Satellite Data Communication

Technology Roadmap Sections and Deliverables

- 2SDC - Satellite Data Communication

This technology is described a the level 2 level as it is a delivered service. While the service could be split across many markets (e.g. selling bandwidth and owning satellite only), for the purposes of this roadmap, 2SDC includes the ground segment, space segment, and user equipment to enable Satellite Data Communications.

Roadmap Overview

The working principle and architecture of satellite data communication is depicted in the below.

Satellite-based internet/voice access is enabled by satellites, which provide relay to extend communication beyond traditional (terrestrial) line of site of the network and users. Data encoded in radio waves is sent from the ground station, relayed via the satellite, to the user’s location. Advances in technology include High Throughput Satellites (HTS) and some next-generation satellite systems may follow low-earth orbit rather than geosynchronous orbits, which would reduce latency dramatically.

Design Structure Matrix (DSM) Allocation

The 2-SDC tree that we can extract from the DSM above shows us that Satellite Data Communication (2SDC) is part of a larger abstraction of wireless duplex communication (1WDC), and that it requires the following key enabling technologies at the system level:

- 3SCP Satellite Communication Payload

- 3SGT Satellite Gateway Terminal

- 3USM User Satellite Modem

- 3UST User Satellite Terminal

In turn these require enabling technologies at level 4, the technology subsystem level:

- 4SRA Satellite Receive Antenna

- 4STA Satellite Transmit Antenna

- 4SCE Satellite Communication Electronics

- 4SGA Satellite Gateway Aperture

- 4GTE Gateway Transmit Electronics

- 4GRE Gateway Receive Electronics

- 4UMM User Modem Modulator

- 4UMD User Modem Demodulator

- 4USA User Satellite Aperture

- 4TSC Transmit Signal Conditioners

- 4RSC Receive Signal Conditioners

Note the DSM identifies the launch vehicle interface as a critical external dependency. While this is not in the scope of this roadmap, the availability and ultimately cost ($/kg) to launch the satellite to orbit is critical to the 2SDC roadmap and its profitability. Please reference Orbital Launch Vehicle Roadmap for more on that roadmap.

Roadmap Model using OPM

We provide an Object-Process-Diagram (OPD) of the Satellite Data Communication (2SDC) roadmap in the figure below. This diagram captures the main object of the roadmap, its decomposition into systems (gateway, satellite, user terminal, etc.), its characterization by Figures of Merit (FOMs) as well as the main processes (Transmitting, Receiving).

An Object-Process-Language (OPL) description of the roadmap scope is auto-generated and given below. It reflects the same content as the previous figure, but in a formal natural language.

Figures of Merit

The table below show a list of FOMs by which satellite data communication can be assessed.

| Figure of merit | Units | Description |

|---|---|---|

| Throughput capacity | [Gb/s] | Maximum total data (in Gb) per second which the satellite can successfully deliver data to end users |

| Latency | [s] | Amount of time needed to deliver data between the communication endpoints. Unless otherwise stated, we assume this to mean two-way latency between the ground and satellite (e.g. user TCP/IP). |

| Per-user downlink rate | [Gb/s] | Downlink data rate as experienced by an individual user subscribed to the service. General identified as maximum downlink rate. |

Note that cost is a critical factor into any consumer decision to buy telecommunication services. However, the pricing when comparing internet services is largely in flux due to competitive demands and will change over time (such as prices for cell phone data limits). Therefore we did not use the consumer price Figure of Merit of $/Mbps/month and will focus on throughput as the primary figure of merit through this roadmap. The costs will be discussed in the financial modeling and our firm expects to be competitive in the market so long as throughput is sufficient to meet demand.

| Inputs | Key relationship or governing equation | Outputs |

|---|---|---|

| Signal-to-noise ratio | Shannon-Hartley theorem: <math>C = B \log_2 \left( 1+\frac{S}{N} \right) </math> |

