Rocket Engines

Technology Roadmap Sections and Deliverables

Executive Summary

Roadmap Overview

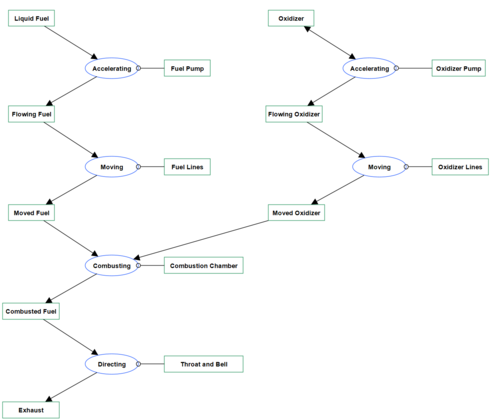

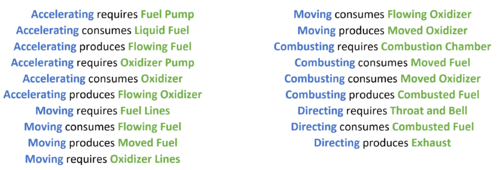

The primary function of rocket engines is to convert chemical energy to kinetic energy. This means that a rocket engine would be placed squarely on the cell “Transforming Energy” in our 5x5 technology matrix. There are several different styles of rocket engines that are used today (all of which meet the primary functional requirements) but the perform those functions in slightly different ways with slightly different architectures. These architectures are all determined by their fuel type and their fuel consumption method. The rocket engines we will examine here include: solid rockets, open cycle liquid fuel, closed cycle full flow liquid fuel, and nuclear. Below is a generalized OPD describing the operation of a liquid fuel rocket engine.

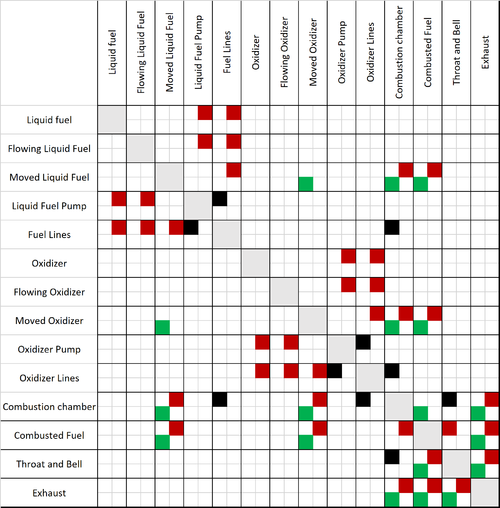

Design Structure Matrix (DSM) Allocation

ADD DEPENDENCY TREE

Below is a schematic DSM for the simplified and generalized liquid fuel rocket engine described in the first section. Cells colored black indicate a physical connection between formal elements. Red indicates a mass flow between formal elements. Green illustrates an energy flow between formal elements. There can be multiple colors for a single cell.

Roadmap Model Using OPM

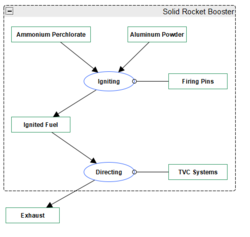

Solid Rocket Boosters

Solid rocket boosters are a comparatively simpler system. However, once ignition starts, there are no ways to stop the process. Ammonium perchlorate acts as the oxidizer, and aluminum powder acts as the fuel source.

Examples of solid rocket boosters getting used in large quantities are the space shuttle and the lower stages of the Ariane-6 rocket.

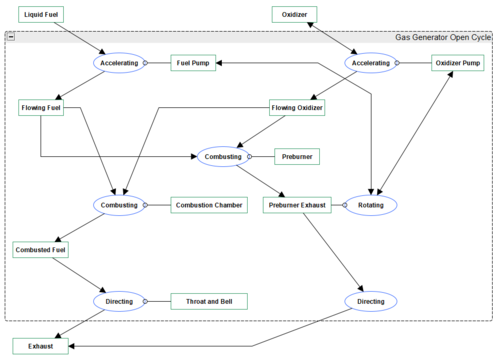

Gas Generator Open-Cycle Engine

A gas generator open cycle engine is one of the simplest forms of liquid fueled rocket engines. In order to supply more fuel and oxidizer to the combustion chamber – which in turn increases pressure of combustion, and generally higher thrust – turbopumps are installed in the lines of the engine. The turbopumps are rotated by a small rocket engine called a preburner which is itself fueled by the same liquid fuel and oxygen. The spent preburner exhaust is directed outside of the main throat and bell as exhaust.

Examples of this style of rocket engine are the F-1 and the Merlin Engine.

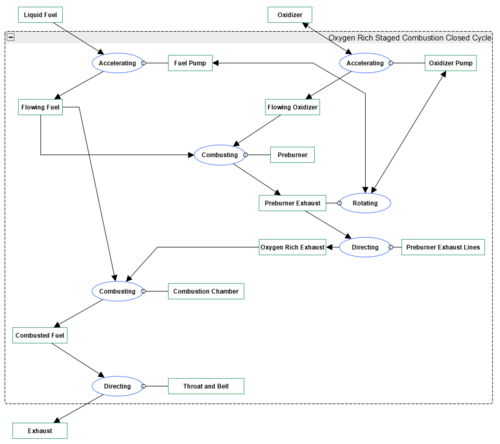

Oxygen-rich, Closed-Cycle, Staged-Combustion Engine

An oxygen-rich, closed-cycle, staged-combustion engine is one of the more complex than open cycle gas turbine engines, but they are more efficient because they use more fuel and oxidizer in the main combustion chamber. In these engines, all oxidizer is pumped into the preburner, with some fuel. The remainder of the fuel is pumped directly to the main combustion chamber. The preburner exhaust is oxygen rich, and is pumped into the main combustion chamber where it supplies the required oxidizer for combustion.

