moderate levels of automation, and control (mission and payload management) up to three systems. In general, teams led to better performances. Hence, shifting design efforts toward developing tools that support teamwork environments of multiple operators with multiple UASs (MOMU).

3. Bauranov and J. Rakas, "Urban air mobility and manned eVTOLs: safety implications," 2019 IEEE/AIAA 38th Digital Avionics Systems Conference (DASC), San Diego, CA, USA, 2019. This paper explores the risks associated with manned eVTOLs, and the impact of automation system failures on pilot workload and flight safety by using Bayesian Belief Network.

4. X. Yang and P. Wei, "Autonomous Free Flight Operations in Urban Air Mobility With Computational Guidance and Collision Avoidance," in IEEE Transactions on Intelligent Transportation Systems, vol. 22, no. 9, pp. 5962-5975, Sept. 2021. In order to enable safe and efficient autonomous on-demand free flight operations in UAM, a computational guidance algorithm with collision avoidance capability is designed and analyzed. The approach proposed in this paper is to formulate this problem as a Markov Decision Process and solve it using an online algorithm Monte Carlo Tree Search.

5.Harris., "With Ultralight Lithium-Sulfur Batteries, Electric Airplanes Could Finally Take Off", November 4, 2022. IEEE Spectrum

Technology Strategy Statement (incl. Swoosh Chart)

In the lead-up to an anticipated entry into service in 2030, a hypothetical autonomous eVTOL company should follow the outlined phased technology development strategy.

- Beginning in 2024 and extending through 2025, the focus lies on sustaining robust Research and Technology (R&T) collaborations with battery providers, infrastructure partners, and airspace integration experts. This period serves as a critical foundation-building phase, ensuring our technology aligns with cutting-edge advancements in power storage, ground infrastructure, and seamless integration into existing airspace systems.

- By 2026, the company envisions the deployment of its eVTOLs in geo-fenced, controlled airspace, marking the initial step towards commercial operations.

- Looking to 2028, the focus shifts towards achieving a Minimum Viable Product (MVP) for Level 4 autonomy, a pivotal milestone in the pursuit of fully autonomous flight.

- Finally, as we approach the targeted entry into service date in 2030, the technology strategy pivots towards enhancing operational capabilities for Level 4 autonomy, solidifying our commitment to delivering a safe, efficient, and cutting-edge urban air mobility solution.

References

2. https://www.eucass.eu/doi/EUCASS2022-7362.pdf

3. https://www.nature.com/articles/s41586-021-04139-1

5. https://batteryuniversity.com/article/bu-304a-safety-concerns-with-li-ion

7. https://www.nature.com/articles/s41586-021-04139-1

8. https://evtol.news/aircraft

9. https://www.youtube.com/watch?v=ZR2t_w8xQi4

10. https://www.techsciresearch.com/report/evtol-aircraft-market/3984.html

11. https://aamrealityindex.com/aam-reality-index

12. https://wisk.aero/autonomy/

13. https://evtolinsights.com/2022/11/evtol-operational-costs-and-profit-does-anyone-have-a-clue-yet/