Throughput capacity |

| Bandwidth | ||

| RF Design Parameters | <math> \frac{E_b}{N_o} = \frac{P_t L_l G_t L_a G_r}{k T_s R} \left( \frac{\lambda}{4\pi S} \right)^2 </math> | Link Margin |

| Orbital distance | <math>t = d/c</math> | Latency |

| Variable | Units (metric) | Description |

|---|---|---|

| <math> \frac{E_b}{N_o}</math> | [-] | Energy per bit to noise ratio |

| <math> P_t L_l G_t </math> | Watts | Effective Isotropic Radiated Power (EIRP), includes the Transmit Power, Line Loss, and Transmit Gain |

| <math>L_a</math> | [-] | Loss due to atmospheric absorption |

| <math>G_r</math> | [-] | Receiver gain |

| <math>k</math> | J/K | Boltzmann's constant (1.380649×10−23 J/K) |

| <math>T_s</math> | K | System Noise Temperature (receiver) |

| <math>R</math> | bits/sec | Data rate |

| <math>\lambda</math> | m | Radio-frequency wavelength |

| <math>S</math> | m | Distance from transmitter to receiver |

| <math>C</math> | bits/s | Channel capacity |

| <math>B</math> | Hz | Total bandwidth available |

| <math>S/N</math> | dimensionless | Signal-to-noise ratio |

| <math>t</math> | s | Latency |

| <math>d</math> | m | Orbital distance |

| <math>c</math> | m/s | Speed of light in vacuum (299,792,458 m/s) |

Alignment with Company Strategic Drivers: FOM Targets

The following table shows the firm's strategic drivers and their respective alignment with the satellite data communication technology roadmap.

| Number | Strategic driver | Alignment and targets |

|---|---|---|

| 1 | To deliver competitive high data rate internet service to our users at an affordable price to provide data connectivity across the globe. | The current technology roadmap is focused on delivering solutions which maximize data throughput and while minimizing cost. Our analysis will determine which architecture is best suited to compete in this market. This driver is currently aligned with the technology roadmap. |

| 2 | To meaningfully reduce the latency experienced by our subscribers, thereby enabling our service to support new low-latency use cases and opening new selling points to consumers such as voice over IP, gaming, virtual reality, live captioning etc. | The current technology roadmap considers low-orbit satellite systems that will significant reduce the propagation delay and latency between ground and satellite when compared with current GEO satellite architectures. This driver is currently aligned with the technology roadmap. |

| 3 | To improve the quality and reliability of our service indoors, which is important for potential subscribers in high-wealth, highly-urbanized areas, and take market share from our competitors in the cable and DSL sectors. | While our roadmap targets higher receiver gain, the resulting signal is generally not strong enough to penetrate building walls. Improving service indoors will require installation of more antennas on roofs by working closely with developers and building administrators, which is not part of the current technology roadmap. This driver is not currently aligned with the technology roadmap. |

The firm's current technology roadmap is aligned with the first two of its strategic drivers. The third driver of improving the quality and reliability of service indoors is not being targeted by the roadmap, and it will require either a re-evaluation of priorities in goal setting (to prioritize ground antenna technology and costs), or a non-technical approach (for example, increasing outreach to real estate developers and marketing to homeowners).

Positioning of Company vs. Competition

This section will examine key figures of merit (FOM) of contemporary satellite systems owned by HughesNet (Hughes Communications) and ViaSat. At present, both HughesNet and ViaSat hold the dominant market share for satellite internet in the US. This market dominance did not always exist. There used to be five Satellite ISPs available to consumers: HughesNet, Excede Internet, WildBlue Satellite Internet, DishNet, and EarthLink. HughesNet continues to exist today. Excede Internet changed its name to ViaSat and bought WildBlue Satellite Internet in 2009. The remaining Satellite ISPs discontinued their satellite internet services.

The current generation of satellite systems by Hughes and ViaSat are largely similar, using high powered satellites in geostationary orbits and RF frequency in the Ka band (26.5–40 GHz).