Examples of this style of rocket engine are the RD-180 and the BE-4.

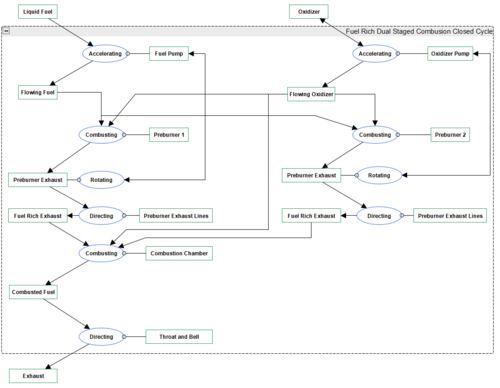

Fuel-rich, Closed-Cycle, Staged-Combustion Engine

A fuel rich dual staged combustion closed cycle is similar in concept, but much more difficult in execution to the already complex oxygen rich staged combustion closed cycle engine. In the fuel rich closed cycle engine design, all of the fuel is sent to the two preburners, and the oxidizer is sent to the preburners as well as the main combustion chamber. Super-heated, fuel-rich exhaust is then directed from the preburner to the main combustion chamber. The advantage to this setup is that it is very efficient and generally has a high thrust to weight ratio as it is quite compact in its dimensions.

An example of this engine is the RS-25.

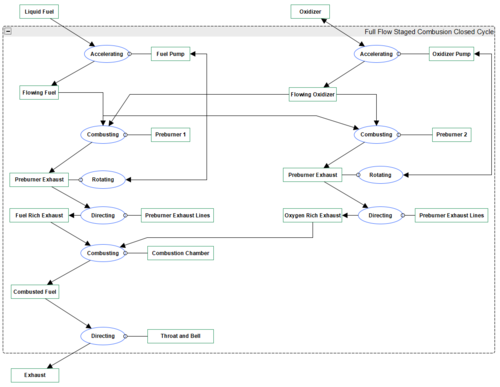

Full-flow, Closed-Cycle, Staged-Combustion Engine

A full flow staged combustion closed cycle engine takes advantages of oxidizer rich and fuel rich closed cycle designs. This design is technically the most difficult to successfully built, and only one engine has ever been flight tested with this configuration. The key differentiator is that flowing fuel and oxidizer are never directly connected to the main combustion chamber. Instead, they are all directed through turbopump assemblies. One assembly is responsible for producing an oxygen rich exhaust – which drives the oxidizer turbopump – and the other assembly produces a fuel rich exhaust – which drives the fuel turbopump.

There are only three engines which have ever attempted this design, and only one has ever flown. The soviet RD-270, the Rocketdyne integrated powerhead demonstrator (never tested), and the Raptor engine, which was first flown in August 2019 for a 1 minute 150m flight demonstration.

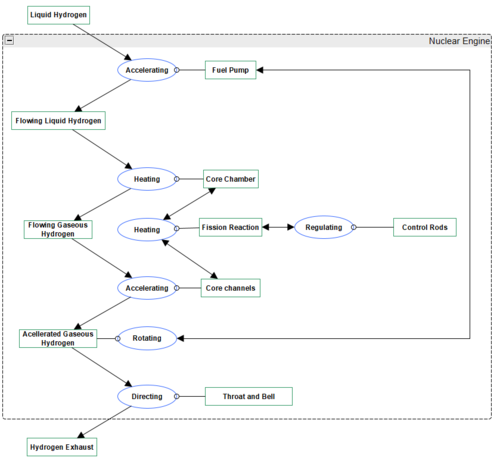

Nuclear Engine

Nuclear propulsion is slightly different then chemical rockets, in that chemicals are not getting combusted, but rather chemical reactions are taking place. A nuclear rocket uses the expansion of liquid hydrogen to gaseous hydrogen in confined spaces to generate thrust. The heat required to generate this expansion is achieved by forcing hydrogen through a nuclear core. Nuclear rockets have significant advantages to chemical rockets in their Isp values, but the major downside is their very low thrust to weight ratios.

The NERVA rocket is one of several examples that have ever been built.

Figures of Merit

ADD HISTORICAL EVOLUTION? MAKE EQUATIONS MORE OBVIOUS?

Tsiolkovsky Rocket Equation (m/s)

Δv = ve*ln(m0/mf)

- ve = effective exhaust velocity

- m0 = initial total mass including fuel and oxidizer

- mf = final mass without fuel and oxidizer

Specific Impulse (s)

Isp = ve/g0

- ve = average exhaust speed along the axis of the engine (either at sea level or vacuum)

- g0 = standard gravity in m/s2

Net Thrust (N)

Fn = M*Ve

- M = exhaust gas mass flow

- Ve = effective exhaust velocity

Thrust-to-weight ratio (N/kg)

TTW = Net Thrust (N)/m (kg)

- m = dry mass of the engine

Comparison of FOMs Across Platforms

| Engine Name | Engine Type | Use Case | Year of First Development | Isp vac (s) | Thrust vac (kN) | Dry Mass (kg) | Thrust/Weight Ratio | Cost ($Million) | Isp/Weight (s/kg) | Thrust/Cost (kN/$) | Isp/Cost (kN/$) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Raptor | Full flow staged combustion closed cycle | Starship | 2019 | 330 | 3,297 | 1,700 | 198 | 1 | 170 | 3,297 | 330 |

| BE-4 | Oxygen rich staged combustion closed cycle | New Glenn | 2020 | 340 | 2,400 | Unknown | Unknown | 8 | Unknown | 300 | 43 |

| Merlin | Gas generator open cycle | Falcon 9 | 2007 | 305 | 981 | 470 | 213 | 0.75 | 146 | 1,308 | 407 |

| Vinci | Gas generator open cycle | Ariane 6 | 2017 | 465 | 180 | 93 | 197 | Unknown | 240 | Unknown | Unknown |