Starting in 2018-2019, Telesat, OneWeb and SpaceX began deploying a new generation of low-orbit satellite constellations. These involve satellites operating at lower altitudes, thereby reducing ground-to-satellite latency. While the satellites have significantly lower throughput individually compared to the Hughes and ViaSat counterparts, they are planned as large constellations comprised of hundreds of satellites, resulting in a higher overall throughput for the system upon final completion. Full deployment of these systems are expected to take years, subject to changes and cancellations in launch schedules. Our tentative selected architecture is shown here for comparison

| Satellite | Owner | Year entered service | Throughput capacity per satellite (Gb/s) | Per-user downlink (Gb/s) | Orbit range (km) | EIRP (kW) | RF frequency | Ref. |

|---|---|---|---|---|---|---|---|---|

| ViaSat-1 | ViaSat Inc. | 2011 | 140 | 0.1 | 35,783 (geostationary) | Ka band | <ref>ViaSat Inc. (https://www.viasat.com/news/viasat-announces-highest-speed-unlimited-satellite-internet-service-nationwide)</ref> | |

| EchoStar 17 | Hughes Communications | 2012 | 120 | 0.1 | 35,804 (geostationary) | Ka band | <ref> Hughes Network Systems, LLC – (https://www.hughes.com/technologies/hughes-high-throughput-satellite-constellation/echostar-xvii)</ref> | |

| EchoStar 19 | Hughes Communications | 2017 | 200 | 0.1 | 35,801 (geostationary) | Ka band | <ref>Hughes Network Systems, LLC (https://www.hughes.com/technologies/hughes-high-throughput-satellite-constellation/echostar-xix)</ref> | |

| ViaSat-2 | ViaSat Inc. | 2017 | 300 | 0.1 | 35,706 (geostationary) | Ka band | <ref> “ViaSat-2” Wikipedia. (https://en.wikipedia.org/wiki/ViaSat-2</ref> | |

| Telesat (constellation) | Telesat Inc. | 2018 (deployment ongoing) | 38.68 (117 satellites planned) | 0.558 | 2,439 | 36.0 | Ka band | <ref> “ViaSat-2” Wikipedia. (https://en.wikipedia.org/wiki/ViaSat-2</ref><ref> del Portillo et al. (2018) "A Technical Comparison of Three Low Earth Orbit

Satellite Constellation Systems". http://www.mit.edu/~portillo/files/Comparison-LEO-IAC-2018-slides.pdf</ref> |

| OneWeb (constellation) | Network Access Associates ltd | 2019 (deployment ongoing) | 8.8 (720 satellites planned) | 0.599 | 1,504 | 34.6 | Ku Band | <ref>del Portillo et al. (2018) </ref> |

| Starlink (constellation) | SpaceX | 2019 (deployment ongoing) | 20.12 (4,000+ satellites planned) | 0.674 | 1,684 | 36.7 | Ku Band | <ref>del Portillo et al. (2018) </ref> |

| Our Firm (constellation) | The Firm | 2024 (est.) | 61.80 (600 satellites planned) | >0.100 | 1,700 | 36.0 | Ka Band |

This data is plotted to show the different trends in GEO and LEO satellites over time and how The Firm's system will compare (Firm system in red).

A different way to look at this data is to look at the total system throughput, which takes into account the many satellites in LEO constellations. This different view of throughput shows the stark difference in total system throughput. Note the dates for LEO constellations are much more difficult to assess as the first launch does not represent true capacity. Each constellation would grow over a period of years. Note the modeled exponential growth for GEO satellite capacity has an annual rate of 24% increase, which is smaller than the 65% shown in the Deep Space Network (DSN) example.

Ultimately we looked not only at throughput as a comparison, but also comparing the two Figures of Merit of throughput per satellite and latency. Latency has not been a significant discussion in this market as it has been widely accepted, however the addition of LEO constellations drastically reduce latency. The plot below shows the trend of latency vs throughput over time with pareto frontiers labeled. It should be noted that the minimum latency values are set based on the orbital distance and a "double-hop" requirement for two-way data communications (e.g. TCP/IP), and would not change significantly unless new orbits were used or in-orbit internet routers were available.