| Vulcain 2 | Gas generator open cycle | Ariane 6 | 1995 | 431 | 1,140 | 1,800 | 65 | Unknown | 682 | Unknown | Unknown |

| P120 | Solid rocket booster | Ariane 6 | 2018 | 279 | 4,500 | 11,000 | 42 | Unknown | 682 | Unknown | Unknown |

| Space Shuttle SRB | Solid rocket booster | Space Shuttle | 1975 | 242 | 12,000 | 91,000 | 13 | 8 | 1,835 | 1,500 | 30 |

| RS-25 | Fuel rich staged combustion closed cycle | Space Shuttle | 1980 | 452 | 2,297 | 3,177 | 73 | 50 | 630 | 46 | 9 |

| RD-180 | Oxygen rich staged combustion closed cycle | Atlas V | 1989 | 338 | 4,150 | 5,480 | 77 | 25 | 446 | 166 | 14 |

| F-1 | Gas expansion open cycle | Saturn V | 1964 | 304 | 7,770 | 8,391 | 94 | 30 | 328 | 259 | 10 |

| NERVA | Nuclear solid core | Test Only | 1964 | 850 | 334 | 18,144 | 2 | Unknown | 46,175 | Unknown | Unknown |

Alignment with Company Strategic Drivers

The table below shows some potential strategic drivers and alignment of the Raptor engine technology roadmap.

| Number | Strategic Driver | Alignment and Targets |

|---|---|---|

| 1 | To develop a liquid fueled, reusable, full-flow, staged combustion, closed-cycle rocket engine that can enable an affordable launch marketplace in which we have a distinct first-mover advantage. | The liquid fuel rocket engine roadmap will target the development of a methane fueled rocket engine that will provide at least 3,000 kN of thrust in vacuum. This would represent a disruptive technology in the rocket engine marketplace. It is aligned with the liquid fuel rocket engine technology roadmap. |

| 2 | Capture marketplace advantage through low cost manufacturing capacity ensuring dominant design architecture from a cost-normalized standpoint | This liquid fuel rocket engine roadmap will target the development of a rocket engine that can be rapidly produced in an assembly line style to minimize cost. This rocket engine will be produced at a rate of 500 engines per year, or 1 engine every 12 hours at dedicated fabrication facilities – enabling costs of <$1 million per engine. This would represent a disruptive technology in the rocket engine marketplace. It is aligned with the liquid fuel rocket engine technology roadmap. |

| 3 | To ensure we are the rocket engine of choice for multiple use contexts, the engine shall provide a sufficiently high Isp such that clients requiring less thrust (with lighter payloads) will still find the product ideal for their projects. | The liquid fueled rocket engine roadmap will target the development of a rocket engine that will deliver an Isp in vacuum of at least 330s, and a thrust to weight ratio of at least 190. This would represent a competitive position in the existing marketplace. It is aligned with the liquid fuel rocket engine technology roadmap. |

The company’s technology roadmap is aligned with all three of its strategic drivers. There is sufficient organizational capability, funding, and time to meet our ambitious target launch date using these new rocket engines by the second half of 2020. All of the targets are within the parameters set forth by the governing equations, and thus they are technically feasible. They would indeed represent a disruptive technology in the aerospace field, and so there may be hurdles that are not captured by the roadmap (e.g., certification, new regulations at launch sites, or unscheduled rapid unplanned disassembly events).