Technical Model: Morphological Matrix and Tradespace

The key formula used to describe technology is the Link Budget Equation shown below:

<math> \frac{E_b}{N_o} = \frac{P_t L_l G_t L_a G_r}{k T_s R} \left( \frac{\lambda}{4\pi S} \right)^2 </math>

The variables are described in the table below.

| Variable | Units (metric) | Description |

|---|---|---|

| <math> \frac{E_b}{N_o}</math> | [-] | Energy per bit to noise ratio |

| <math> P_t L_l G_t </math> | Watts | Effective Isotropic Radiated Power (EIRP), includes the Transmit Power, Line Loss, and Transmit Gain |

| <math>L_a</math> | [-] | Loss due to atmospheric absorption |

| <math>G_r</math> | [-] | Receiver gain |

| <math>k</math> | J/K | Boltzmann's constant (1.380649×10−23 J/K) |

| <math>T_s</math> | K | System Noise Temperature (receiver) |

| <math>R</math> | bits/sec | Data rate |

| <math>\lambda</math> | m | Radio-frequency wavelength |

| <math>S</math> | m | Distance from transmitter to receiver |

Note in high throughput satellite communications, this equation must be balanced with the bandwidth and power limitations of the satellite. This is often done by breaking the allocated bandwidth (allowed for each frequency band by the FCC and ITU) and creating different "spot beams" which have certain frequency and polarity characteristics. This equation is generally done for a specific spot beam and then the overall throughput for the satellite is the sum of the throughput for each beam. The spot beams are generally balanced that the power available by the satellite payload (e.g. transmitter in this equation when the satellite transmits) is sufficient to utilize the total bandwidth available. For our analysis we assumed the number of beams were for total power and bandwidth optimized balanced beams and calculated total throughput as the throughput (data rate) per beam multiplied by the total amount of beams.

Morphological Matrix

To assess the different options available, a morphological matrix is created below with key parameters showcasing the differences in types of parameters. This Matrix is shown on Table 1 on the next page, and contains additional information to provide context for how these values were identified. Note our group assumed that the stressing case is for the satellite to user in the highest data rate/carrier available, as that would stress the user equipment and produce the highest value in the system. Other links would produce different options (e.g. Q/V gateway to satellite links) that we are not considering in this exercise. This data is based on general satellite architectures and design options pulled from the previously cited LEO paper, O3B (MEO satellite) data, and KA-SAT GEO satellite data. <ref>Fenech, H., S. Amos, A. Tomatis, and V. Soumpholphakdy. “High Throughput Satellite Systems: An Analytical Approach.” IEEE Transactions on Aerospace and Electronic Systems 51, no. 1 (January 2015): 192–202. https://doi.org/10.1109/TAES.2014.130450.</ref>

| Decision Variable | 1 | 2 | 3 |

|---|---|---|---|

| Satellite Orbit: Range (S) (km): | LEO 1700km | MEO 10,000km | GEO 40,000km |

| Data Rate (R) [bps] | 30Mbps | 250Mbps | 500Mbps |

| RF Range Wavelength (λ) [m] | Ku (13.5 GHz) 0.0222m | Ka (18.5 GHz) 0.0162m | n/a |

| EIRP (Satellite) (PtLlGt) [W] | (Small LEO-class) 4kW (~36 dbW) | (MEO-class) 250kW (~54 dBW) | (Geo HTS-class) 3200kW (~65 dbW) |

| Receiver Gain (User) (Gr) [-] | D=0.3m Ku: 1,260 Ka: 2,500 (31/34 dBi) | D=0.7m Ku: 6,300Ka: 12,600 (38/41 dBi) | D=1.2m Ku: 20,000 Ka: 50,000 (43/47 dBi) |

| Temperature | 250K | 275K | 300K |

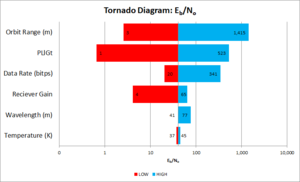

These values were used to serve as the basis of information to analyze the sensitivity of each range of each attribute. This analysis resulted in the Tornado diagram shown on the next page, which identifies that the satellite range (e.g. orbit) and EIRP (satellite payload transmit power and gain) are the major drivers in closing a link. This matrix does not include the important figure of number of satellites and cost. That analysis was later used to determine the overall tradespace.