Positioning of Company vs. Competition

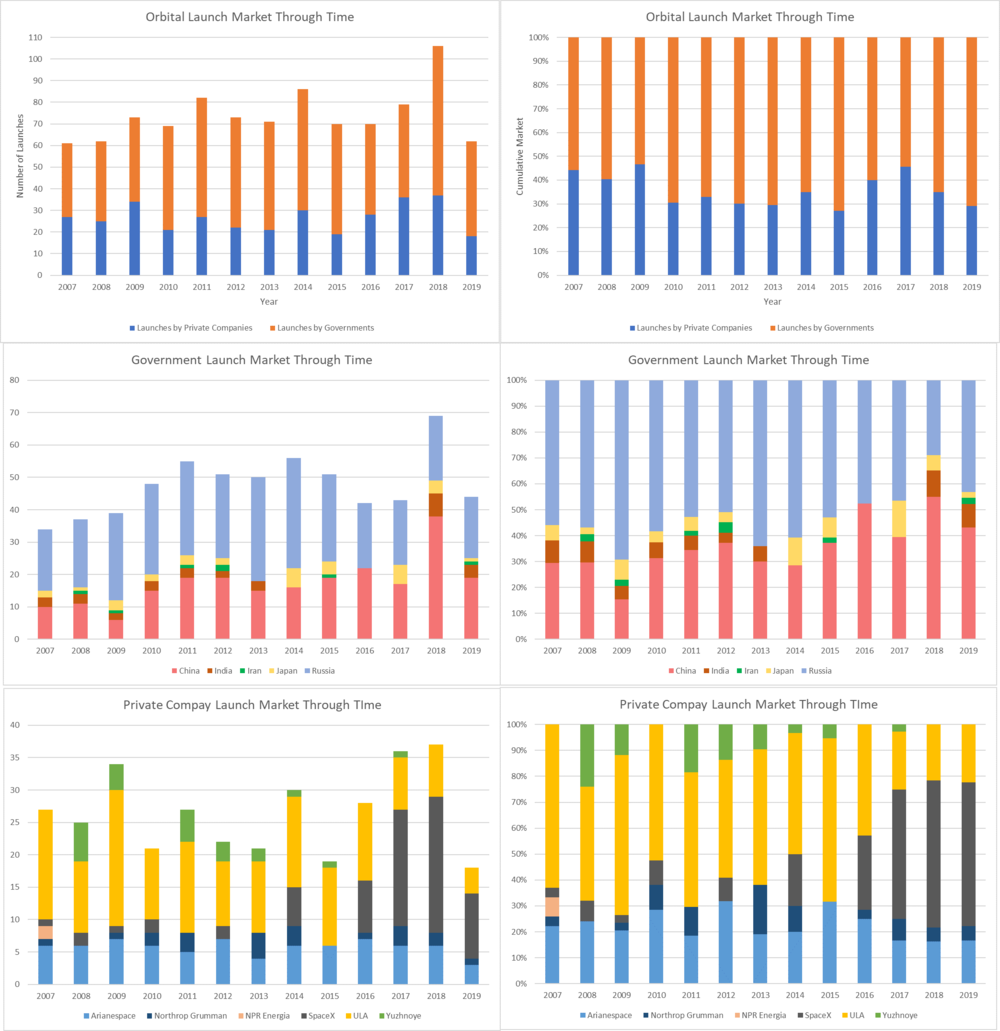

Summary

At the highest level, there are two semi-competitive solutions – governmental funded agencies and private companies. Publicly funded agencies are nation specific, and account for between 50% and 75% of all orbital class launches annually. For orbital class launch vehicles, China, India, Iran, and Japan utilize exclusively publicly funded organizations. Russia uses almost exclusively publicly funded organizations with rare exceptions. Chinese and Russian launches together account for ~90% of all publicly orbital class launches in the world on an annual basis. The remaining 50% to 25% of all orbital launches annually are publicly and privately funded but launched by private companies.

Public Competitive Landscape

China and Russia are the primary consumers of state-funded and state-organized (and state-researched, and state-produced) products. For these examples, the pricing scheme is extraordinarily difficult to find detailed reports. However, one can safely assume that massive amounts of funds are dedicated to the research of new technologies. In examining the development of the “Long March” rocket (the current iteration has roots back to 1993) there have been over 100 launches of various incarnations. Most of which have been almost 100% expendable. There are currently three new Long March rockets in development with differing fuselage diameters to fulfill different mission profiles – including a 100m tall, heavy lift behemoth called the Long March 9. This development of this program must have cost a minimum of tens of billions of dollars.

The Russian space program is another important example to examine. Most of the lift vehicles that the KSRPSC operate are old ICBMs that have been decommissioned. Specifically, there is a major use of R-7 rockets that have provided lifting capability for payloads ranging from sputnik to the Soyuz (after modifications). In fact, the Soyuz-U, a member of the R-7 rocket family, is the single most launched carrier rocket in the world with 786 launches and 22 failures (success rate = 97%). A single launch of a Soyuz-U is claimed to cost ~$50 million bringing the total cost of launching Soyuz-U rockets to ~$40 billion. This excludes development costs, doesn’t account for any other Soyuz launches, and excludes monies paid to the Russian government to use their services. Regardless, it is a reasonable claim to estimate the cost of the R-7 space program to be on the same order of magnitude (tens of billions of dollars, possibly hundreds of billions of dollars) as the Chinese program.

From a competition perspective, the Russian government has been much more willing to work with other governments (including the United States government, the Israeli government, the Ukrainian government, and more). In this sense then, the Russian publicly funded space program is in direct competition with the private sector while simultaneously achieving some levels of internal funding guaranteed and specific research requirements dictated by national defense. The Chinese space program, on the other hand, is not in competition with anyone and in fact is likely not going to be a user of any other space program pending political resolutions.