Tornado Analysis

The Tornado Diagram shows the importance of range and EIRP (PtLlGt) on the performance of the link. Table 2 is shown below to clearly identifies the values used in this analysis.

| Parameter | Option 1 | Option 2 | Option 3 | |

|---|---|---|---|---|

| S | Orbit range (m) | 1.7E+06 | 1.0E+7 | 4.00E+7 |

| R | Data range (bps) | 3.00E+7 | 2.50E+8 | 5.00E+8 |

| λ | Wavelength (m) | 0.0222 | 0.0162162 | 0.016216 |

| PLlGt | EIRP (W) | 4000 | 250,000 | 3,200,000 |

| Gr | Receiver gain | 1260 | 12600 | 20000 |

| T | System temperature (K) | 300 | 275 | 250 |

| Eb/No | Noise density ratio | 32.41342 | 40.894572 | 28.56129 |

Architecture Selection

Architecture Trade: The morphological matrix was also used to identify the most desirable architecture as the basis for our companies product. After completing initial financial modeling for the given design options, the architectural trade space is identified in Figure 3. This figure shows a requirement for the satellite data rate to be at least 20 Mbps to even be considered as viable. This architecture comparison was used to determine that many simple (e.g. small satellites and communication payloads) Low-Earth Orbit (LEO) satellites are the most desirable to achieve greatest data rate to cost value. Initially the firm was heading towards a decision to launch 16x medium-sized Middle-Earth Orbit satellites, however the NPV analysis showed little flexibility to insert new technology in future years (at a discounted rate), and adjustments in the detail of the architecture model showed that a LEO constellation ultimately would have a lower cost per satellite.

Additionally, the total throughput of these options can be plotted when accounting for the modeled constellation size of 600 LEO satellites, 16 MEO satellites, or 3 GEO satellites to obtain global overage. This is shown in Figure 4 and clearly shows that although the LEO satellites have the fewest throughput per satellite, the vast number of satellites increase the total constellation throughput when compared to other MEO or GEO architectures.

Conclusion: The sensitivity analysis matches what one would expect while looking at the Link Budget equation - that the biggest contributor is the distance due to an inverse square relationship. Interestingly the wide EIRP range also created a large sensitivity, which would represent different satellite payload technologies and designs. After comparing the data rate against the cost for these options, our company is going to move forward with a baseline architecture of a fleet of 600 low-cost satellites in Low Earth Orbit (LEO). The designs matches our strategic intent goals of a low-cost communication solution while providing a fast data rate and low latency.

Financial Model

Net Present Value Baseline: The small-class LEO satellite design was used to estimate the Net Present Value (NPV) baseline given an assumed life of 15 years and subscriber count of 1,000,000 users. The results of this model show that the overall choice is profitable; however, it should be noted that this model contains assumptions including a fixed overall subscriber count, which in reality is uncertain. As such, this baseline will be used to identify key technology areas which will be focused on adding technical performance (measured in data rate per user), driving costs per satellite down (which provides greater cost efficiency per launch), or maximizing sales performance (to include driving down aperture cost and size). The figure below shows the NPV analysis with an overall NPV of $2,348M. Note that this model does not account for losses due to satellite or launch failures and represents a maximum NPV but is useful for a baseline comparison for different projects. Additional spare satellites and rockets should be added in a more complete model.

The graphical view of this is shown below with costs, revenue, and discounted cash flow.

A delta NPV analysis was performed to see the financial impact of maturing the electronically steerable phased array apertures technology. The technology is assumed to potentially double the subscriber count (to 2,000,000). The results of the analysis estimated the incremental NPV to be $2.2 billion, which is why the R&D effort at the top of the priority list. For a complete breakdown of the different projects, please see the section below.