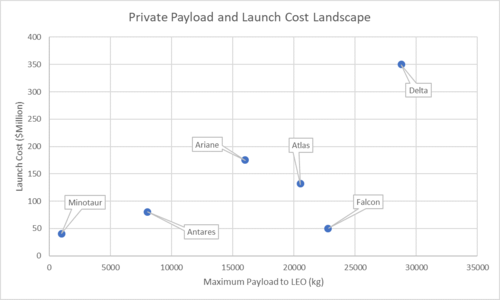

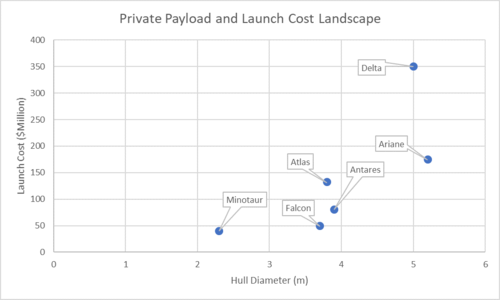

Private Competitive Landscape

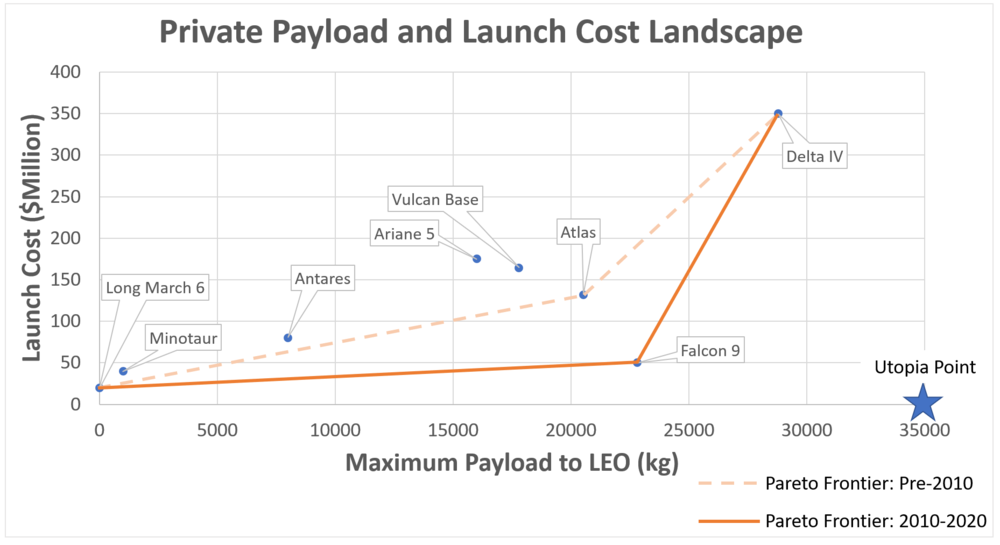

ADD UPTOPIA POINTS, ADD NEW TECHNOLOGY, ADD PARETO FRONT

Within the private sector there was a duopoly that existed prior to 2016 between Arianespace and ULA. Arianespace is partly owned by 17 separate private entities. Arianespace was initially founded with European governmental agencies but is currently mostly privately held. The largest shareholders of Arianespace are Airbus and Safran SA. Arianespace was founded with the specific intent of enabling commercial launches to space. From 2007 to 2015, Arianespace accounted for between 20% and 30% of the private space market for orbital launch vehicles. ULA is a joint venture that has existed between Boeing and Lockheed Martin since 2006. The venture was chiefly formed to help the US government launch their own military and civilian satellites, but ULA also allows for commercial launches.

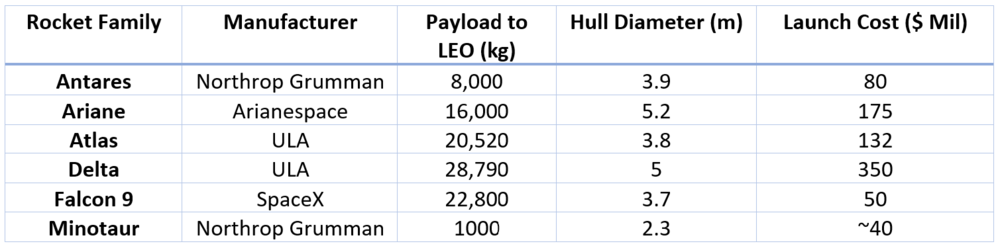

Prior to 2016, Northrop Grumman, Arianespace, and ULA all occupied slightly different markets as launch providers. Northrop Grumman was largely a small payload and cheap launch provider. If you needed an orbital class rocket, and a small-lift vehicle didn’t have the diameter to hold your satellite, Northrup dominated because of their cheap launches. If you had a light, but large payload, then Ariane dominated with a massive 5.2m hull and a cost that was comparable to much smaller diameter rockets. If your payload mass exceeded 16,000kg, then ULA was your only option with their Atlas and their massive Delta rocket offerings. Given that each provider was well positioned in this landscape, they were all in the position of defenders with the emergence of SpaceX’s Falcon 9 rocket.

Everything changed in 2016. SpaceX now dominates the private sector launch market – and in fact, in 2018 China launched the most orbital class rockets (38) and the second most rockets were launched by SpaceX (21) with Russia launching 20, and ULA launching 8. In 2018, SpaceX alone accounted for 57% of all the launches in the private sector. In a span of one year, SpaceX upset the duopoly held by Arianespace and ULA and became the largest single force in the private launch provider sector. See the graphs and tables below to summarize the private launch capabilities that currently exist.

By 2016, the Falcon 9 had flows 20 times with one failure. With a cost of $50 million the Falcon 9 and SpaceX were unquestionably in the position of attacker and pioneer. The Falcon 9 could outperform every other vehicle in almost every realistic launch scenario. There were a few circumstances where a payload was too heavy or too wide to work with the Falcon 9, and in those situations either Ariane or Delta was used. It is no surprise however, that clients flocked to the affordable solution provided by SpaceX. In almost every scenario, the Falcon 9 is a dominating strategy.

SpaceX continues this strategy of attack and pioneering by developing the Starship platform. No firm claim for launch costs have been settled on for Starship, but it will have payload capacity of ~100,000 kg and a diameter of 9m dwarfing every other private provider option. Estimates for cost range from gobsmackingly low ($10 million – Elon Musk at the IAC 2017) to shockingly low ($100 million – Business Insider estimate). If the real cost per launch is in that window, then Starship paired with Falcon 9 will become dominant designs.

Technical Model: Morphological Matrix and Tradespace

needs stuff

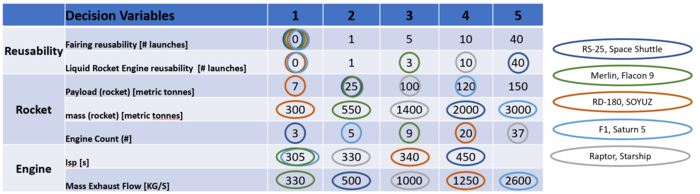

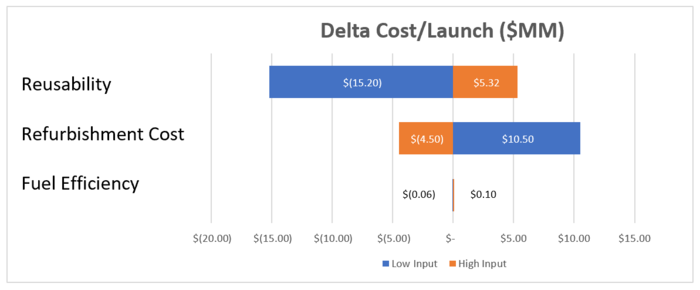

To explore the trade space for a LEO capable rocket design, the team must consider a variety of design parameters. The two most important figures of merit on which to evaluate a rocket’s capability are cost/launch and payload to orbit (a function of thrust and mass). Not surprisingly, the cost/launch is dominated by the re-usability of a design. This is why our company is focusing so heavily on this aspect of the design vector (see tornado diagram below).

Based on the design decisions shown above one can see the variety of designs for achieving LEO. For example, notice that the Soyuz, RD-180 design employs 20 engines to lift a payload of 7 metric tonnes, while the RS-25 driven Space Shuttle uses just 3 engines to lift a payload of 25 tonnes.

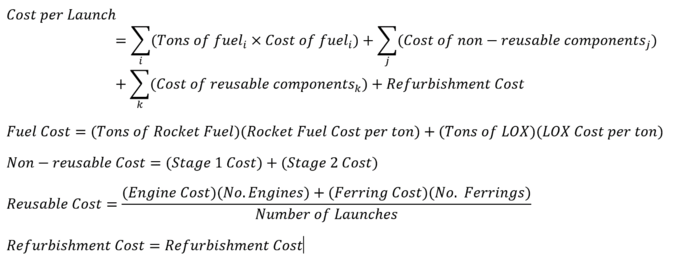

The equation below illustrates how some of these design decisions manifest themselves in the HeilbrunHorton Rocket Cost Equation.

Early analysis of the trade space shows that cost/launch is most sensitive to re-usability and refurbishment cost.

Key Publications and Patents

ADD MORE

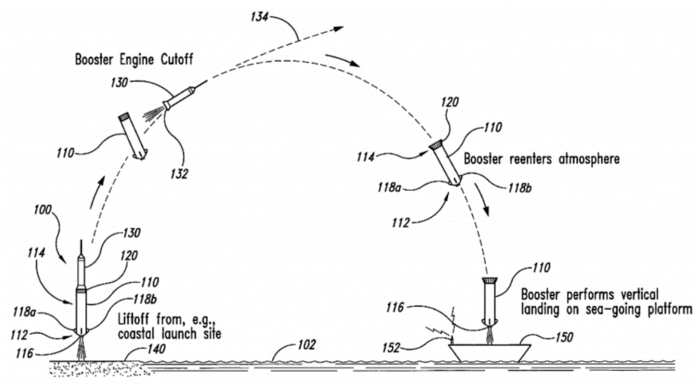

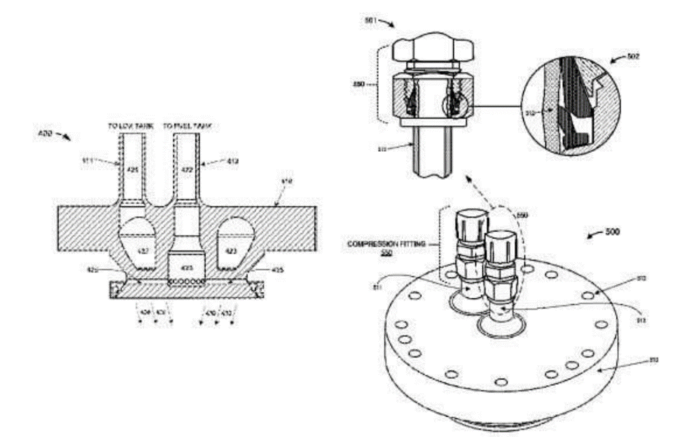

Patent 1 - Re-usability

this patent (filed but not awarded) highlights the current state of patents and IP in the United States where patents can be tools to protect R&D investment as well as tools for trolling your competitor. The image below shows a patent filed by Blue Origin in 2010 for a reusable rocket design. The idea is simple, launch a rocket from the coast, drop the booster and land it on a sea-going platform. While this is a novel idea that has successfully been employed to reuse a booster, it just wasn’t Blue Origin’s idea. At the time the patent was filed SpaceX had already developed this technology and was actively making test flights. This example highlights how the patent system can be abused in a manner that “impedes innovation rather than encouraging it” (Urgelt).

Patent 2 - oxygen propylene engine design

In September 2018, Vector (small-satellite launch start-up) was awarded a patent for their liquid oxygen propylene Engine design. The patent is a breakthrough in liquid fueled rocket technology because the engine design is the first to use propylene and liquid oxygen as a fuel source. This is particularly interesting to the FOM: cost/launch because propylene fuel is much more dense than standard liquid rocket fuel (Rocket Propellant-1, RP-1) making it a more efficient fuel. As such, the fuel can be stored in smaller tanks and used in engines without the need for turbo pumps, thereby also reducing the complexity of the engine design. Furthermore, the new engine design utilizes metallic 3D printing to reduce the number of parts in the engine. Increased fuel efficiency, reduced engine complexity, and utilization of cheaper manufacturing techniques makes this patent the trifecta in the race to reduce launch cost.

Financial Analysis

● What is the R&D and ramp-up time?

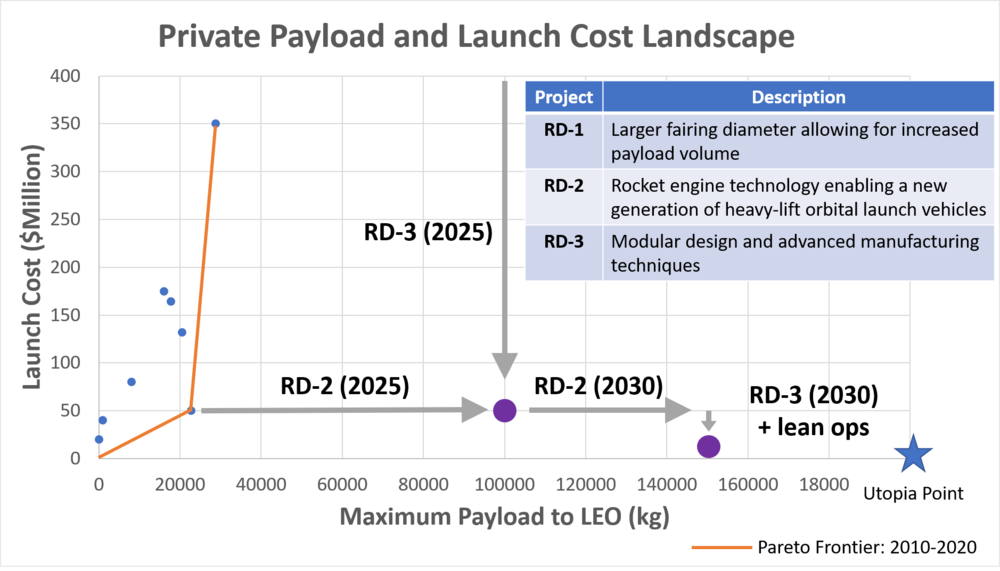

List of R&T Projects and Prototypes ● Where are your R&D projects on the payload vs. launch cost graph? It’s not immediately clear that RD-2 and RD-3 lead to Starship 2025 whereas RD-1 eventually leads to Starship 203. ● Why/How did you select these 3 R&D projects