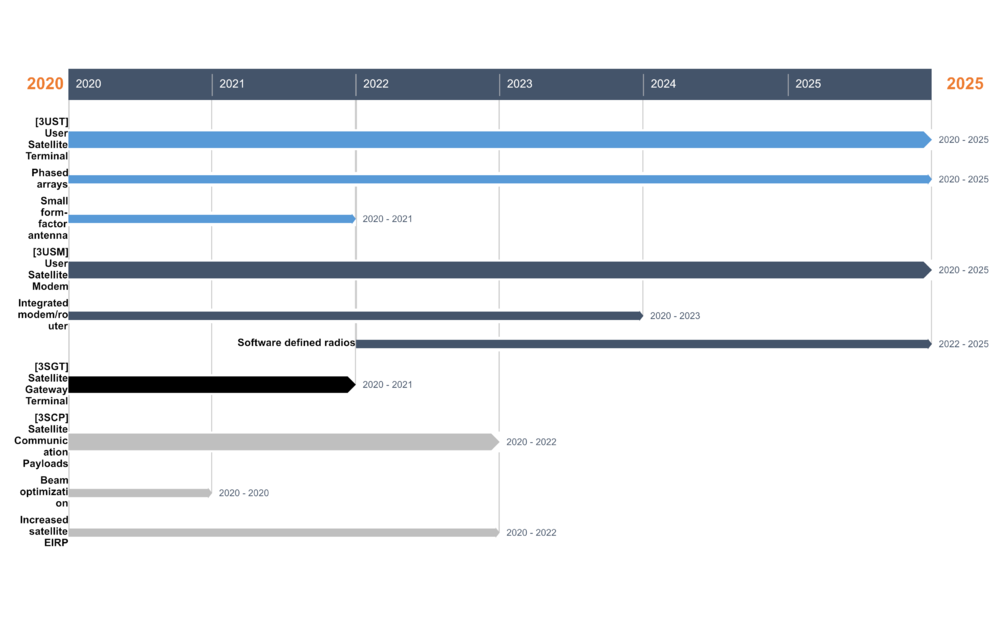

List of R&D Projects

R&D considered projects: The table below identifies 11 projects which were considered for implementation to improve the overall profitability in this project. The table is broken out into those projects which will be pursued and projects which will not be pursued. When considering the totality of all projects completed, we expect a total ΔNPV of $7.2B - from $2.3B to $9.5B, with a total investment of less than $900M. The increase was largely in the features that would lead to a greater number of subscribers, from 1 million to 3.25 million subscribers.

R&D investment projects These technologies being pursued are further described in the table below. As identified, the most significant investment in is the electronically steerable phased array technologies [3UST], as shown in the previous figure with the ΔNPV graphed over time. Other consumer-focused products like the modems are also supporting the increase in subscribers which increases NPV. It should be noted that this analysis shows overall sufficient capacity for all new subscribers, but showed the peak rate might fall towards 22 Mbps during the initial years of service, ultimately arriving above 50 Mbps by the end of the constellation launch. This trend would need to be analyzed as further capacity increasing technologies may need to be pursued in parallel if this would limit subscriber increases. We did decide to move forward with beam optimization capabilities as this may be a solution to increase data rates to the right location during peak times.

R&D investment Projects not being pursued: During this business prioritization meeting, the board decided that more complex or immature technologies such as optical cross-links and Q/V bands were not going to be pursued at this time, as shown in the figure below. Also we are not planning to pursue substantial manufacturing increases but may revisit next year if the total impact is determined to reduce manufacturing costs more than 10%.

Project Gantt Chart: The following table shows the timelines of R&T/R&D investment projects and demonstrators that are to be pursued, with corresponding milestones over the course of the next six years.

| Technology area | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|

| [3UST] User Satellite Terminal |

|

|

|

|

|

|

| [3USM] User Satellite Modem |

|

|

|

|

|

|

| [3SGT] Satellite Gateway Terminal |

|

|

||||

| [3SCP] Satellite Communication Payloads |

|

|

|

Key Publications and Patents

Key publications and patents are listed below. In addition, analysis was performed on publicly available information, such as company shareholder meetings, tweets, and key individual movement between competitors. These sources of information are also important to understand the socio-technological landscape of this project, as much of the information on the commercial state of the art products are kept closely guarded by the companies.

Publications

- VanderMeulen, Richard A, and Meredith Caligiuri. ANALYSIS OF COMMERCIAL SATCOM ALTERNATIVES CLOSING GAPS IN NATIONAL SECURITY SPACE, 34th Space Symposium, Technical Track, Colorado Springs, Colorado, United States of America, Presented on April 16, 2018. Executive Summary: Viasat describes its value to US Defense Department; stresses importance of gateway networks and demonstrates growing capacity of GEO satellites towards 1Tbps.

- Portillo, Inigo del, Bruce G. Cameron, and Edward F. Crawley. “A Technical Comparison of Three Low Earth Orbit Satellite Constellation Systems to Provide Global Broadband.” Acta Astronautica 159 (June 2019): 123–35. https://doi.org/10.1016/j.actaastro.2019.03.040. Executive Summary: Three LEO satellite communications constellations, Oneweb, SpaceX, and Telestar are analyzed and predicted performance is provided (based on FCC filings).

- Perez-Trufero, Javier, Barry G. Evans, Mathieu Dervin, and Cedric Baudoin. “High Throughput Satellite System with Q/V-Band Gateways and Its Integration with Terrestrial Broadband Communication Networks.” In 32nd AIAA International Communications Satellite Systems Conference. San Diego, CA: American Institute of Aeronautics and Astronautics, 2014. https://doi.org/10.2514/6.2014-4384. Executive Summary: Paper identifies use of Q/V-band gateway to satellite links; performance can be shown with one dedicated backup gateway.

Patents

- Krebs, Mark. (2017). US Patent No US9647749B2. “Satellite constellation” assigned to Google LLC., available on https://patents.google.com/patent/US9647749. Executive Summary: Description of many satellite Low-earth orbit communication satellite constellation. Note Mark Krebs moved from Google to SpaceX and now is employed by Amazon's Project Kuiper, which is Amazon's plan for a LEO mega-constellation.

- Nichols, et al. (2012). US Patent No US8334809B2. “Active Electronically Steered Array Antenna for Satellite Communications” assigned to Ratheon Co, available at https://patents.google.com/patent/US8334809B2/. Executive Summary: Description of using Electronically Steered Arrays (ESAs) aka Phased Arrays for communications on the move; specific to L-band INMARSAT-4 case.

- Kaplan, et al. (2010) US Patent No US7705793B2. “Applications for Low Profile Two Way Satellite Antenna System”, available at https://patents.google.com/patent/US7705793B2/. Executive Summary: Describes vehicle mounted phased arrays with rotating horizontal plane to close satellite link.

Two key trends observed in this analysis is the shift from greater and greater High Throughput Satellites in GEO towards a new architecture type with LEO options as well as the shift in phased array technology from a combination of electronically and mechanically steerable arrays to purely electronically steerable arrays.

Technology Strategy Statement

Our target is to develop a new low-cost, high-throughput LEO satellite constellation to deliver internet service directly to consumers within four years of product launch. This product will deliver comparable internet rates of 50 Mbps or higher at a very low latency. To achieve our business goals, the user terminal will use electronically steered phased arrays to deliver 50 Mbps in a 0.7m effective aperture diameter or smaller. The three highest rated R&D projects are the phased array user terminal by 2025, advanced satellite payload electronics to increase the satellite EIRP for satellites produced after 2022, and an integrated modem/wireless router to enable connectivity in urban or other wireless applications by 2023. Three other smaller investments will be running in parallel to attempt to decrease gateway terminal costs, decrease user aperture size, and identify future algorithm designs for dynamic beam shaping.

Maturing the R&D projects in the figure above are critical for achieving the goal of developing low-cost, high-throughput LEO satellite constellation to deliver internet service directly to consumers.