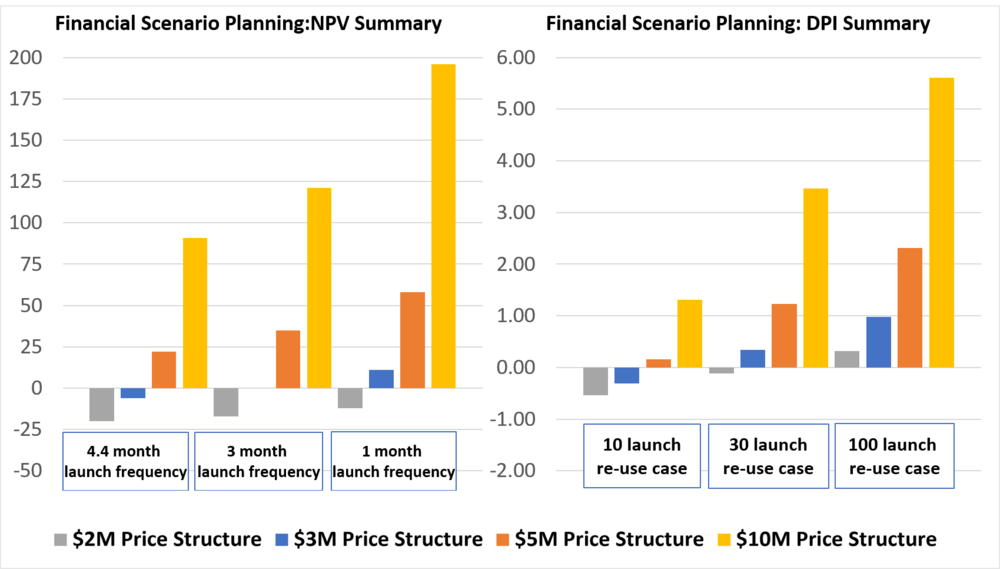

The corporate objective is to revolutionize space technology with the ultimate goal of enabling people to live on other planets. However, in order to fund the technological revolutions that are required, fundamental fiscal goals must be met. In evaluating the financial viability of the starship there are multiple attributes that must be considered to anchor on a viable price to charge a customer for a single launch. This heavy lifting technology was modelled assuming the enabling technology of functioning raptor engines was in place and functioning to required specs.

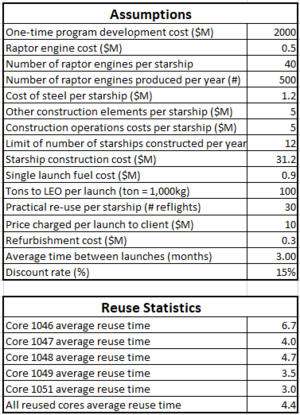

Model Assumptions

There are several variables that are pertinent to consider for financial evaluation of this technology program. Each of these variables will impact our main financial drivers. In this evaluation we treat all of these as independent, but it is likely that they will be related to each other. A high-level list of all required includes:

1) The discount rate

2) Vehicle assembly costs (includes engine costs, steel costs, labor, and other parts)

3) Recurring launch costs (includes fuel and refurbishment)

4) Time between launches of a unique starship

5) Number of re-uses that a single unique starship will encounter

6) Financial drivers: NPV and DPI

Please reference the following table for all assumptions that were used for the model:

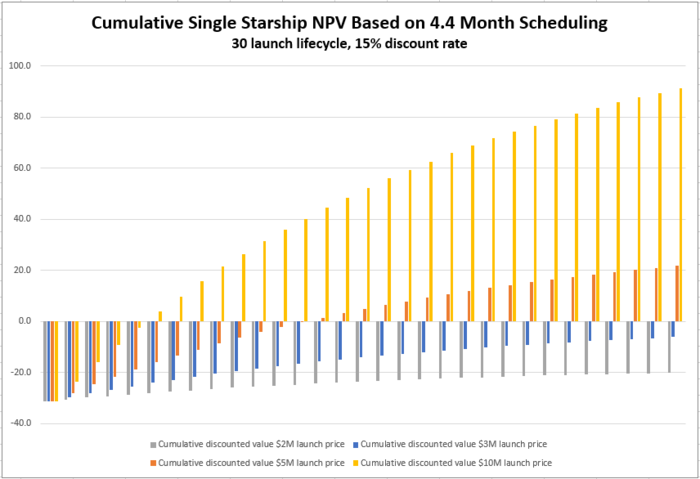

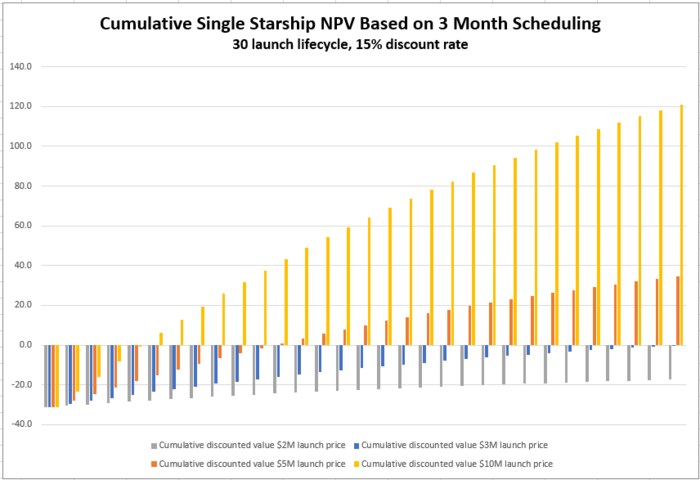

Discussion

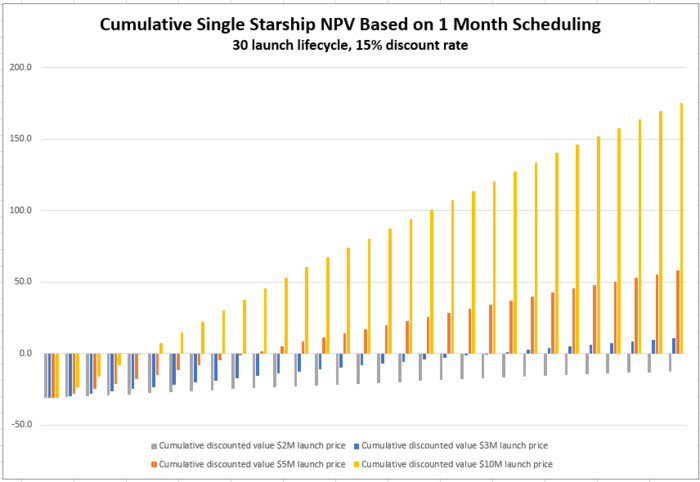

Four different pricing schemes were considered for evaluation. There are public statements from the company CEO that launches will start charging ~$10M per launch on starship, and then decrease over time to possibly as low as ~$2M per launch for the customer. It is worth noting, that currently the cheapest orbital class rocket to launch is a re-used falcon-9 charging ~$40M per launch to a customer. If these figures are even remotely correct, then cost reductions are on the order of a factor of 4 – 20 over the course of starship operation. Payload to LEO capacity will be increased from ~22 tons to ~100 tons, or a similar increase of a factor of 4 or more. Cost reductions of this magnitude paired with capability increases are heretofore never seen in the private launch sector industry.

The first pricing scheme that was considered is $10M per launch – the high-end public estimate by the company. $5M and $3M provide interesting intermediate points, and $2M represents a low-end estimate of what would be charged to the customer. There is a complex relationship that relates launch cadence and viable re-usability amounts (10, 30, and 100 re-flights were modeled) but the results are unsurprising nonetheless. With increased launch cadence and higher reusability all pricing schemes improve in both NPV and DPI.

The $2M price point has a negative NPV for all examined permutations and even cases with incredibly optimistic cost estimates exceeding our normal assumption envelope. Additionally, in our main modeling cases, the $2M price point never exceeds a DPI of 1.0.

Recommendation

The $10M price point is the best for all financial measures across all scenarios. However, our recommended course would be to take a baseline pricing approach of ~$5M per launch to remain consistent with the stated corporate goal to enable humans becoming an interplanetary species. Afterall, the lower we can drive prices, the more people will be able to use our services. The $5M price point achieves a DPI of 1.21 in the 30-launch re-use case, and an NPV of $35M.

See supporting materials to see the effects of depreciation over time for the different multi-attribute analyses.

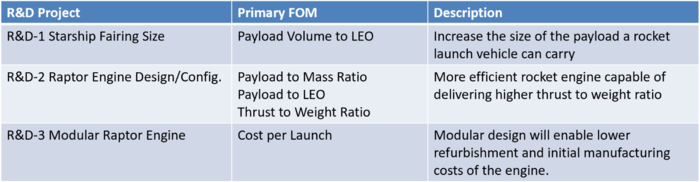

List of R&T Projects and Prototypes

Summary

Our technology strategy is to develop an orbital launch vehicle capable of delivering payloads to space at minimal cost. Historically, this has been accomplished by focusing on the payload to LEO and payload to mass ratio figures of merit (how much mass a vehicle can carry and what percentage of the total rocket weight it constitutes). The R&D portfolio presented here aims to further improve these figures of merit, as well as address emerging figures of merit like payload volume to LEO and launch vehicle reusability with the development of the Raptor powered Starship rocket launch vehicle.

Figures of Merit and R&D Objectives

Payload volume to LEO is a figure of merit that measures the payload volume that can be carried to LEO. The Falcon Heavy demonstrated major advancements in the amount of mass a launch vehicle can carry to orbit; however, it does little to address the fact that some payloads are bigger than they are heavy (large optics, habitational modules, space stations, and interplanetary spacecrafts cores).

R&D-1 Starship Fairing Size addresses this by incorporating a larger fairing design in the next generation launch vehicle.

R&D-2– Raptor Engine Design/Configuration aims to increase the payload mass a launch vehicle can carry to LEO by a factor of 6 through more efficient design and higher total engine count.

R&D-3 Modular Raptor Engine will reduce the net cost per launch by reducing refurbishment costs of the Raptor Engine. This will be achieved through a more modular design that is able to take advantage of new facilities that employ assembly line manufacturing techniques.

A summary of the R&D Portfolio is provided below:

Technology Statement

Our target is to develop a new rocket powered launch vehicle capable of delivering 150,000 kg by the year 2030 at a $/kg cost to LEO of under $300. This will be achieved through two R&D projects. The first project (R&D-2– Raptor Engine Design/Configuration) will increase rocket engine efficiency and employ a larger engine configuration on the launch vehicle. The second project, R&D-3 Modular Raptor Engine, will reduce refurbishment cost of the engines by employing a more modular design. Both of these R&D projects will be delivered in phases achieving half of the full-project benefit by 2025 (launch tested), and delivering the remaining value by 2030. Additionally, the company will be funding (R&D-1 Starship Fairing Size) which looks to increase the cargo bay volume on the new launch vehicle by 20% (diameter) by year 2030.